ABI Research recently forecast that VR in retail and marketing sectors will generate $1.8 billion in 2022, with shopping and travel listed as two categories likely to be transformed by immersive consumer experiences.

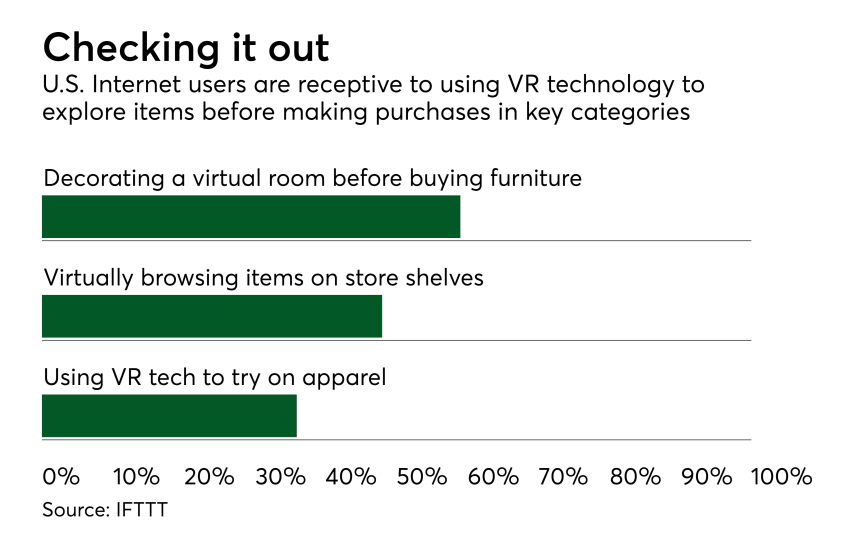

Major retailers including Walmart are exploring the potential for VR and augmented reality to change the way consumers shop. Other retailers and manufacturers are experimenting with giving users the virtual experience of visiting a prospective travel destination, virtually test-driving a car, seeing how apparel and accessories would look and trying out different furniture and home improvement ideas before making a purchase, according to ABI.

Payments will likely be woven into VR technology, but it’s too early to tell whether VR will be an enhancement or a disruption for existing payments providers. Here’s a look at recent VR activities involving payments providing some clues to the future.

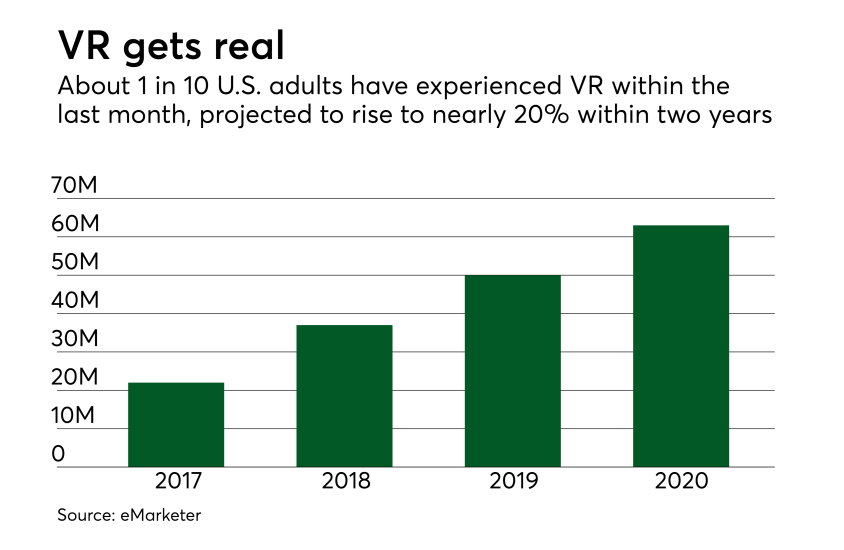

Though those numbers seem relatively small, the adoption curve so far is steep. The percentage of potential VR users is higher among Internet users versus the general population, but VR is becoming available in more public venues for demonstrating products, exposing a wider audience to the technology.

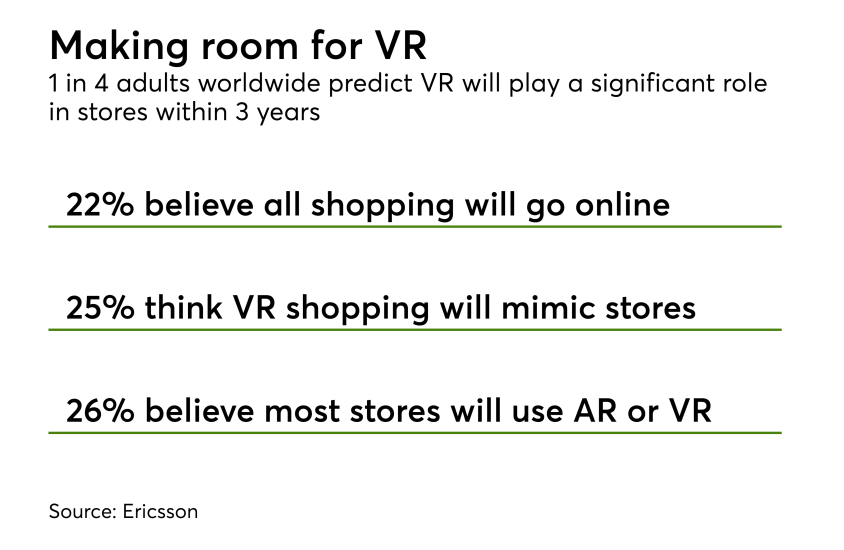

Twenty-two percent of consumers predict almost all shopping will be conducted via smartphones and physical stores will disappear within three years, according to Ericsson’s survey. A solid one-fourth of consumers think technologies like VR and AR will make it possible to get all the benefits of shopping in a store directly on a smartphone by 2021, and 26% predict stores will have much less floor space and use VR and AR instead to display products. Ericsson conducted a global survey of 5,048 consumers between 15 and 69 years old during January 2018.

VR shopping is not yet mainstream, but retailers are working to find a place for it within legacy systems and structures. Earlier this year Walmart reportedly bought the VR startup

IKEA has been working with AR since 2013; and Lowe’s is leveraging ARKit to demonstrate furniture in its stores.

Qualcomm’s new Snapdragon XR1 chip platform unveiled this week aims to support a new category of advanced portable VR headsets that consumers can take almost anywhere and experience 360-degree immersion untethered to a smartphone or a computer. The platform is expected to expand the market for lighter, more versatile headsets such as Facebook's $200 Oculus Go.

VR games connecting players in different locations are a fast-growing category of online gaming, where PayPal already is a major force. PayPal’s total gaming payments volume rose 23.5% in 2017 over the previous year to $12 billion, and it’s on track to continue with a loyal base of users and game publishers.

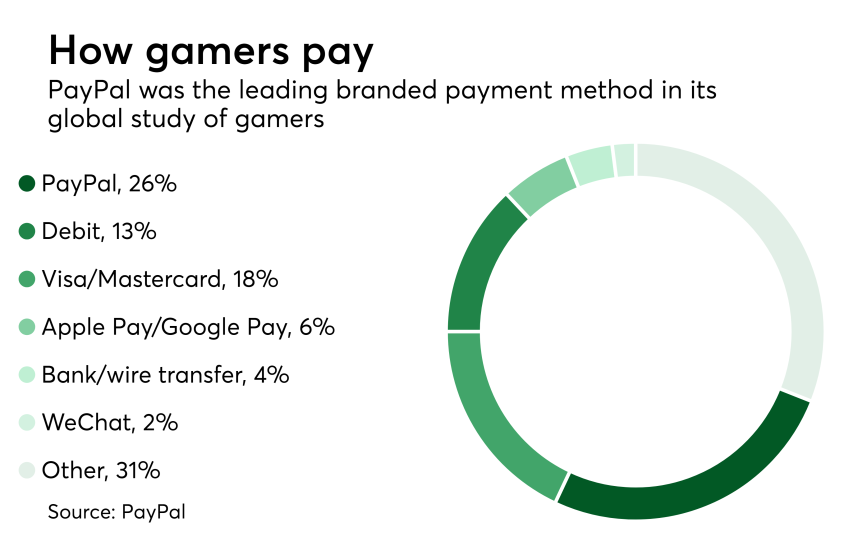

PayPal is the leading branded payment method for gamers worldwide, commanding more than one-fourth of all gaming payments, according to a global survey the payments provider conducted this year. Visa and Mastercard (combined) ranked second at 18%, followed by debit cards as a whole at 13%. Wire transfers accounted for 4%, and Asia's WeChat came in at 3%.

PayPal conducted an online survey of 25,000 consumers across 25 global markets in February and March of 2018.

U.S. gamers rank first in total spending, averaging $156 per quarter, followed by gamers in France and the U.K., according to PayPal’s study earlier this year.

Asked to rank the reasons they chose a specific payment method for online games, nearly 80% of all respondents said they chose the method that was easiest. About half said their preferred payment method was fast, and about 25% said they prefer a payment method that has few steps.

Apart from speed and convenience, other considerations mattered little to gamers when selecting a payment method. Fewer than 20% of respondents said security influenced their choice, and 15% or fewer cited privacy, fear of hackers and the ease of disputing errors as factors, perhaps because of relatively low per-game expenditures.