-

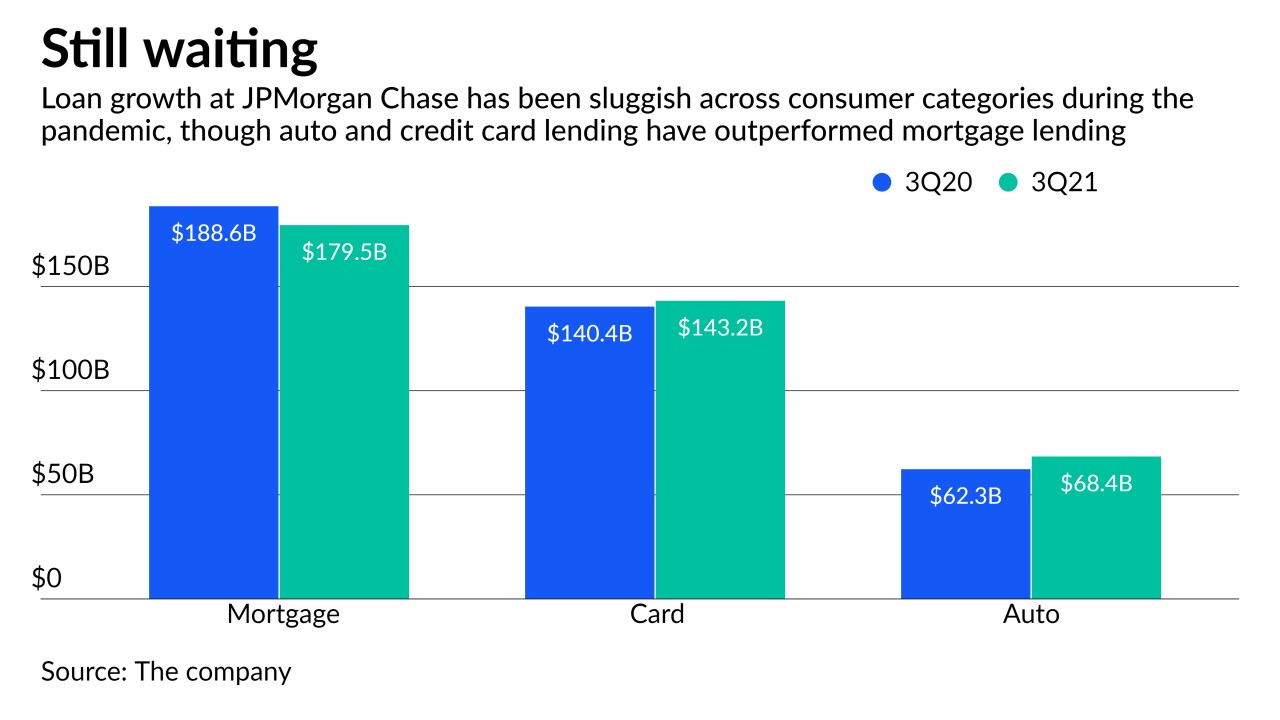

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

As part of American Banker's Most Powerful Women in Banking and Finance program, we have selected five "Top Teams" for 2021. Centric Financial is one of the team honorees.

October 6 -

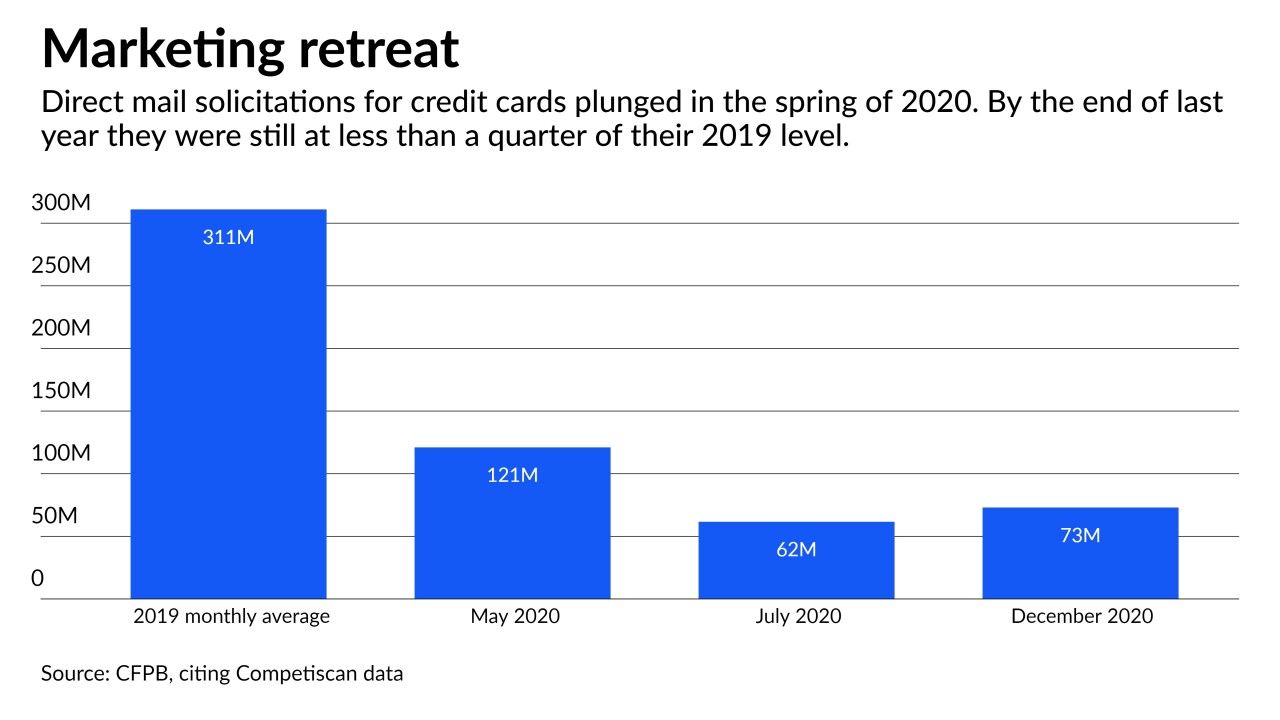

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

Several company leaders will relocate to Atlanta as part of the expansion, and the office will focus on technology and client services.

September 29 -

The second of three credit cards announced in June, Reflect rewards consumers who don't miss payments by extending the 18-month promotional period for its 0% annual percentage rate to 21 months.

September 29 -

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

September 28 -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

Merchants and banks have taken predictably opposing positions on a Federal Reserve proposal to increase competition among networks that route online debit transactions. But amid the hundreds of comments, it's those from supposedly neutral parties — the Department of Justice and the Federal Trade Commission — that stand out.

September 20 National Association of Convenience Stores

National Association of Convenience Stores -

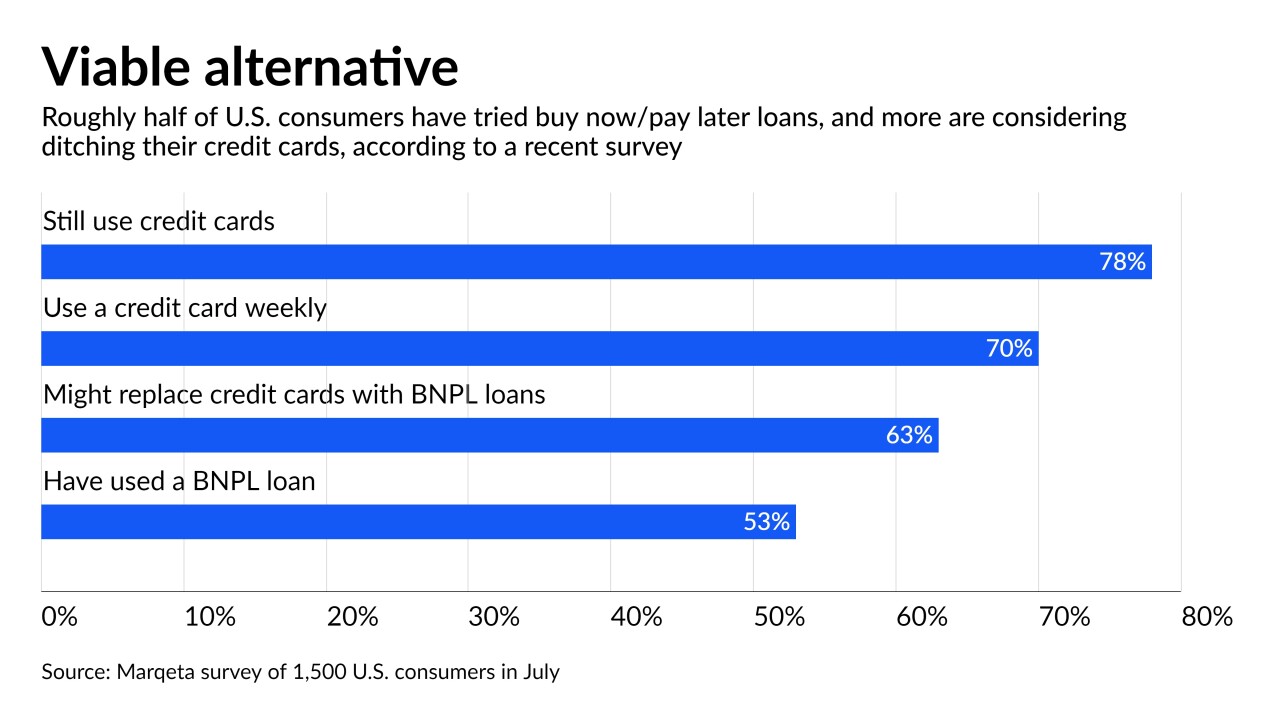

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Executives at JPMorgan Chase, Capital One and U.S. Bancorp all spoke this week about plans to take on upstarts that offer interest-free financing on consumer purchases. The increased competition figures to result in tighter margins across the category.

September 16