Cross-border payment startups like

Western Union this month made a deal with

TerraPay’s digital technology will simplify the integration process and ensure interoperability for Denver-based Western Union’s systems in Europe, Africa, Asia and Latin America, the companies said in a recent press release.

Rival MoneyGram this month also launched its digital app in the U.S. and 14 other countries, leveraging new technology that simplifies and speeds up the process of sending funds to key emerging markets in Africa, Asia, Europe and North America.

“We’ve overhauled the front end of our service, rebuilding our products to be much more digital and responsive to the mobile user’s needs,” said Alex Holmes, MoneyGram’s chairman and CEO, in an interview.

What’s most significant about these moves isn’t the fact that Western Union and MoneyGram are expanding to new markets, but that they’re offering new payment methods in existing markets, enabling them to be more competitive, said Talie Baker, a senior analyst with Aite Group.

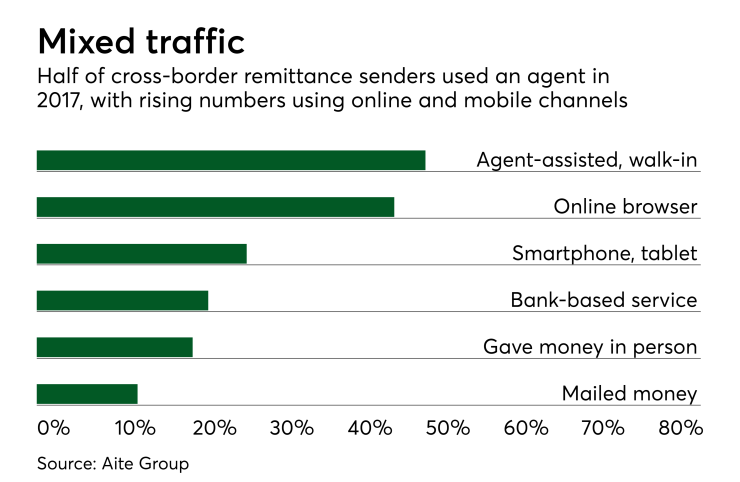

“The global remittance market is going mobile, so offering improved digital services like these is enabling Western Union and MoneyGram to move with the market, which will eventually be dominated by mobile phones instead of the (legacy) agent-based remittances,” Baker said.

MoneyGram’s digital app is a big leap forward for users who previously were confined to a slower, more complex online approach using a browser, said Holmes.

Sending remittances via a browser is prone to sluggish response if Internet and Wifi connections are weak, and the app drives a quicker, more intuitive approach than the old online method, added Youri Bebic, MoneyGram’s head of innovation.

“We immediately saw more than 30 percent of our remittance traffic shift from the browser to the app when we made it available in Europe,” Bebic said.

MoneyGram’s app also enables senders using cash across borders to “stage” the transaction before arriving at a MoneyGram office to save time, which is driving new use cases, according to Holmes.

In Canada and other markets where senders have traditionally had to wait in line to hand over the cash to an agent sending funds via MoneyGram, the app enables them to set up the transaction details ahead of time so they only need to show the agent a QR code, giving rise to ‘express’ payment lines at offices, Holmes said.

The app’s rollout coincides with MoneyGram’s expanded digital footprint in emerging markets, particularly in Africa and Asia.

Three months ago MoneyGram partnered with Zeepay, the Ghana-based fintech, enabling MoneyGram users to send funds directly to mobile wallets in Ghana, reaching potential audience of more than 11 million consumers with mobile phones in the region.

MoneyGram already had established similar partnerships enabling its users to send funds to recipients’ wallets with GCash in the Philippines and Safaricom’s M-PESA in Kenya and Tanzania, and its digital app enhances those connections, Holmes said.

“Unlike some of the bigger remittance corridors between the U.S. and Mexico or U.S. to the Philippines, in Africa and Latin America we’re seeing a lot of growth in mobile funds-transfers of smaller amounts sent more frequently,” he said.

Though the U.S. government blocked MoneyGram’s

“With the work we’re doing with our digital app and reaching mobile wallets, we’re also working toward getting regulatory approval so that one day we’ll be able to push funds from our senders into Alipay wallets,” Holmes said.