The patent office is getting buried in applications for distributed ledger systems, a mountain of documents that chart a clear course toward making static identity and password protection irrelevant.

But the strongest language in the patent application — which BofA emphasizes is still just a concept — speaks to security, giving a roadmap toward using distributed ledgers such as blockchain to manage ID risk or modernize data management. Such an approach could help the payments industry migrate away from top-down data ownership.

Banks and payment companies are turning to distributed ledgers for everything from

"There is a reason why digital identity providers are choosing distributed ledgers, and that's privacy," said Krista Tedder, head of fraud management and cyber security research at Javelin Strategy & Research.

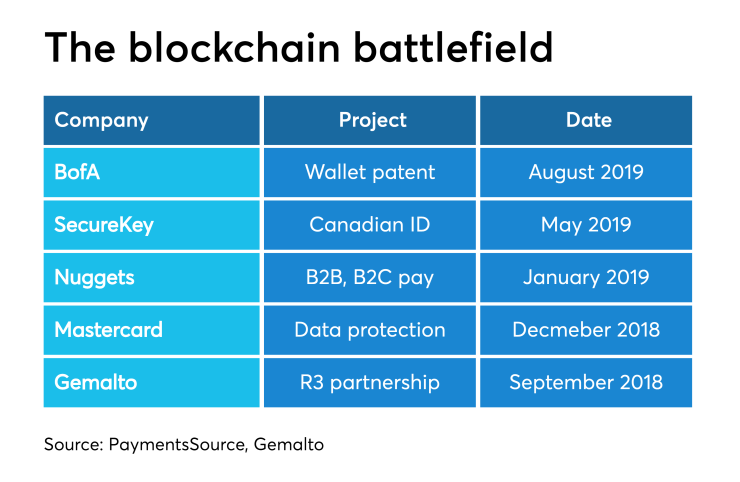

Many companies are pursuing blockchain to digitize identity protection. Examples include

Blockchain patents have grown dramatically in recent years, with an annual compound growth rate between 2013 and 2018 of more than 200%, according to

In the financial services industry,

These patents are mostly concepts for potential payments technology. One of PayPal's applications would patent a system to move cryptocurrency payments faster, while one of Chase's filings is for technology that would underlay a bank-to-bank transfer system.

Blockchains are considered among the primary ways to modernize identity management. Regulations such as PSD2 and GDPR are spurring movements toward greater data sharing between banks and third parties in Europe and other parts of the world.

Combined with e-commerce and faster payment processing, there's more pressure on normally competitive companies to

BofA's version is a decentralized system with a tiered identity model, allowing authentication to be more flexible and usable in broad venues, but only for specific purposes.

"For both regulatory and customer requirement reasons, payment networks, banks and vendors are relying on permissioned blockchains because they want to provide the ability to provision, and deprovision, aspects of their identity in real-time," Tedder said. "It has more to do with giving customers increased control over their personal information, especially when they're sharing that personal information across an entire ecosystem of service providers."

There are multiple approaches to digitizing identity, which could complicate matters as

"The key here is to establish industry standards and best practices across banking institutions, and to make sure to involve the regulators," said Gabriel Wang, an analyst at Aite Group. "So from that aspect, BofA's application will help enable a modern system of authentication."