As technology around us evolves to be more pervasive but less intrusive, the interface between devices and the world around us is adapting to mimic and recognize human senses such as voice and sight. To that end, a couple of recent findings point to the camera taking on more roles in payment authentication and execution.

A researcher recently unearthed code in the firmware for the new Apple HomePod device that references infrared facial recognition called “Pearl ID” in a paired device, which is presumably the next iPhone, according to

This would complement the augmented reality applications that consumers can already test in the iOS 11 public beta. For example, the simple Apple Notes app can now scan any document and let users mark it up or add their signature through the touchscreen.

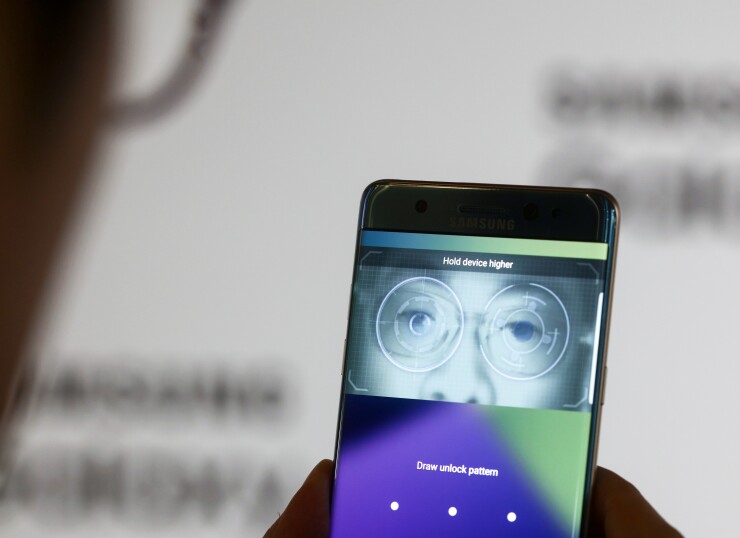

Apple won't be alone in these features. Samsung's ill-fated

So what's this got to do with payments?

Familiar territory

The use of the camera has been an integral part of payments as long as smartphones have existed — one of the earliest and arguably most useful features of mobile banking has been remote deposit capture (RDC), enabled in the U.S. in the wake of Check 21 Act passing in 2003. The law allowed images of checks to be treated as equal to a physical check, and even though people could scan checks from computers early on, it was the addition of this technology to mobile that made it take off as a consumer service.

The craze over mobile RDC was driving unconventional decisions, such as when banks chose to put out

Smartphone cameras are also heavily relied upon for scanning QR codes, or reading embossed credit card numbers to input into a mobile wallet or shopping app. More recently, Mastercard began using the smartphone's camera for

Even in light of these advances, Apple seems best placed to leverage the commercial capabilities of the camera inside and outside the home given the breadth of its ecosystem.

Apple's AR capabilities will allow for real-time information overlays on the world around us, presumably with sponsored calls to action from retailers and brands. And facial recognition can provide not just a robust form of authentication of the user in card present and card not present environments, but the ability for the merchant to know more about the habits and preferences of their customers prior to the point of purchase, bringing KYC to another level.

The inevitable fraud question

If and when Apple brings these features to market, there will be inevitable attempts to hack the system, particularly if accessing the phone simultaneously provides access to payment capabilities. The question will be what is the level of reward compared to the level of risk and effort.

The enrollment process could also be a weak point, as it was when

Besides the fraud issue, there is also the question of whether the end user will be willing to shift to a more visual use of the phone for payments, when the modern apps such as Uber take effort to make the payment invisible. In this, there may be generational differences of comfort that need to be addressed. In an era of Snapchat and selfies, a certain audience may not see the camera as a barrier to adoption.