Homeis, an internet platform that creates social immigrant communities, has partnered with money transfer fintechs Remitly, TransferWise and Afriex as it registers its millionth user.

Founded in 2017 and dual-headquartered in New York and Tel Aviv, Israel, Homeis creates self-curated internet communities for immigrant groups to improve their ability to integrate with their new home countries while gaining greater access to financial services. The partnerships with Afriex (a

“We are an internet platform that creates social communities for immigrants,” said Ran Harnevo, co-founder and CEO of Homeis. “We are the biggest community for Latinos. On top of that community product, we are building a marketplace for financial services. It is a curated marketplace to allow our partners to make offers to users of the community as well as for members to share other companies they’ve used for services such as remittances.”

The partnerships will enable Homeis users to be able to send money more quickly and securely as well as at a lower cost, Harnevo said. Users will also be able to search for additional money transfer agents recommended by others in their community in addition to banks, insurance and lending products. Currently only partners can offer deals to Homeis users.

Homeis brands itself as a digital platform for foreign-born communities around the world, serving French Speaking Africans in France, Israelis in the U.S., South Asians in the Emirates, Latinos in Canada and more. Each community enables the immigrants to engage in their native tongue, including English, Spanish, French, Hebrew, Arabic and Filipino languages.

Homeis has raised $16 million since its founding, according to

“What we’re building is like a USAA for immigrants,” Harnevo said. “Remittances are an extremely important financial service [to] our members, so it’s the first of the partnerships we are offering. We are proud to offer deals from our partners to the different communities we serve.”

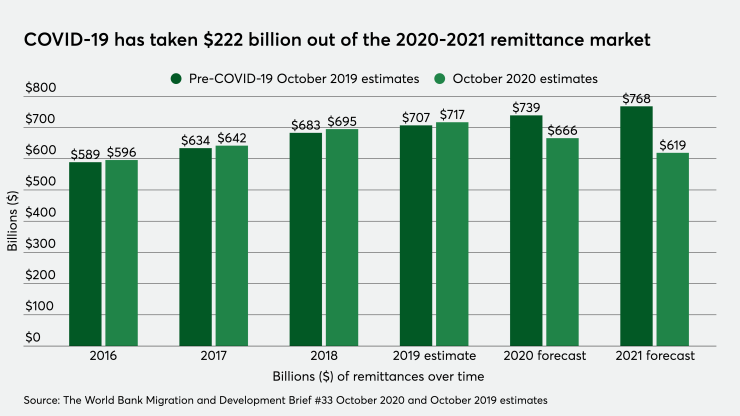

Before the COVID-19 pandemic hit the global community, the

It’s clear the pandemic has impacted global remittances over the course of the year — payment volume will fall a collective $222 billion over 2020 and 2021, according to the October 2020

“Many times immigrants don’t know that they have access to services and vendors, or even deals with partners,” said Harnevo. “That’s what Homeis is offering to them with this first series of partnerships with remittance fintechs.”