Innovating is tough even in ordinary times, but during the coronavirus pandemic many payments startups had to dig into deeper reserves of creativity and resilience to meet expectations.

With workers scattered to remote offices, payments products required rapid changes to adapt to the crisis, and two firms in expense- and spend management, Bento for Business and Teampay, reshaped their development processes to new conditions.

Bento faced a particularly interesting challenge. Not only did workers abandon company offices around San Francisco, Chicago and Provo, Utah, but a new CEO came aboard in the middle of the crisis.

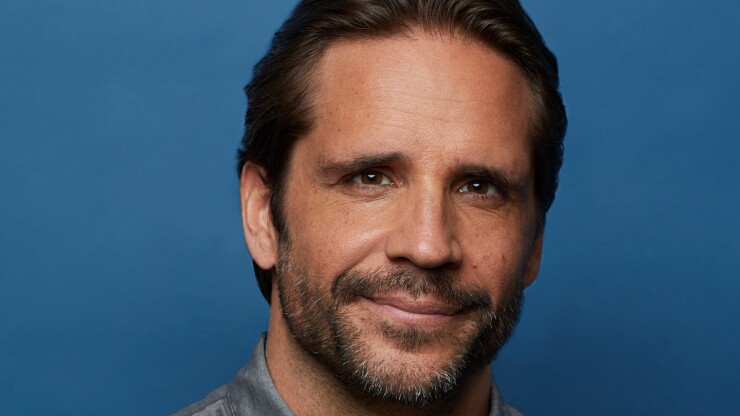

Farhan Ahmad, who founded Bento in 2014, had tapped Guido Schulz — a longtime payments executive who’s worked at Bluefin Payment Systems and Travelex — to guide Bento’s next growth phase, with Ahmad becoming executive chairman.

“We plowed ahead with our plans, and coronavirus gave everything a sense of urgency,” said Schulz, who assumed his new post in April, working from home along with his new colleagues.

Prior to the coronavirus outbreak, Bento had momentum with small and midsize businesses that use its platform to control company expenses by distributing physical or virtual cards to employees. Each card is designated for specific purposes as needed — such as fuel purchases, travel expenses, project materials or petty cash, and managers can adjust spending or allowed merchandise categories on the fly.

When Schulz arrived at the peak of the pandemic, one of his first moves was changing the way Bento Visa debit cards are distributed so they could meet companies’ new remote-workforce requirements.

Before the pandemic, Bento typically shipped companies’ new expense cards to the business owner for distribution. Since the switch took place between April and May, Bento expense cards ship directly from the card manufacturer to employees, based on their temporary work location.

“For companies whose workers were no longer coming into their headquarters, we had to find a different way to get physical cards to them, and we changed the architecture of our system on the fly to make it happen,” Schulz said.

The fact that the company’s systems in California, Illinois and Utah were already linked made it easier to shift development to home offices via videoconferences, he said.

“We’ve continued innovating using all kinds of electronic channels and video meetings, and we’re finding new ways to test and try things when we’re not all in the same room,” Schulz said.

New needs and use cases for Bento’s core products are also surfacing during the pandemic.

The changing retail landscape, with more online and in-app purchases, has also changed the mix of transactions flowing through Bento’s platform, requiring deeper adjustments and controls, Schulz said.

“The types of expenses businesses need to control has changed even in the last couple of months, payment tools are being used on the road and from home offices, and we’re finding new, streamlined ways to support that,” he said.

Card security is also taking a higher priority in the coronavirus era. According to Schulz, one of the leading factors in bankruptcy is misallocation of funds, and Bento helps companies keep track of that while they reorganize.

“We won’t come out of this unchanged, and some of the new processes we’re adopting will be permanent,” Schulz said.

Bento eventually plans to have its workers return to company offices, but not immediately.

“We’re a platform business so we can work remotely or go back to occupying our offices when the time comes. We’re in no hurry,” Schulz said.

Spend-management firm Teampay was in the middle of an aggressive product-development cycle when the pandemic struck, and its 45-member staff decamped from Manhattan offices that are designed for hands-on collaboration to home offices scattered around the region.

The company’s first devised new methods of meeting and communicating that would emulate Teampay’s typical working style, said CEO Andrew Hoag, who founded the firm in 2016.

“We have a very strong in-office culture based on good communication and sharing jokes and memes that encourage working fast and smart, and those values helped us make the transition to a remote work environment,” Hoag said.

The firm, which launched its services in 2017, looked at the pipeline of products in development for midsize and large corporations — Bitly and Zumper are two of its clients using its platform for automatic reporting and reconciliation of business expenses in real time — and flipped things around.

“We actually held up development of a mobile iOS app, because users were at home, not on the go,” Hoag said.

Teampay put a priority on new products and improved processes to further control company costs and improve businesses’ access to capital in the sudden economic downturn.

“We were already working on payments solutions for remote workers, but that became a top priority. We’re also emphasizing more ways companies can get quicker access to capital because cash is tight,” he said.

Employees suggested and devised new ways of collaborating, including moving whiteboard design sessions to Zoom and setting up new meeting schedules, with plenty of time built in to edit and refine these approaches as they went along.

“As we started working and innovating remotely, we’ve probably built more mock-ups than we used to, and in some cases we’ve gone further in the design phase as we found our pace,” Hoag said.

There’s been no dip in productivity, Hoag estimates, because employees are spending less time commuting.

“Productivity is probably up, because people have more time available, nobody’s traveling, and the flow is good,” Hoag said.

Early on, Teampay made a commitment to transparency by minimizing one-on-one discussions between employees.

“When everyone’s all in one office, you pick up on things — you hear the discussions, the high fives — and the proximity keeps you connected to what’s going on. We want to make sure that when we’re working remotely, we stay connected to broad developments by sharing more on Slack than we did before,” Hoag said.

Teampay has no plans to return to the Manhattan office yet, and the company will evaluate its situation month by month. Eventually some or all may move back downtown, and Hoag expects that transition will be relatively painless.

“If you have a crappy offline culture, it’s hard to make it work when you pick up and change your location like this, but we’ve made it work,” Hoag said.