Transit systems want to use contactless and open payment systems to address ridership declines, an innovative strategy that nonetheless is riddled with pain points due to how transit has traditionally modernized.

Transit systems for decades have operated on their own time frame with bespoke systems to collect fares, and rarely conform to universal systems or standards. That's a tough stance since operating open-loop payments creates new compliance and security risks, and an expectation of universal user experience that portends frequent upgrades in the future. As

“One of the challenges is to create a system that allows the transformation with minimal work,” said Myung-Hwa Calais, FIME’s director of transport. “And you want it to work the same way as it does in other cities.”

Part of the

The wide range of mobile and contactless reader brands makes it harder to align with security standards such as PCI and general processes that allow interoperability, said Calais, who just finished consulting work on a transit upgrade project in Taiwan as part of FIME. Even in a single market like Taiwan, there are differences among hardware suppliers that could hinder uptake among riders, she said.

As part of the project, the Antony, France-based FIME worked with the Taiwan Association of Information and Communication Standards to create similar processes for contactless transit fare collection and micro retail payments — a move designed to make it easier to support the mix of new transit payments and “nearby” retail that often accompanies metro systems.

Calais has also worked on open-loop transit payment projects in France and Dubai, with the goal of creating cohesion in the different regions by encouraging adoption and adherence to standards. “The transit authorities don’t often talk to each other,” Calais said.

In the transit technology industry, the move to open-loop payments is called account-based ticketing, or a fare collection system that uses a back office to manage fares, collections and settlement. This often uses a cloud or externally managed system that allows riders to use a payment method that’s not directly tied to the local authority, such as Apple Pay. The pre-existing, card-based system requires the authority to operate and settle transactions inside of its own network. That’s why even in a local metropolitan area, suburban commuter rail and subway systems can have their own fare systems. It's also why an MBTA card in Boston doesn't work in New York.

While an account-based system would appear to be better because it gets transit systems out of managing a hyperlocal currency that's useless everywhere else, there’s a cultural gap in how transit systems operate that makes that transition hard, said Ben Whitaker, one of the founders of Masabi, a transit ticketing technology company with offices in New York and London.

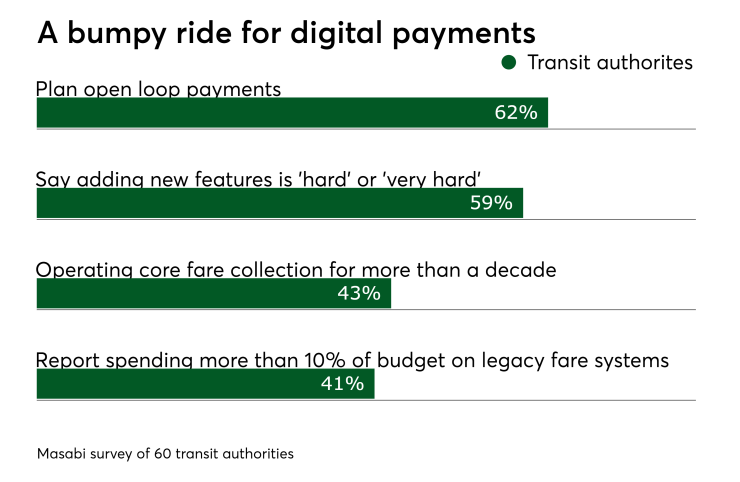

Systems rely on bespoke automated fare collection systems, Whitaker said, and these systems have often not been updated in more than a decade. When updates do come, it often takes more than three years to complete the project. Also, nearly 60% of the transit agencies Mesabi studied in its recent research said adding new features was either “hard” or “very hard.”

“The challenge for us is getting agencies out of the habit of buying everything in this bespoke manner,” Whitaker said. “When agencies do a project, they have an exact vision of how it works for them. If they can get more into using off-the-shelf or SaaS systems, they can configure the system to get close to what they need without having to spend a year and a half on every upgrade. And when the next set of upgrades comes, for something like IoT payments or a new fraud scheme, they don’t have to go through the entire procurement and building process again.”

There are also challenges for the third-party suppliers, who have to adjust PCI compliance and risk to a new industry that doesn't work like traditional retail.

“Any time you introduce a new set of security compliance layers to a payments ecosystem, there is going to be an adjustment period that takes time and financial investment to address,” said Randy Vanderhoof, executive director of the Secure Technology Alliance, adding the U.S. open-loop transit payments market is a very small community of technology suppliers who have had over 10 years to adjust to the PCI requirements. "Those industry leaders who have been actively implementing transit payments in other cities like Chicago, Philadelphia [and] Salt Lake City are well past most of the data security hurdles that PCI represents, but for companies who are new to open-loop transit, they have a steep learning curve."