While anyone can lose employment during a pandemic or recession, below a certain threshold it becomes more likely that workers could lose their income — and thus default on credit card payments.

Logica Research puts that figure at $75,000. According to Logica’s study, just 13% of workers earning less than $75,000 were very optimistic about the state of their personal finances in the next six months, compared with 19% of workers earning $75,000 or more (the difference is statistically significant). The level of respondents who were somewhat confident about future finances was at 33% for both groups of workers.

“People making less than the $75,000 are more likely to be negatively affected by COVID,” said Lilah Raynor, Logica's CEO. “They are more concerned if their jobs will be around in six months. They are experiencing increased stress and lower job satisfaction levels. As a result, lower paid workers are more likely to be taking on debt and less likely to be paying down credit card bills. They are bracing themselves for the future. Banks need to brace themselves for the potential that a number of these people will begin to default.”

The lower confidence levels are "all due to the pandemic and its impact on jobs as many of the losses have been among people who make less money in industries such as restaurants, travel and entertainment," Raynor explained.

About 33% of workers surveyed who were making less than $75,000 have recently been laid off or furloughed due to the pandemic, compared to just 17% of those making $75,000 or more. Additionally, 53% of workers paid below $75,000 reported working fewer hours, compared with just 38% of those paid above that amount.

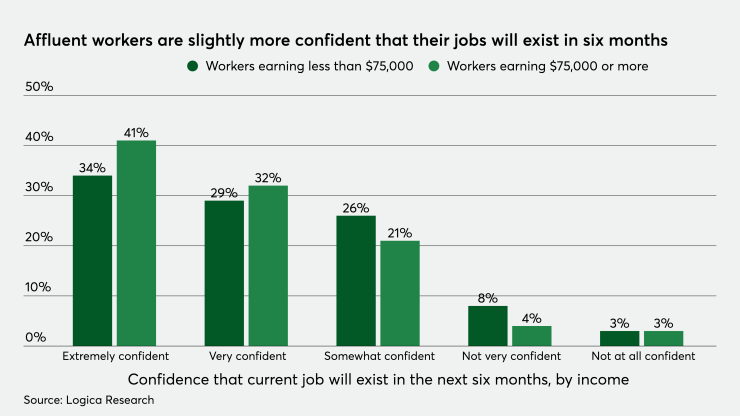

The impact on confidence about future personal finances is also correlated with the confidence, for those who are employed, as to whether or not their jobs will exist in the next six months. Logica’s study found that 41% of workers paid above $75,000 were extremely confident that their jobs would exist in the next six months, compared to 34% of those paid below that amount, a statistically significant finding. In contrast, 26% of workers paid below $75,000 were only somewhat confident and 8% were not very confident about the future of their jobs, versus 21% and 4%, respectively, of workers paid above $75,000 who felt the same way.