Ripple isn't a part of Facebook's Libra. It's more likely to be a rival, and it must be careful to make sure that lawmakers see the distinction.

Ripple recently opened an office in Washington, and while it’s not unusual for a technology company to diversify geographically, the focus of this new location will be regulation.

Ripple, and other companies in the blockchain and cryptocurrency ecosystem, are often subject to a variety of state, national and international regulations that have complicated the industry’s development. But even these past spats over

“It’s too early to determine if Libra has a future and what that future might look like, but the negative reaction from regulatory bodies and central banks worldwide has been notable,” said Michelle Bond, global head of government relations at Ripple.

While the pressure on Libra doesn’t impact Ripple directly, the overwhelming noise Libra has generated does require Ripple’s attention. Ripple’s D.C. office is focused on lobbying, or what it’s described as educating policymakers about cryptocurrency and blockchain.

For now, that means drawing a contrast with Facebook.

Other large companies have also done this, partly through patent applications.

Ripple’s contending it’s focused on a different market, and a different model. “Rather than focusing on intra-network payments, we’re focused on solving a global payments problem to make the U.S. a leader in blockchain innovation,” Bond said. “And we’re doing so by working within the financial system, not around it.”

Ripple has faced its own regulatory battles. The blockchain company has faced legal battles over the

Ripple predicts that obtaining more regulatory clarity, such as definitions of "security" or "utility" for regulatory purposes, will create an incentive for blockchain to remain in the U.S.

“Today’s uncertain regulatory landscape is causing companies to look abroad to countries that have more established regulatory frameworks, which is a tremendous loss considering how much of the innovation is starting here in the U.S.,” Bond said.

Ripple’s D.C. office will be home base to new board member Craig Phillips, a former advisor to U.S. Treasury Secretary Steven Mnuchin. Phillips will advise Ripple on regulatory affairs, as will new Ripple hire Susan Friedman, who also worked for the Treasury. Another new Ripple hire, Ron Hammond, worked on the Token Taxonomy Act as a legislative aide.

The Token Taxonomy Act is a key piece of legislation for Ripple and other blockchain companies, since it would exclude certain currencies from an older definition of “security.” That would provide clarity for cryptocurrencies, potentially clearing the way for greater merchant acceptance.

“We’re in the formative years of digital asset regulation today, and we believe the U.S. has a major opportunity to lead on the policy front, whether that leadership comes from Congress or the SEC or" the Commodity Futures Trading Commission, Bond said.

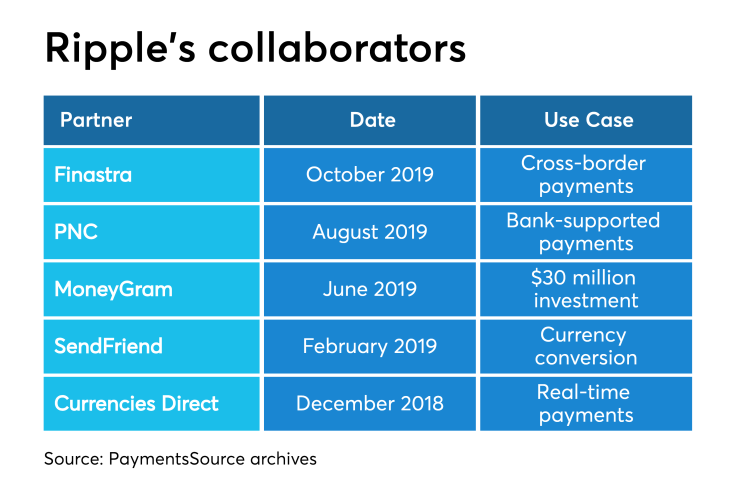

Ripple's roots are in the XRP token and in providing blockchain technology to streamline transactions such as cross-border payments by removing third party intermediaries. Ripple has partnered with banks and has opened its

As Ripple's partnership and use cases proliferate, so does its regulatory profile. Ripple's other government moves include sitting on the Federal Reserve's Faster Payments Task Force, participating in the IMF's Fintech Advisory Board and hosting a blockchain summit for central bankers.

Beyond the D.C. office, Ripple has also registered with FinCEN as a money services business, and it follows the Bank Secrecy Act, Bond said.

"There are nearly 3,000 different digital currencies out there and it’s imperative that governments have frameworks that appropriately consider the utility and nature of all kinds of digital assets — without lumping them together in a single bucket,” Bond said.