When consumers were sheltered at home during the worst of the pandemic, shopping moved online and fraudsters found ripe new targets.

As many countries and U.S. states now begin to lift stay-at-home orders, fraudsters too are being unleashed to return to familiar targets such as bank branches, ATMs and retail stores.

Of course, fraudsters were quick to design coronavirus-related scams and phishing campaigns to hijack consumers’ payment card details and accounts — but it was still a limited bag of tricks.

“We’re likely to see a spike in fraudulent transactions as restrictions lift, because fraudsters looking to convert stolen information into cash usually need to move around to make that happen,” said Rob Tharle, global fraud expert NICE Actimize, an Israeli firm with offices in various U.S. cities. NICE Actimize provides fraud-prevention and anti-money-laundering tools for banks and other organizations.

Even partial reopenings in states could create opportunities for fraudsters, as stores and financial institutions will be quickly exploited by fraudsters who need to monetize the accounts they stole during lockdown, he said.

“Fraudsters who succeeded in account takeover and account application fraud will now be trying to move money into those accounts they fraudulently control and spread out the funds so they can’t be easily traced,” Tharle said.

The restored ability to travel across borders also will likely be boon for fraudsters, especially in Europe, according to Tharle.

“Remote payments pose serious fraud threats, because a large number of investment scams show up in wire and P2P payments and as lockdowns lift, fraudsters will be able to travel to other regions to leverage stolen credentials,” he said.

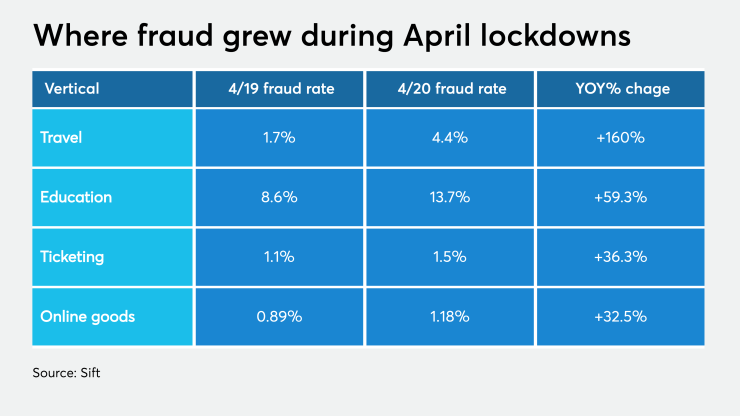

Industry sectors where fraud rates surged or waned during the lockdowns — widely in effect during April — could provide clues about the sectors where fraudsters may focus fresh attention when restrictions ease.

During April certain types of general financial services fraud declined while fraudsters focused on attractive new areas of exploitation in travel and online education, according to Sift, a San Francisco-based fraud-detection firm that works with many merchants and banks.

Digital fraud rates actually declined about 60% versus the same month a year earlier; and restaurants, which also had lower foot traffic, saw a 26% decline in fraud rates in April, Sift said.

Fraud related to travel and transportation — likely aggravated by a surge in consumer chargebacks from canceled trips and hotel stays — soared 160% during the lockdowns, while ticketing and event fraud rose 36%, according to Sift's data.

Online education fraud shot up 60% during April, reflecting the mass movement to online lessons when schools were closed. That trend is likely to persist after lockdowns ease, with students continuing to work online throughout the summer.

To combat fresh waves of fraud, banks and merchants must step up screening processes, but they face a difficult balancing act as stressed-out consumers may be poised to cancel their accounts in frustration when critical transactions are declined.

The problem already has come to a head in the U.K., where high demand for home delivery of grocery has created long queues, according to NICE Actimize’s Tharle.

“Getting a grocery delivery slot is like gold now, and having your transaction declined at the last second is a big deal because you might get pushed to the back of the line and have to wait all over again,” Tharle said.

Banks and merchants whose fraud-detection models were already thrown off by consumers’ altered shopping behavior during the lockdown must now adjust parameters again to account for a gradual return to normal with a higher level of fraud, Tharle said.

“The massive shift to more online shopping during the pandemic has masked a lot of fraud, and as the lockdowns ease banks and merchants will have to watch for another wave of fraud hiding in what looks like normal shopping behavior,” he said.