However, in recent weeks three surveys have been released that assess the U.S. fraud landscape across all of these audiences. Conducted in similar time frames, these reports provide a holistic snapshot of where payments fraud in the U.S. is today.

The first of these to note is that fraud is growing for the third straight year after a significant drop between 2012 and 2015, costing consumers $16.8 billion in 2017. What may be more alarming is the incidence of fraud among U.S. consumers — this has risen to 6.64% of consumers in 2017 from 6.15% of consumers in 2016, the highest rates since 2011. With the massive Equifax data breach in 2017 bringing fresh PII into the public domain, it can be expected that this figure will only rise.

On the flipside, card not present (CNP) fraud has been growing since 2014, with a particularly aggressive uptick between 2015 and 2016, to 3.4% of consumers from 2.4% of consumers. The trajectory decreased slightly in 2017, but it still reached an all time high of 3.8% of consumers experiencing CNP fraud.

It can be expected that the continued clampdown on card present fraud via EMV’s increased penetration in retail and expansion to ATMs and gas pumps, combined with the ever increasing volume of online transactions, will mean that CNP will continue to rise this year.

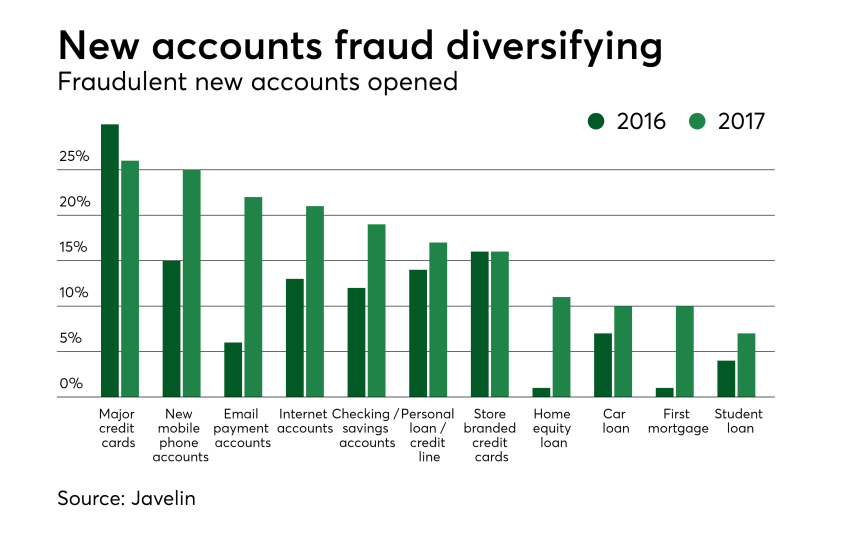

From new mobile phone accounts to personal loans and even mortgages, there has been a significant uptick in fraud. While fraudsters may be altering their modus operandi in the wake of tightening card fraud prevention measures, undoubtedly much of the new fraud occurring can be attributed to data breaches and the eye of the storm — Equifax.

From a financial institution perspective, the most prevalent type of fraud was debit. Signature debit was recorded to have the highest incidence of fraud, with 96% of institutions reporting losses in this category, closely followed by 81% of losses occurring with PIN debit. Credit card fraud resulted in losses for 77% of FIs. Check also remains a pervasive fraud channel — 74% of FIs reported losses in this category.

Notably, ACH and wire fraud remain relatively low in the U.S. It will be interesting to track whether these categories' fraud dynamics change with the introduction of same day ACH.

When asked whether fraud had increased since 2016, 63% of FIs reported that signature debit fraud had increased and 50% reported that PIN debit had increased. Credit is notably lower than debit, with just 41% of FIs reporting an increase in credit card fraud — the difference in debit and credit possibly attributable to credit card portfolios moving to EMV more quickly than debit card portfolios.

FIs cited an overall lack of budgetary resources — the cost of implementing detection tools (55%), lack of staff resources (48%) and availability of tools needed (33%) were all seen as impediments to better fraud management.

Other handicaps were primarily around access to information — consumer data privacy restrictions (48%), access to shared information on fraud schemes across the industry (44%) and corporate reluctance to share information (28%) were all determined to be restricting fraud prevention.

As with consumers and FIs, businesses also cite card fraud as the most prevalent type of fraud — 65% of businesses surveyed stated that card fraud was prevalent in their industry.

However, account takeover, synthetic identity fraud, information theft and phishing were determined to be prevalent by a significant number of businesses — a trend likely attributable to fraudsters shifting their attention to PII and away from stolen card accounts. Lesser problems included mobile fraud and check fraud, presumably due to relatively low levels of usage by consumers in both categories.

However, there is also a sweet spot for fraudsters between $10,000 and $35,000, with 11% of businesses stating that they had experienced fraud attempts within this range.

However, their customers were seen as a significant cause in the inability to manage fraud. Forty-six percent of businesses stated that lack of customer awareness of fraud was major challenge, and 40% stated that customers' antipathy to increased effort or friction in fraud prevention was a hurdle to better management of the problem.

Other notable impediments were more internally facing, including insufficient resources (29%), organization silos (22%) and internal lack of awareness of fraud (17%).