In the gig economy, more companies need to make more frequent payments to workers, and that need is being met through the use of open development tools and web delivered services to power complex transactions.

"With the increase of contract work, there's an increase in the number and types of SaaS (software as a service) platforms that serve freelancers," said Scott Galit, CEO of Payoneer, which sells payment technology that powers cross-border transactions. "In addition, as freelancers are becoming more savvy with the digital and global economy, their customer base is further necessitating the use of tools and platforms that can help with time and resource management."

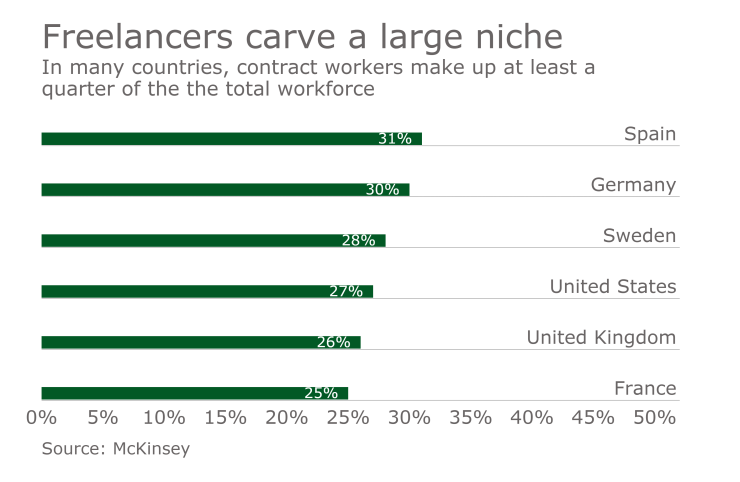

The growth in freelancing, often referred to as the "app economy" or "gig economy," is usually associated with the ridesharing app Uber. But a lot

New York-based Payoneer, which over the past year has introduced

APIs are often used to embed e-commerce checkout pages for online merchants, and in this case Payoneer hopes to reach billers and service providers by integrating payment functions into their services. "These freelancers are looking for simplicity and usability — in short, a ‘one-stop shop’ that can help them manage, track and reconcile their costs and income," Galit said.

Other companies are also targeting this niche.

"The cross-border payments market is very crowded, but the opportunity is large enough to attract a lot of interest, especially from investors," said Patricia Hines, a senior analyst for Celent. "Cross-border payments historically enjoined relatively high profit margins due to a lack of competition. But emerging financial technology players are dramatically changing the world of cross-border payments, promising to improve processes, costs and the customer experience."

Payoneer, which supports payments in more than 200 countries in 150 currencies, has other use cases in mind beyond contract payments for its API, which Galit said does not have a fee. The API enables Payoneer to integrate into ERP systems for manufacturers or time tracking for a service provider, for example.

"Small to medium sized businesses around the world often do not have access to financial infrastructure that allows them to collect or make international payments in a cost-effective way," Galit said. "These businesses increasingly rely on SaaS platforms to manage their businesses, utilizing cloud-based tools for time tracking, invoice, and resource management. With the API, these business management platforms will be able to add an embedded 'Pay Now' button."

There are several challenges when it comes to the payment needs of small to medium sized businesses, according to Galit, who adds sending or receiving payments with a bank necessitates leaving the business management platform to track whether payments have come in, then returning to the platform to reconcile invoices, send payment reminders and handle other tasks. Galit also hopes to reach emerging economies, where the cost of international business is often a barrier to expansion.

"Payoneer's advantage is that it already has a platform that covers many countries globally and is already delivering payout solutions, serving both companies that need to pay and individuals that need to receive money," said Zil Bareisis, a senior analyst at Celent. "APIs should make it easier for small businesses to integrate into the platform and further expand their customer base."