-

Bankers said legislative fixes to the small-business rescue program should help more borrowers secure loan forgiveness, though new demand will likely remain tepid because the process is still extremely cumbersome.

June 5 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

As merchants are challenged to adapt their business just to survive, and consumers push for greater control over where and how they spend, the payments industry is in a position to align the various needs, says Splitit's Brad Paterson.

June 5 Splitit

Splitit -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

Representatives of lenders as well as businesses that received pandemic bailout money told an oversight board Wednesday that delayed and confusing instructions from the government hampered the effectiveness of the main rescue program for smaller companies.

June 4 -

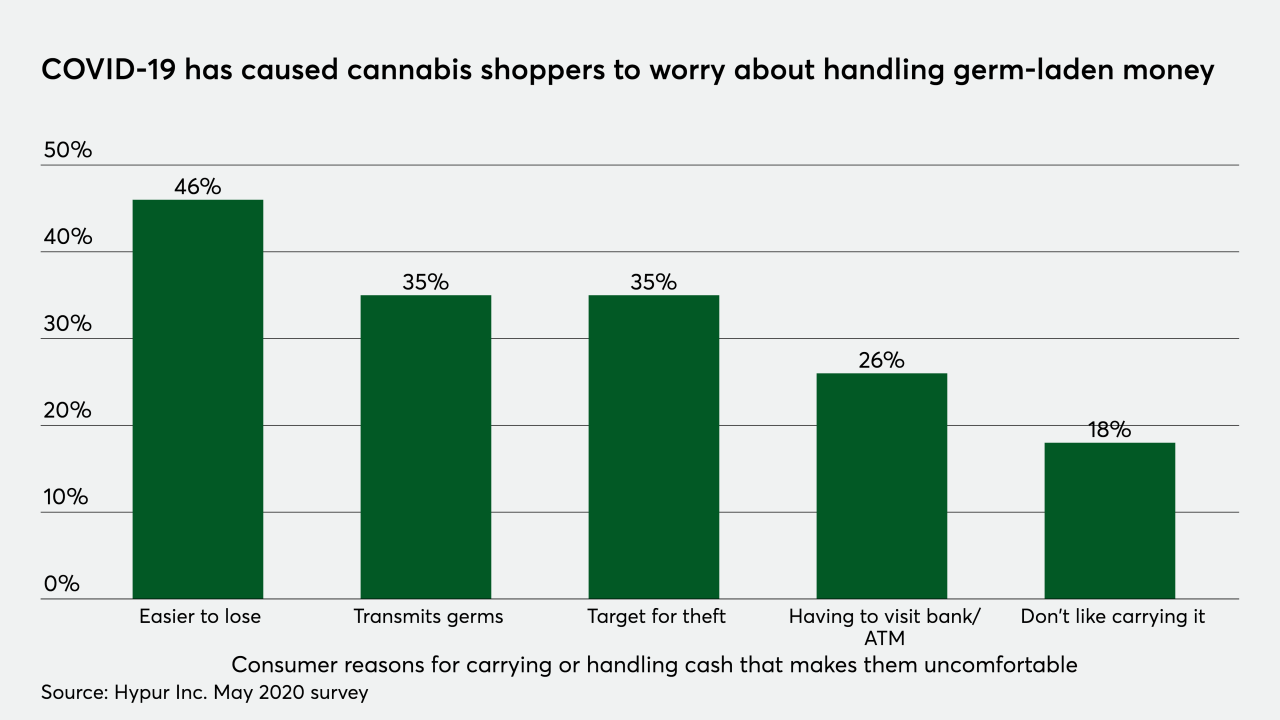

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

The demonstrations following George Floyd's death in police custody are forcing the industry to grapple with how it can — or if it should —advocate for equality and better race relations.

June 4 -

Walt Disney Co. has at least temporarily cut several reservation and incentive features tied to its closed loop payment system, revealing the complexities of mixing health guidance with tourism.

June 4 -

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3