A dynamic digital identity that can work across functions and channels has to start somewhere. To get into digital ID at the ground floor, more companies are pushing to address identity risk when onboarding new accounts.

Mitek and Citigroup, for example, recently upgraded authentication technologies with a particular focus on onboarding. Mitek updated its desktop browser experience to support auto-capture for enrollment ID checks across browsers, mobile web and native applications; while Citi expanded real-time verification in a separate deployment.

Citi’s Treasury and Trade Solutions this week released Citi Verify, an ID and account verification system that’s part of a collaboration with identity and authentication company Giact Systems. Users are linked to Giact's network of real-time verification services to streamline onboarding.

Citi Verify uses an API to connect to Giact, providing virtual terminal access to identify customers across business lines. The bank is positioning the collaboration as a way to strengthen the use case to adopt instant payments by addressing costs from misdirected payments and ACH returns.

The onboarding experience is the first point of contact where Citi Verify can be used to validate the identity of the customer, said Alberto Casas, North America payments and receivables head with Citi’s Treasury and Trade Solutions. “We’re helping to manage, secure and enhance strategic verifications for the customer life cycle in real time,” Casas said. An account may change five months into the relationship, and “we’ll have to validate that account again and have a compliance process to manage that,” he added.

As mobile commerce expands and becomes global, companies are moving away from more static forms of ID such as user names and passwords to

The trend has drawn interest from large companies, such as

“Authentication is important now and has always been important, but it takes on an increasing significance with the transformational opportunities and industry changes toward digital, secure and real-time payment ecosystems, which Citi aims to provide holistically for each of our clients,” Casas said. Businesses are moving away from batch-oriented systems for updates to more real-time processing, for which they need real-time payment products embedded and institutionalized, especially in the realm of authentication, he added.

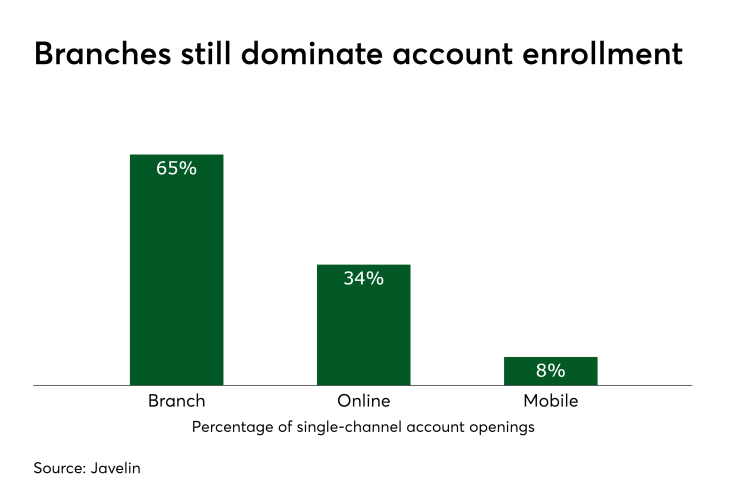

In its rollout, Mitek is attempting to accommodate channel mixing, recognizing that single-channel account opening is a rarity. Only about a third of new accounts are opened entirely on a desktop, according to

As biometrics take hold for mobile payments and other forms of e-commerce, Mitek hopes to avoid pain points from images from the account opening in one channel that don’t qualify for repeat usage in another.

“A good image isn’t easy to get,” said Sanjay Gupta, global head of product for Mitek. “And once you take a selfie, you want to be able to patch that with other ID documents.”

Mitek’s broader strategy is to use AI to improve image quality, building off its core business of supporting image capture for remote check deposit. It’s using tech from a couple of acquisitions over the past two years—IDChecker, a Dutch company that provides cloud-based identity document verification and facial recognition; and Icar, a firm that grew out of the University of Barcelona. Icar develops technology to tie account opening to identity verification.

“Digital onboarding is the first step,” Gupta said. “If you do that first step correctly there’s a digital ID available that you can get access to very fast.”

Document capture can serve as one element to verify a user's identity, and can also streamline data entry, thus improving user experience, said Julie Conroy, a research director at Aite, adding it's not a "silver bullet" and should be part of a layered approach.

Document scanning is probably not an alternative to usernames and passwords because it’s too cumbersome for consumers to use on a regular basis, said Al Pascual, a senior vice president at Javelin. “There is a clear role for this technology during the account opening and subsequent customer identification process, as well as in select high-risk transactions,” Pascual said.