The Federal Trade Commission has filed a lawsuit against FleetCor Technologies and its CEO Ronald Clarke, alleging they used deceptive practices that defrauded its business customers of hundreds of millions of dollars in fees and false claims about fuel savings.

The

“FleetCor strongly disagrees with FTC’s complaint, which the FTC Commissioners were not unanimous in approving, and believes the FTC’s claims are without merit," FleetCor said in a press statement. "We intend to vigorously defend ourselves against the FTC in court.”

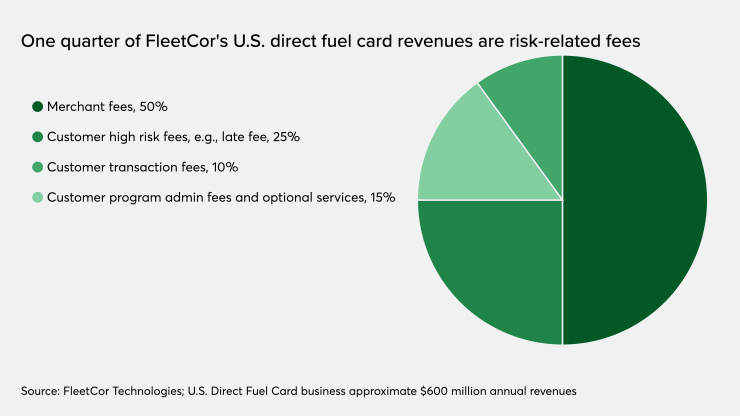

FleetCor stated that the FTC investigation and allegations are directly related to FleetCor’s U.S. direct fuel card business within North America, which generates approximately $600 million annually. It should be noted that the FTC has filed a lawsuit and is not engaged in an investigation.

In FleetCor's

FleetCor declined to provide further comment to PaymentsSource.

The FTC reported that the vote authorizing the staff to file the complaint was 4-1, with Commissioner Wilson voting no, and Commissioner Philips voting yes but dissenting in part as to the inclusion of Ronald Clarke as an individual defendant.

On

“Despite whether or not these fees and changes were in the card agreement or notifications were provided, this case may likely trigger an industry-wide change that calls for enhanced card controls that give business owners and drivers greater control over their spend and how fees can be charged to an account," said Richard Crone, principal at Crone Consulting LLC. "Card controls could also enhance an issuer’s ability to provide timely alerts and notifications that could meet the appropriate legal requirements.”

If it turns out that FleetCor charged these fees without giving its customers the proper change in terms (CITs) notifications or was not spelled out in its agreements, then it could deal a severe blow to FleetCor’s case. Crone predicted that much of the upcoming effort spent by lawyers for the FTC and FleetCor will revolve around the agreement terms and notifications.

The argument of the 55-page lawsuit centers on three acts and practices (section nine): “FleetCor has enticed businesses to sign up for its fuel cards by making three main claims: that customers will save money; that the cards provide fraud controls that protect customers from unauthorized transactions; and that the cards have no set-up, transaction, or membership fees, including when used to purchase fuel at any of the thousands of locations nationwide that accept FleetCor fuel cards. Each of these claims is false or unsubstantiated.”

The FTC also claims that after sign-up, FleetCor has charged customers at least hundreds of millions of dollars in unexpected fees. It reports that when customers have called to complain to FleetCor and FleetCor has agreed to remove them, “in many instances FleetCor has begun charging these customers for different fees to make up the difference,” according to the suit.

The FTC also reports that at least tens of thousands of customers have complained about these practices to the company, the government and the Better Business Bureau.