Despite its capability to adapt to different verticals and an expansion of

ACI Worldwide seeks to address that weakness by adding "incremental learning" technology into its machine-learning models for fraud prevention and risk management. The learning models will be able to make adjustments as needed to stay relevant and keep pace with fraudsters and consumers who change habits.

The company has filed a patent application for the technology and has implemented it into its fraud-prevention solutions — the Proactive Risk Manager for financial institutions and intermediaries, and ACI ReD Shield to secure e-commerce and support merchant fraud management capabilities.

"Artificial intelligence has focused for a long time on predicting fraud and doing so accurately," said Jimmy Hennessy, director of data science at ACI. "We see our incremental learning approach taking a step further by being prescriptive."

In a 13-month testing period, using data from three major retail customers, ACI says it learned that traditionally trained models began to degrade after as few as three months, while the new models maintained performance over the entire test period.

The new technology makes adjustments to itself automatically to ensure customer protection and to spot new fraud patterns, Hennessy said.

Because fraud attack vectors evolve so quickly, using machine-learning technologies has become the new "table stakes" for banks and merchants alike, said Julie Conroy, research director and fraud expert with Boston-based Aite Group.

"Machine learning is a big umbrella term, and there is a lot of nuance in terms of the specific techniques — dozens of algorithms, and everything from supervised (trained) to unsupervised (no training data) to semi-supervised techniques are in use today," Conroy said.

Even though artificial intelligence has provided plenty of promise for merchants, a key challenge remains in that banks and merchants don't always know how to best harness the correct data to feed the solutions, Conroy added.

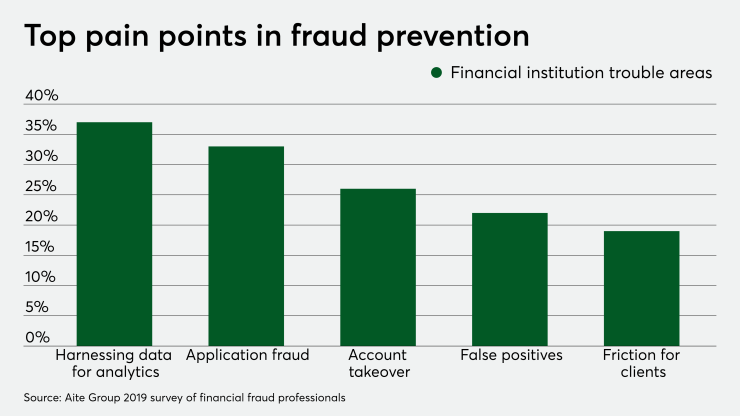

In an Aite Group survey of financial fraud professionals in 2019, 37% chose the task of harnessing the proper data to feed into analytics technology as the top fraud-prevention pain point. Application fraud was second at 33%.

"The old adage, 'garbage in, garbage out,' is quite applicable," she said. "I've spoken with firms that have made substantial investments in these technologies, only to have those investments sit there without realizing their potential while the firm struggles to harness the right data to feed the analytics."

ACI hopes to take some of the guesswork out of the process for clients in that the incremental learning algorithm will essentially detect fraud behavior changes by looking at smaller amounts of data over shorter intervals.

"It can make changes to itself in production, ensuring model performance for more extended periods of time," ACI's Hennessy said. Incremental learning allows the machine to basically act as a human being would when learning something new, he added, by being more informed without having to retrain on everything previously known.

Because fraudsters are as skilled and experienced as data scientists creating models to stop them, machine learning technology needed an extra boost.

"Data is like a footprint," Hennessy said. "Any fraudulent behavior always leaves a trace behind."

The new approach can spot changes "quicker than traditional methods, ensuring extended model performance for our customers," he added.