Credit counseling took another blow in July when a group charged that creditors control the industry through the National Foundation for Credit Counseling, resulting in poorly served consumers and an industry in need of a complete overhaul.

But the group making the charges, Consumers for Responsible Credit Solutions, has links with credit-counseling agencies that would like to open the industry to for-profit businesses that serve a national clientele ("The Heat Is on Credit Counselors," June). CRCS is a registered lobbying organization with about 800 consumer members, according to Director Darrell McKigney.

CRCS's 80-page report, "Nonprofits in Service to One of America's Most Profitable Industries," is directed to Congressional staff, the media and other influential players. The report claims NFCC members receive about two-thirds of their funding from credit grantors such as credit card issuers through so-called "fair-share" revenues. Fair share is generated from a percentage of the payments made to lenders by consumers who have set up formal debt-repayment plans through counseling agencies.

The report charges that the NFCC's board of trustees doesn't represent consumers because it has long been made up of representatives from credit grantors such as Citigroup, Bank of America, and others.

The NFCC fought back with a statement calling the CRCS report "irresponsible and misleading." The NFCC refers to fair share as "voluntary contributions" from creditors, and says that its member agencies also work with creditors that don't make fair-share payments.

The Silver Spring, Md.-based NFCC is a 53-year-old trade group primarily representing the industry's older agencies that traditionally provided face-to-face counseling. In recent years, the credit-counseling industry has changed rapidly, with financially struggling consumers increasingly getting help from newer agencies that use the Internet and the telephone as communication channels. That, along with reduced fair-share payments, has forced many older agencies into the difficult task of cutting expenses while simultaneously upgrading their technology.

CRCS is a sister organization of the Coalition for Responsible Credit Practices, a trade group made up of counseling agencies. McKigney also is the director of the Coalition.

McKigney has been a consultant to and spokesman for The Ballenger Group, a Frederick, Md.-based counseling agency. Ballenger bought out DebtWorks, a controversial agency that was cited by U.S. Senate investigators in hearings investigating the industry in March. DebtWorks has been sued for alleged deceptive practices. Ballenger executives say they have no links with DebtWorks' former management.

-

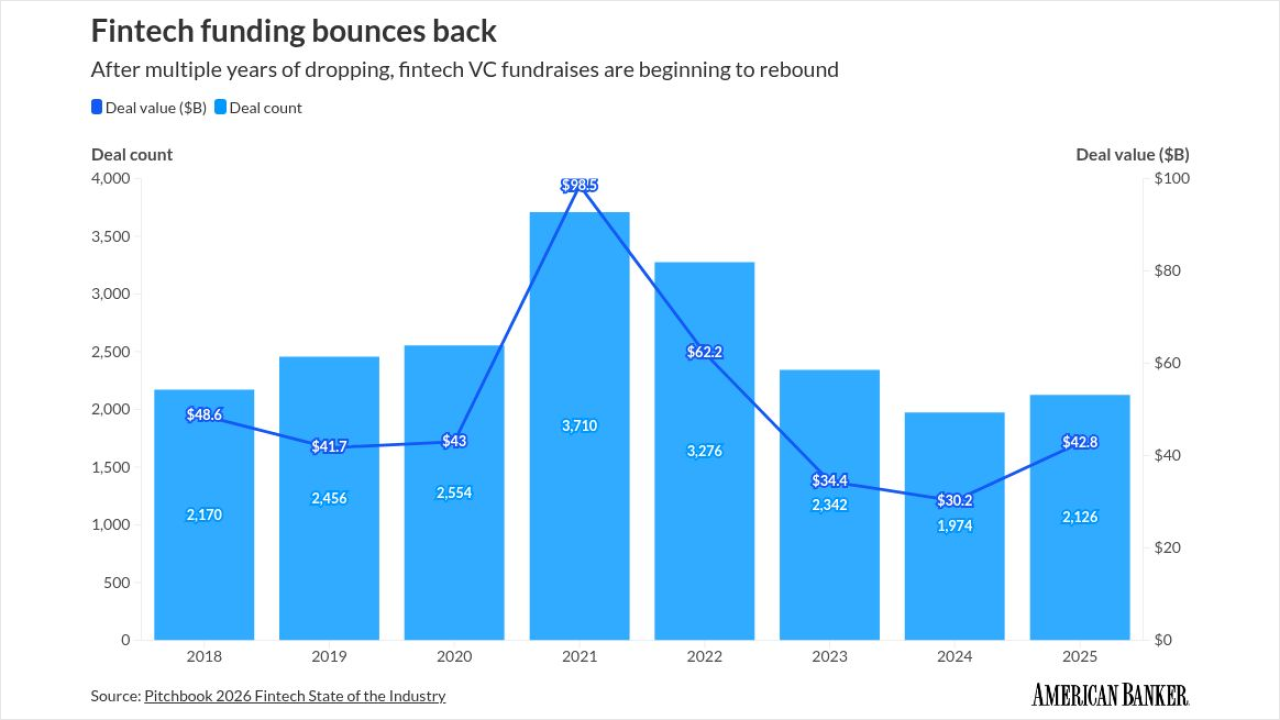

The fintech deal market has started to return to pre-pandemic levels, according to recent Pitchbook data, with boosts from big deals like Revolut's fundraises.

4h ago -

New York Attorney General Letitia James warns that scammers are coaching victims to bypass bank security and using "second act" schemes to steal more.

4h ago -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

5h ago -

Adyen is powering payments on Uber's new ride-hailing kiosk at La Guardia airport in New York. For the Dutch payment service provider, it's an opportunity to advance payment personalization.

5h ago -

The card network is enabling organizations to monitor risk systems and receive grades and plans of action for improvement.

6h ago -

Research from American Banker finds that executives are under pressure from nonbank firms and are concerned about identity theft in 2026.

7h ago