-

The GSEs will hold onto a combined $45 billion as they start the process of going private; PayPal becomes the first foreign firm to win approval to enter the country’s payments market.

October 1 -

House Republicans are pushing the CFPB to continue to allow banks and credit unions to estimate exchange rates and fees for money transfers.

September 30 -

How PayPal obtained a payments license to operate in China — an achievement that’s long frustrated the biggest U.S. banks and payments networks — sheds light on the unique challenges of breaking into the world’s biggest payments market.

September 30 -

To really solve cash management struggles once and for all, it’s critical to start by targeting necessary process improvements, says Bottomline Technologies' Bill Wardwell.

September 30

-

Annual fees for Platinum cards for consumers and small businesses will increase to $250 from $195, while Reserve cards go up by $100 to $550. Gold cards will rise slightly from $95 to $99.

September 30 -

The use of data-rich messaging through the ISO 20022 standard has been at the core of nearly every Federal Reserve discussion about faster payments, as well as Swift's plans for its member banks.

September 30 -

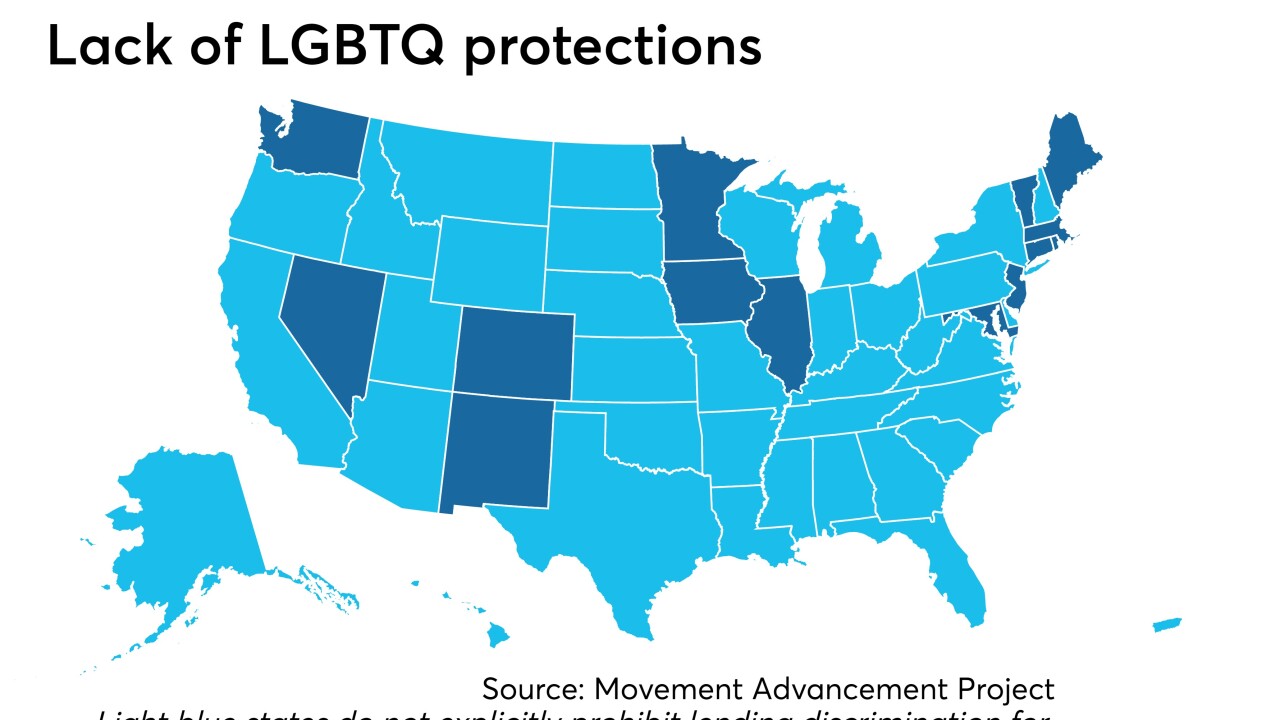

With credit discrimination still legal in many states, the Michigan-based institution aims to help this marginalized group.

September 30 -

In the payments world, Scharf is best known as the CEO of Visa Inc. from 2012 to 2016, where his strategies for faster payments, fintech partnerships and other key issues may shed light on what he has planned when he becomes CEO of Wells Fargo.

September 27 -

Warsaw Federal will keep its name and charter after joining First Mutual Holding in Lakewood, Ohio.

September 27 -

A research paper says the president’s constant criticisms are driving Fed policy, directly or indirectly; the huge demand by banks for cash may be the result of tougher regulations.

September 27