Jack Henry & Associates has overcome an obstacle that delayed banks and credit union integration with Zelle, with a hub to streamline the onboarding process. But the new system’s first bank doesn’t go live until May, and the hub won’t hit full stride until next year.

Monett, Mo.-based Jack Henry on Tuesday announced JHA PayCenter, a proprietary hub offering a single integration point for Jack Henry’s bank and credit union customers to add faster-payment services, including Early Warning’s Zelle P2P service and The Clearing House’s RTP network.

The move could resolve anxieties for some of the smaller institutions that have been waiting in line to adopt Zelle, because the initial integrations can take several weeks on a case-by-case basis. Meanwhile, large banks like Bank of America are driving the largest chunks of Zelle’s growing payment volume.

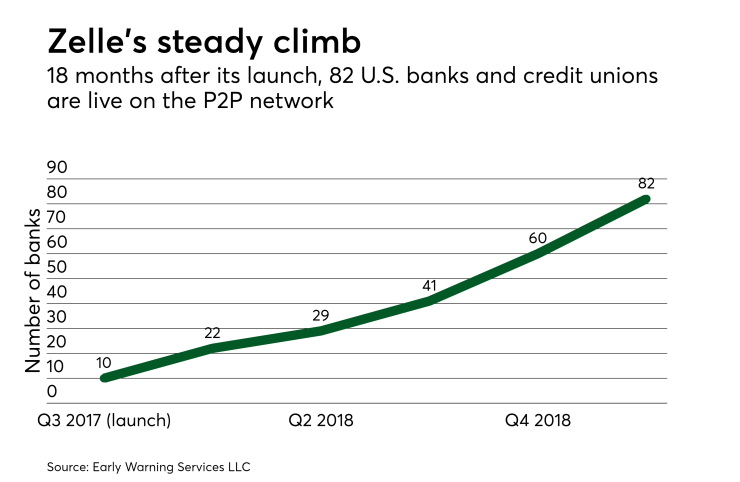

Since launching in September 2017, Zelle has gone live with 82 U.S. financial institutions, and about 350 have signed up to go live in the future, an Early Warning spokesperson said this week.

Several credit unions have been torn about whether—and when—to consider adding Zelle to their mix of services, unsure about costs and benefits.

Even with the prospect of a quicker runway to adoption, smaller financial institutions aren’t necessarily beating a path to adopt Zelle, suggested Greg Adelson, Jack Henry’s vice president and general manager of JHA Payment Solutions.

“In line with the rest of our industry, our clients’ opinions on deploying Zelle remain varied—many are excited; some are still cautious due to the requirement of data distribution, pricing and/or lack of a social aspect; and others prefer to wait and see,” Adelson said in an emailed statement.

Nevertheless, demand is strong enough to justify the months of technical planning that went into developing Jack Henry's onboarding hub.

“JHA is excited about the ability of JHA PayCenter to keep regional and community financial institutions at the center of the payments experience, while also helping to expedite how quickly the industry can reach its ultimate goal of payments ubiquity,” Adelson added in his note.