With midsize businesses still handling the majority of their accounts payable via checks, large corporations are reaping the benefits of digital or card payments.

A lot of this has to do with a misunderstanding of the options available to them.

More than 50% are under the erroneous impression that their vendors don’t accept cards and many believe it would be too hard to set up card payments for accounts payable, so as many as one-third have policies against it, said BC Krishna, CEO of MineralTree, a Cambridge, Mass.-based firm specializing in automating payments for midsize businesses.

While large corporations have cut their use of checks for vendor payments down to about 50% of all payments, according to the Association for Financial Professionals, midsize companies still pay 95% of their vendors by check, according to MineralTree, which has spent six years refining its payment automation services for midsize companies.

"There's just a lot of inertia at these companies that are growing fast and they don't think they have the time or resources to tackle what they think are a lot of barriers so they stick with checks," he said.

Since its launch in 2011, MineralTree has been selling its services primarily through resellers, including accounting platform providers, but a few years ago the company saw the opportunity to get closer to businesses through their banks, and formed a partnership with First Data Corp., which took an equity stake in the company in 2015.

Even when companies express interest in adopting ACH for vendor payments, many are befuddled by solutions that focus on the final stage of the transaction—the payment itself—when the key really is the original purchase order or an invoice, according to Krishna.

“To spotlight where bad payments behavior begins within these companies, you have to go upstream to see how they handle the invoice, and that’s where a lot of manual and antiquated practices are creating problems at the other end,” Krishna said.

MineralTree developed a solution for midsize businesses with between $5 million to $300 million in revenue to streamline vendor payments via an automated system that supports electronic checks, ACH and commercial card payments.

“MineralTree takes over where the transaction originates, automatically capturing the invoice within a company’s accounting or ERP system and matching it with a purchase order—which eliminates the most time-consuming part of manually processing invoices and writing checks—and driving it through a secure, integrated workflow that’s fast and simple,” Krishna said.

The MineralTree system also pairs payments with approved vendors and automatically enrolls new vendors where necessary, giving corporations the option to route payments via electronic checks, ACH or through cards to earn rebates.

Its connection to First Data is starting to bear fruit, as more banks First Data serves are beginning to adopt a white-label version of MineralTree’s solution, according to Cindy Wen, First Data’s vice president of strategy.

So far five banks have adopted MineralTree’s solution through First Data, and several more are exploring it, customizing the offering to fit their business customers’ needs, Wen said.

“Banks tell us MineralTree provides an easy way for their business clients to move vendor payments to electronic channels, and a lot of banks are particularly interested in the prospects of growing their commercial card business through this path,” she said.

Oakworth Capital Bank, a commercial bank based in Birmingham, Ala., recently adopted a white-label version of MineralTree’s invoice-to-pay module, which it calls Business Bill Pay. The service enables corporate customers to easily migrate vendor payments to ACH, and within the next year it will add corporate card payments to the menu, said Dawn Tillery, Oakworth’s head of client services.

MineralTree’s system integrates with popular accounting systems, and Oakworth’s customers access the service through the bank’s online banking portal to approve vendor payments, she said.

“The fact that MineralTree is able to integrate directly with QuickBooks and push information in real time is crucial,” Tillery said.

The opportunity to crush checks at midsize companies is huge, because they lag far behind larger enterprises in adopting technology to modernize accounts-payable systems, according to Krishna.

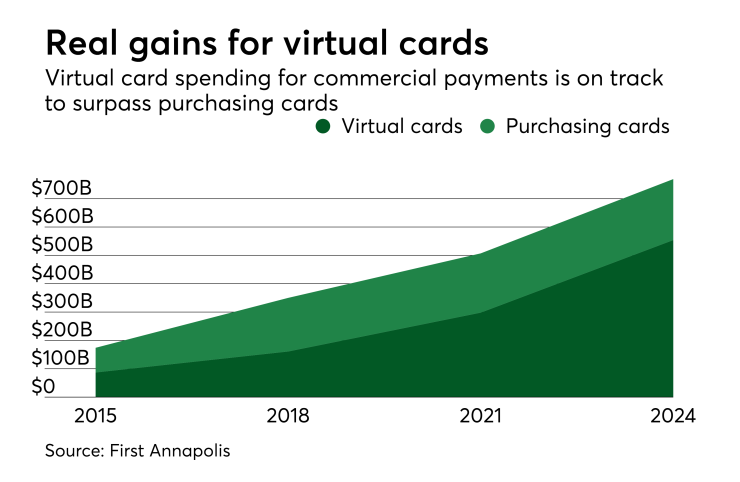

Commercial and virtual cards are poised to capture a growing share of vendor payments, too, expanding revenue opportunities for banks and their customers, he said.

“Trends are moving toward more card-based payments for accounts payable, but the key to change is helping companies rethink their vendor payments at the very start, with the invoice,” Krishna said.