Consumers are increasingly positive about loyalty programs, mobile ads, chatbots and making a purchase from a smartphone, despite an early resistance to changing their payment habits when mobile wallets debuted years ago.

"The mobile wallet is interesting in that people think of it first and foremost as a payments vehicle, after all 'Pay' is in the name of most of them," said Sophie Vu, chief marketing officer for Chicago-based Vibes, a mobile engagement consultant and researcher. But Vibes research reveals that consumers find convenience "in just having a mobile wallet to carry cards and coupons" while eliminating the need to carry plastic or cash, Vu said.

In a survey of more than 2,000 U.S. consumers from November 2016 to January 2017, 91% of respondents said they regularly participate in loyalty programs they have joined, and 70% indicated they had a more positive perception of a brand because it delivered digitized loyalty cards they could use through mobile devices.

Seventy-three percent of respondents said they noticed mobile ads on their phones on a weekly or daily basis, and of those, 32% said they tap on the mobile ad with a "purpose" in mind, to either learn more or potentially make a purchase. Only 10% said they never noticed these types of ads.

Of note to merchants and wallet providers is that 33% said they were "extremely likely" to make a purchase from their smartphone after clicking a mobile ad, with only 17% saying they would never do so.

In the prior year's

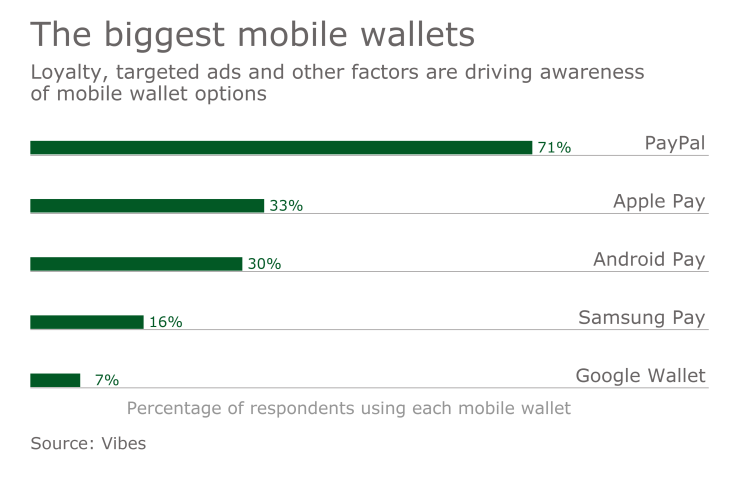

As for payments, PayPal ranked highest in popularity amongst respondents at 71%, Apple Pay had 33%, Android Pay 30%, Samsung Pay 16%, and Google Wallet 7%.

While the Vibes didn't ask respondents how many mobile payments they made, the rest of the research about loyalty and the desire to make a purchase from a mobile ad doesn't necessarily translate to more in-store payments with smartphones.

"There is still a lot of education that has to happen to increase mobile payments," Vu said. "You don't really see it anywhere anymore on commercials or billboards. You just have to go up to the POS counter, where you maybe find out if they accept a mobile wallet or not."

Consumers are not inclined to take too many steps to be able to use their phone for in-store payments, Vu said. "You have to think of the whole ecosystem for it, with the POS being enabled for it, and the mobile device communicating with that POS. There are just a lot of moving parts."

Mobile wallets can also become superfluous on a phone, Vu added. "Just like having hundreds of apps on the phone, if I have 30 different mobile wallets on my phone it becomes overload and defeats the purpose of it."

At the same time, consumers are becoming more comfortable engaging with chatbots, a messaging channel that is increasingly finding its way into the payments equation. Because 65% say they are comfortable with chatbots, the current trend is that "consumers are constantly seeking the next big thing to simplify their lives," the report said.

Payments providers will keep an eye on

"The No. 1 use case is customer engagement, because consumers expect real-time responses and don't want to be put on hold," she added. "If you are not doing customer service well, the consumer will go elsewhere, and you can't introduce other features like payments."