More than 60% of all U.S. payment cards are now EMV-enabled and just over half of all merchants are chip-compliant, which has slashed counterfeit card risk for many operators.

But the U.S. has a long way to go before full conversion to the EMV standard is completely finished, and those who delay may find themselves in the cross-hairs of criminals poised to exploit obvious holes in the system.

Smaller financial institutions and merchants in specific categories that have not made the move to EMV may now be at higher risk for counterfeit card losses from criminals exploiting account data on the shrinking number of older magnetic-stripe payment cards not yet equipped with the more secure EMV chip technology.

“A handful of smaller banks still haven’t taken action on EMV, and they may have to get hit by a significant fraud event before they’re convinced they need to invest the money and time into finally converting to chip cards,” said Troy Bernard, director of strategic marketing and products at CPI Card Group, a card manufacturer.

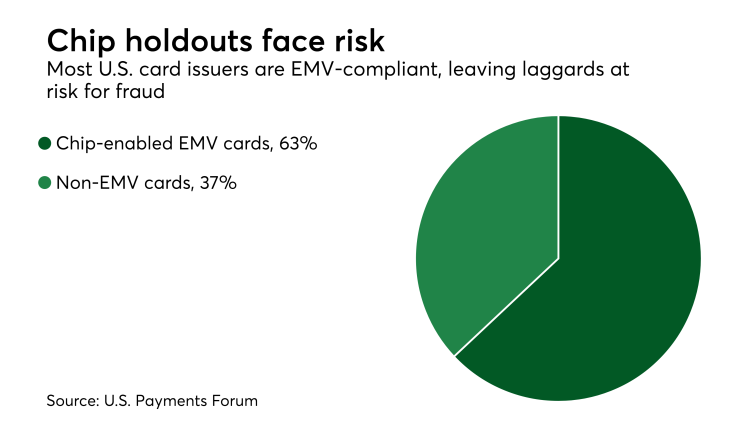

The U.S. Payments Forum reported in April that 63% of all cards in the U.S. market now are chip-enabled. As of two months ago, 81% of credit cards had been converted to the EMV standard and 46% of debit cards were chip-enabled, with numbers increasing each month.

Current data suggests that about 40% of all U.S. debit cards are not yet chip-enabled, and many of those belong to issuers with smaller card portfolios, according to Bernard.

Financial institutions likely to be at the greatest risk are smaller banks, community financial institutions and credit unions, said Randy Vanderhoof, executive director of the U.S. Payments Forum.

“These (smaller financial institution) issuers are such a small part of the 1 billion-plus card market that they’re not very visible,” said Vanderhoof, noting that the STA is working to help this group mobilize their chip-card programs to avoid losses.

Card issuers not yet on board with EMV have certain tools available to battle fraud, he suggested.

“Issuers can still manage risk by using data analytics and responding quickly when fraud occurs by offering mobile alerts or using technology to turn off or limit where (compromised) cards work,” Vanderhoof said.

On the merchant side, progress on EMV conversion has been slow but steady, and currently about 52% of U.S. merchants have converted payment terminals to accept chip cards, according to the U.S. Payments Forum.

Specialty retailers, regional supermarket chains and

A new complication for restaurants that haven't finished upgrading to EMV is the effect of ongoing data breaches and malware attacks at stores that aren’t chip-compliant.

Chipotle Mexican Grill suffered a malware attack in April which in turn triggered a proposed class-action

“In Canada and other EMV markets, we’ve seen that when 70% of all issuers and merchants have completed the shift to EMV, counterfeit card fraud finally falls away, but the U.S. has a long way to go before it gets there,” said Oliver Manahan, director of business development at Infineon Technologies, at last month’s Card Forum in Austin, Texas.