Artificial intelligence is disrupting markets and providing a competitive advantage for early adopters for those investing in the technology now.

Many banks, payment companies and fintechs are attempting to gain a competitive edge in the marketplace by embracing artificial intelligence, via innovative partnerships, strategic investments, and attempting to develop their own cutting-edge technology.

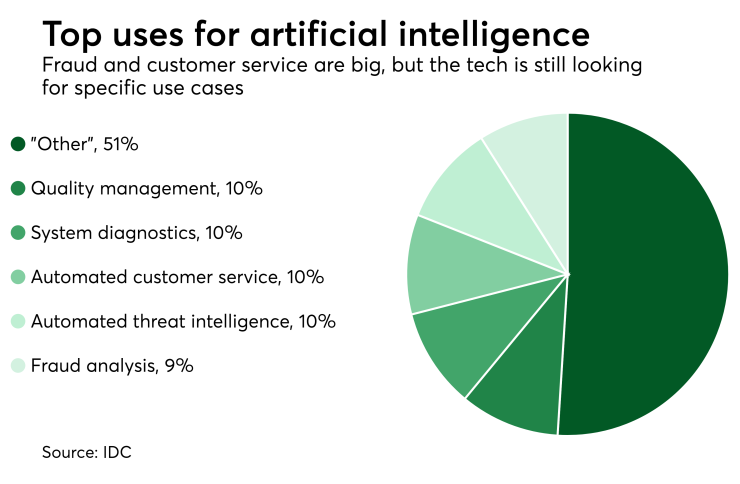

Examples include automation of manual processes and repetitive tasks, predicting how to better serve customers with advice or predicting their next product need, fraud and risk management, chatbots and intelligent virtual assistants, and personalized user experiences.

Artificial intelligence is providing the potential for displacing financial companies that rely on legacy platforms, manual processes, lack of data insights, and lack of real time decision making. Leading AI platforms are capable of processing millions of events in real time, at massive scale. These decision engines are analyzing data at optimal cost, speed and efficiency.

AI usage is growing so quickly because of the ability to create a better customer experience, increase productivity, create business growth, present predictive and relevant offers and mitigate risk.

Create a better customer experience. AI uses contextual awareness, pattern recognition and machine intelligence to create consumer persona-based profiles. AI is the backbone of the optimal customer experience by enhancing data capture and analysis and generating actionable insights in real time. This enables a hyper-personalized experience while constantly limiting risk exposure, eliminating customer friction, and increasing customer engagement.

AI helps you gain a holistic view of your customers and provide a faster response to customer market needs. This creates new opportunities for truly compelling consumer experiences —hyper-personalized customer processes that facilitate consumer shopping decisions.

Improved decision-making increases productivity and processes. AI and ML decision engines are capable of processing millions of events per second and billions of concurrent connections in real time, and at a massive scale to deliver a comprehensive suite of intelligence technologies. These technologies are designed to authenticate customers, reduce risk, eliminate customer friction and maximize digital transactions.

Examples of better risk decision making might be increased approvals, reduced false declines and reduced chargebacks, as outlined below.

Increase approvals. Automated machine learning can effectively score transactions in real time. Gaining a holistic view of customer behavior, pattern recognition and transaction history enables businesses to understand the customer behind the transaction. These platforms ensure the highest chance of an approval without compromising the shopper experience.

Reduce false declines. Automated machine learning lowers false declines by capturing and analyzing transaction data in real time. The platform scores the transaction leveraging myriad data sensors to enhance the accuracy of the score.

Reduce chargebacks. Automated machine learning enables businesses to identify fraudulent activity and high-risk transactions before they occur, dramatically reducing chargebacks and “friendly fraud." These platforms leverage a variety of data sources and behavioral signals to enhance the authorization score of the transactions.

AI is changing the business landscape, and we are only at the beginning of its usage. But those that are slow to adopt AI should be forewarned. They run the risk of being displaced by those that use AI now to create organizations that run with optimal cost and efficiency, reduced risk, and the ability to service their customers better.