Once again, Visa USA and MasterCard International are facing a legal challenge-this time to their chargeback policies.

A defunct card processor for Internet merchants in mid-August filed a 12-count suit against the card associations, alleging their chargeback policies are anticompetitive and violate state and federal antitrust laws.

Cranston, R.I.-based PSW Inc. seeks $240 million in damages from MasterCard and Visa, along with First Data Corp. subsidiaries First Financial Bank and First Data Merchant Services (FDMS). The complaint was filed in the U.S. District Court for Rhode Island.

PSW, which operated under the name PSWBilling.com, served as a middleman between Web sites and First Financial, which processed the payments. PSW's customers included adult-content Web sites, its attorney Richard A. Sinapi says.

In its suit, PSW says it was forced to pay higher prices for network services, pay excessive fees, fines and penalties, and comply with unknown, constantly changing and commercially unreasonable rules.

At issue in the suit are changes by the associations that reduced the allowable percentage of chargebacks a merchant may generate. The associations fine acquirers whose merchants exceed that rate. In extreme cases, a merchant's card-acceptance privileges are revoked. Adult-content merchants typically have higher-than-average chargeback rates.

The associations' chargeback fees increased from $25 per chargeback and a $25,000-per-month fine up to a maximum of $100 per chargeback and a $100,000-per-month fine, according to the suit. PSW claims the increases "imposed excessive, retroactive and progressive penalties."

The lawsuit alleges that First Financial and FDMS held back $1.6 million of PSW's funds in a reserve account to cover potential fines and penalties. As a result, PSW was not able to pay its clients, losing customers. When PWS complained, First Financial and First Data terminated their processing arrangement, effectively putting PSW out of the business, according to the lawsuit.

'Core Values'

First Financial refuses to release the funds in the reserve account, even though MasterCard and Visa have never assessed fines or penalties and it's been more than 10 months since processing was terminated, the lawsuit alleges.

Visa says the lawsuit is without merit. "We have an obligation to vigorously defend the integrity of the Visa network," Daniel Tarman, senior vice president, said in a written statement. "Unfortunately, a small fraction of high-risk merchants have presented us with difficult issues that have imposed additional costs to issuers, acquirers and consumers."

First Data responded in a statement that it "regularly evaluates its lines of business to ensure they are a good fit for the company. We have determined that processing payments for the adult-entertainment marketplace is inconsistent with our core values."

-

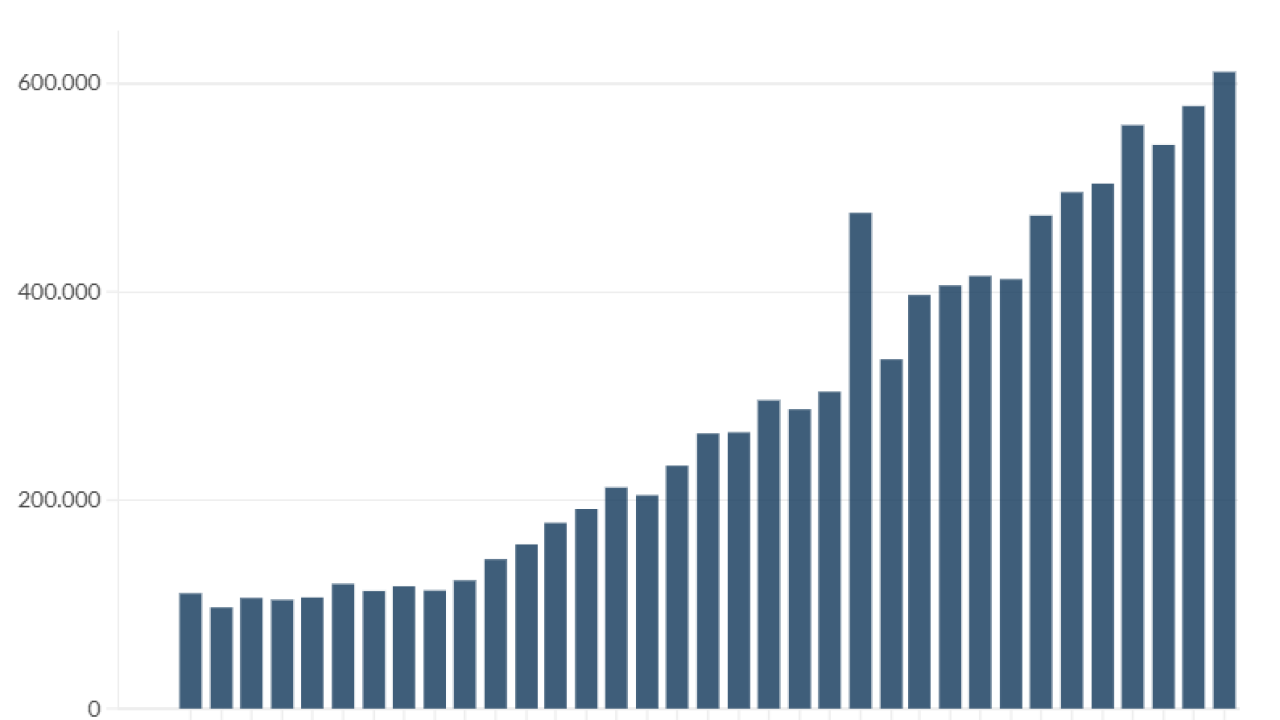

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

1h ago -

Sens. Ted Cruz, R-Texas, and Katie Britt, R-Ala., offered a new bill that would index the Durbin Amendment's debit fee threshold to inflation. The bill joins a number of community bank-centered bills offered or moving through Congress

February 12 -

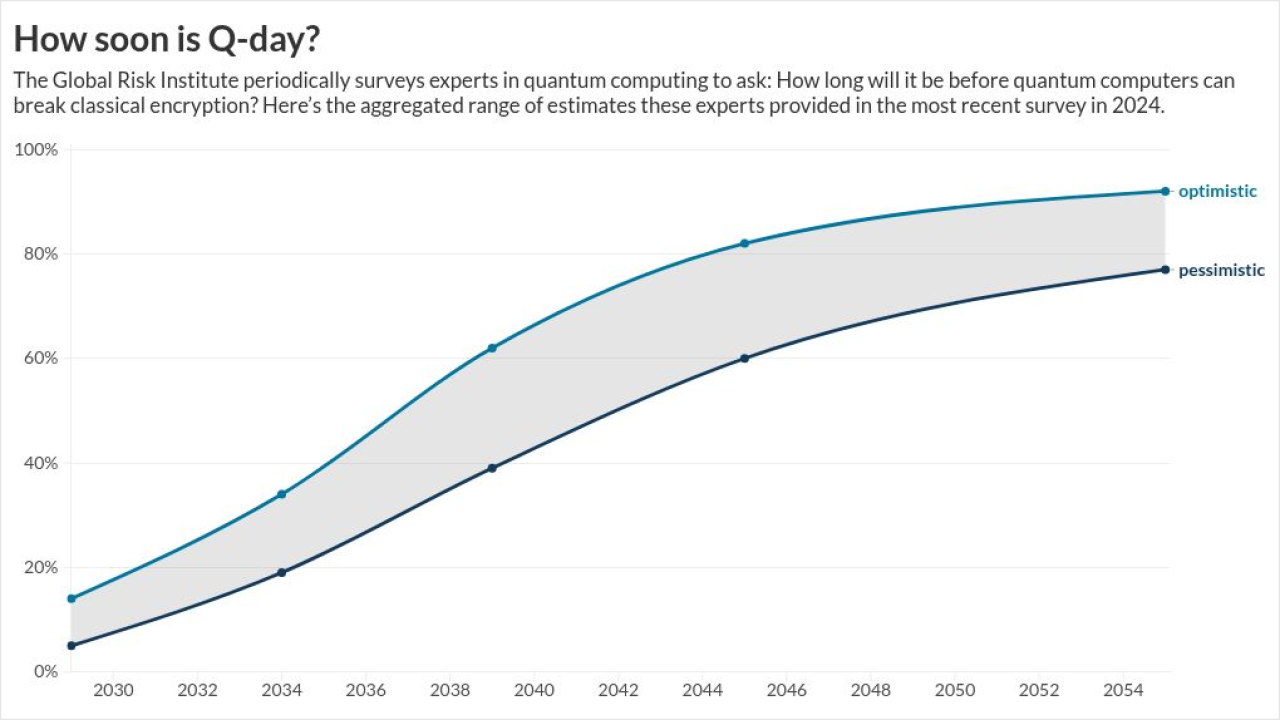

While "Q-Day" may be years away, experts warn hackers are already harvesting encrypted data to decrypt later, making the transition to new standards urgent.

February 12 -

Minal Gupta has implemented new financial technology for years as an executive, and is taking the helm of her credit union as the entire industry ponders how to use real-time payments and new forms of AI.

February 12 -

The Southeast Asian financial services company acquired micro-investing fintech Stash and earned a yearly profit for the first time in its 2025 earnings report.

February 12 -

The Made in America Manufacturing Finance Act would double the loan-size threshold for SBA manufacturing loans to $10 million. It would be the first change to the limit since 2010.

February 12