-

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The U.S. Treasury Department is in talks with some airlines about accepting their loyalty programs as collateral against government loans to help them weather the coronavirus crisis.

April 17 -

Partisan differences get in the way of new aid program for small businesses as SBA program runs out of money; loan servicers want a bailout as defaults are expected.

April 17 -

Banco Santander has launched a new standalone international money transfer service called PagoFX in the U.K. to compete with fintechs.

April 16 -

Airwallex has raised $160 million in a Series D fundraising round to expand global payment offerings for small businesses and enterprises.

April 16 -

As millions of U.S. consumers are beginning to see stimulus checks electronically deposited into their bank accounts as part of the CARES Act, many companies are wondering how Americans will spend these funds.

April 16 -

IT projects are under scrutiny due to the coronavirus, not only in terms of budgets but also how fast firms can deploy automation for tasks such as business payments for companies that have turned to remote work.

April 16 -

Quick forbearance actions averted an immediate hit to asset quality, but executives warned that a spike in unemployment and a looming recession will cause long-term problems.

April 15 -

OCBC Bank has integrated Google Pay into its P2P transfer service, thereby expanding its customers’ options for reducing their cash usage during the coronavirus crisis.

April 15 -

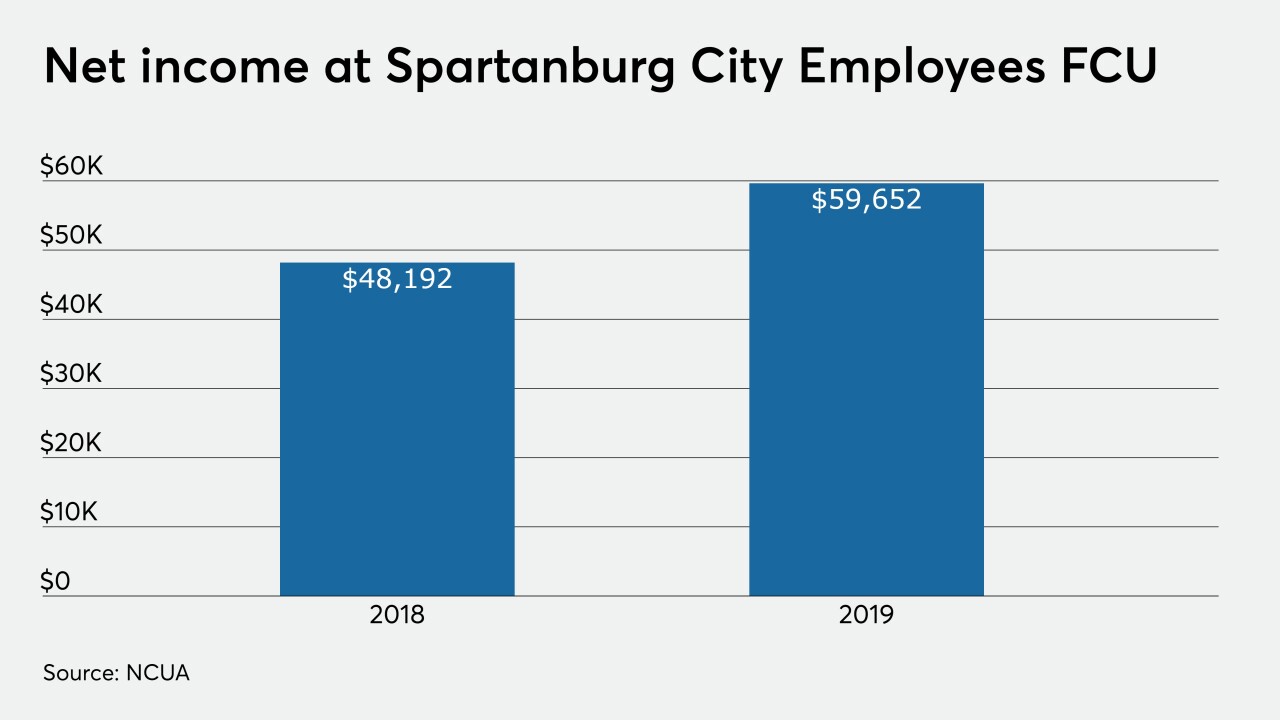

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15