U.K. ATM operator LINK reported that its cash withdrawals have fallen by 60% over the past month ending April 27 when compared to the same period one year earlier.

Despite the fall in cash withdrawals, LINK reported that British consumers are still withdrawing approximately £1 billion (about $1.25 billion) per week. New research from LINK shows that consumers are switching from using cash to contactless and digital payments during the coronavirus crisis.

“The fact people are using less cash shouldn’t come as a surprise because with cafes, pubs, restaurants and some shops closed, people are travelling less and there are far fewer opportunities to spend in the first place," said John Howells, CEO at LINK in a press release. However, LINK ATMs are still issuing around £1 billion per week to 11 million people. Even if this crisis does lead to less cash use in the longer term, people should be reassured that LINK and its members will continue to ensure good access to all who still rely on it.”

LINK is the U.K.’s main ATM network operator according to the

While the final numbers for the full month of April have not yet been released, the impact of coronavirus is expected to be significant. As a reference, in April 2019 LINK ATMs disbursed £9.7 billion in cash. If the £1 billion weekly average holds for the entire month, it would mean that total cash disbursements could come in at roughly £4 billion (about $5 billion) for April — a drop of almost £6 billion ($7.5 billion) in cash withdrawals.

One factor that is potentially having a major impact is that last month Barclaycard increased its contactless payment limit by 50% to £45 (about $56). The net result is that

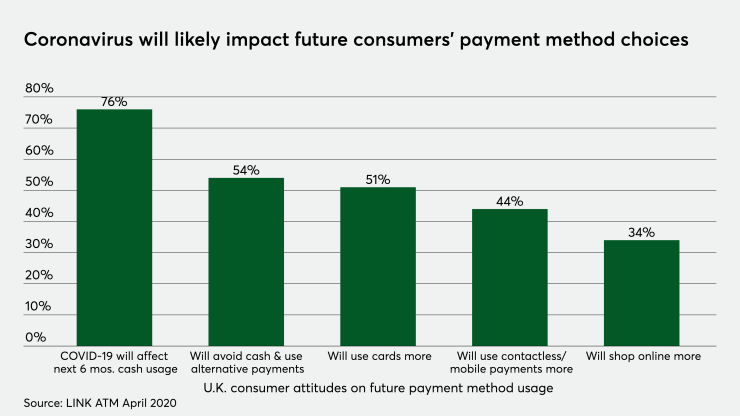

A survey of British consumers conducted on behalf of LINK revealed that three-quarters (76%) expect that the coronavirus will impact their usage of cash over the next six months. Additionally, half (54%) said they would avoid cash and use alternative payments, and another half (51%) said that they would use payment cards more.