Fintechs increasingly use prepaid cards to access card network rails for new payment products ranging from corporate disbursements to gig-worker payments, and the customizable nature of prepaid cards holds significant promise for connected commerce within the Internet of Things.

What follows is a look at the key trends driving further changes in prepaid and gift cards.

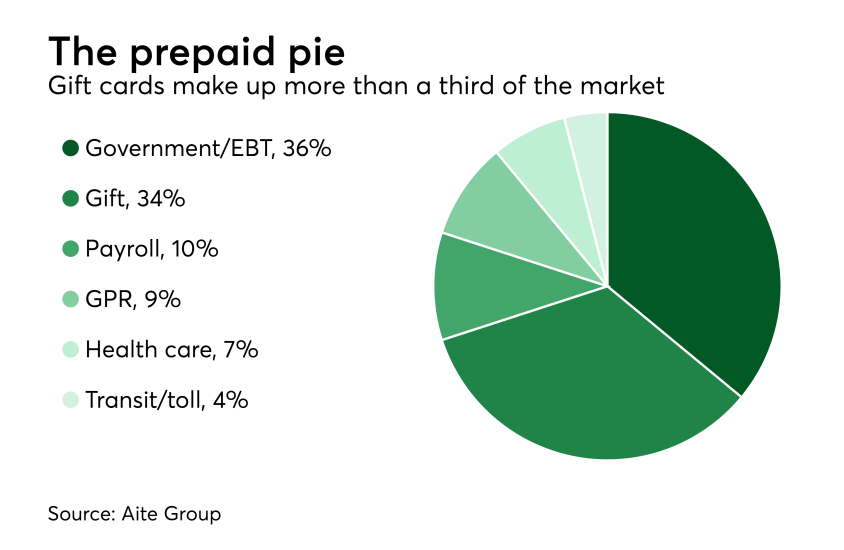

Gift cards—including closed-loop retail cards and open-loop prepaid gift cards used for rewards and incentives—comprise more than a third of the overall market, and the category is poised for change. While gift cards as a whole are growing, various studies indicate digital versions of these cards will begin to displace physical cards as mobile technology advances.

Payroll cards and health care prepaid cards are both predicted to expand modestly, and reloadable prepaid cards are on track to reach $59 billion in total dollar volume by 2020, as the lines blur between payment mechanisms for corporate payouts, campus purchases and wearables, Aite said. Transit and toll payments account for about 4% of the prepaid card market, and growth will be modest as more transit systems welcome open-loop contactless in the next few years.

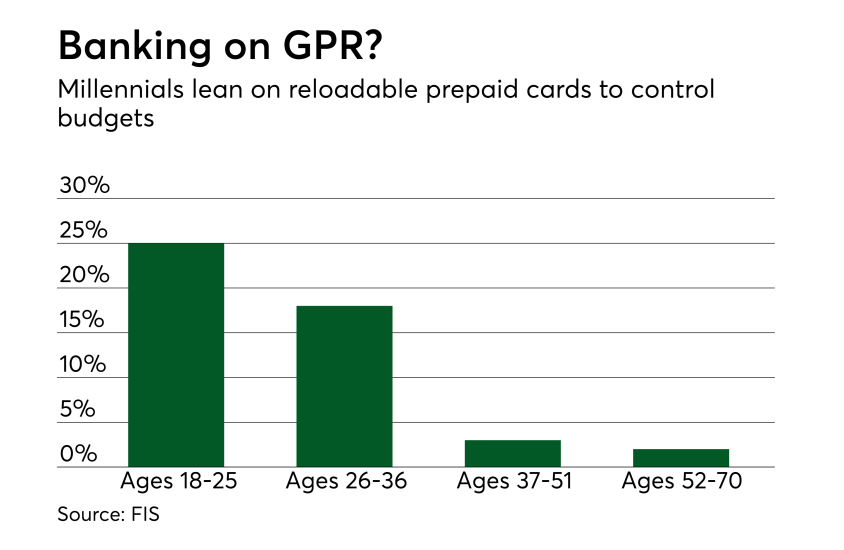

Millennials account for about 40% of total spending reloadable prepaid cards, according to FIS’ data. About 25% of young millennials between 18 and 25 years old who had a bank account used a prepaid card to pay a bill within the previous month, according to a survey FIS conducted last year.

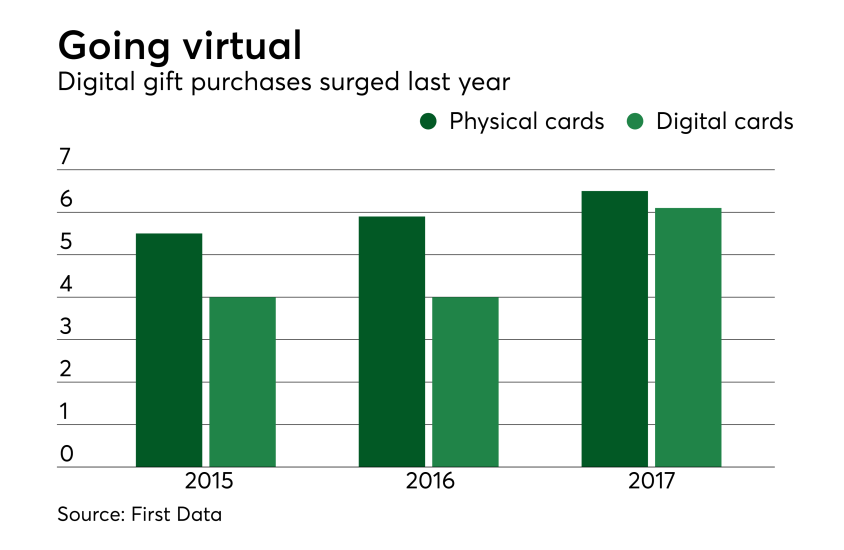

Mobile gift card apps are a significant category driving more digital gift card sales, First Data suggested. Among all consumers who were aware of mobile gift card apps, 52% had used one and among millennial survey respondents, 65% said they had used an app to purchase a gift card, First Data said.

First Data conducted its survey among more than 2,000 U.S. adults in August 2017.

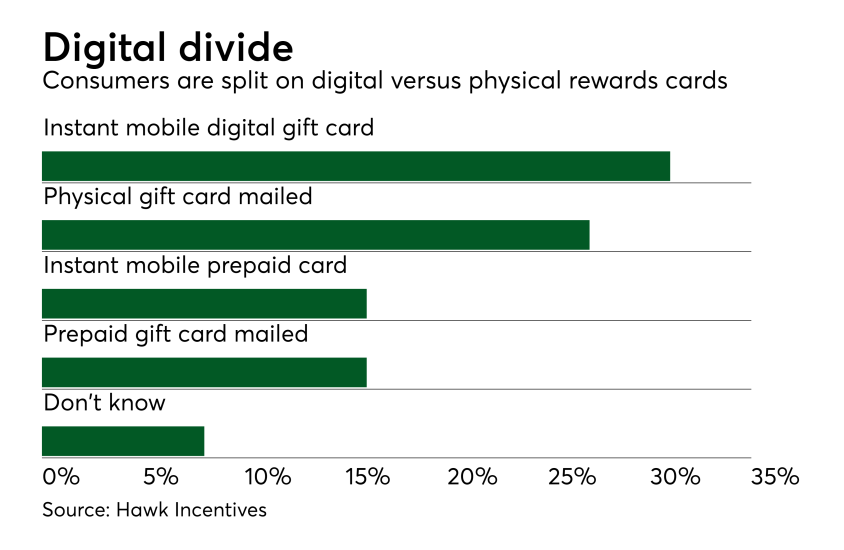

Digging deeper, Hawk Incentives’ survey data suggests that women, along with consumers under age 35 and those who belong to one or more loyalty program, are significantly more likely than men or older consumers to opt for a digital version of their reward, whether it’s a retail gift card or a prepaid cash card.

Consumers over age 55 who tend to be less tech-savvy prefer physical cards—retail or prepaid cash—when redeeming rewards. Leger conducted its online survey for Hawk Incentives among 1,500 U.S. adults Feb. 5-15, 2018.

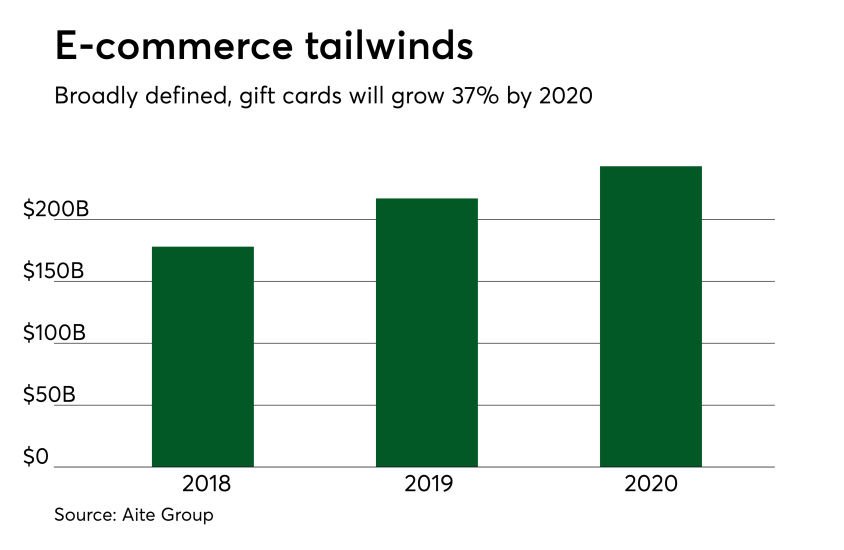

Total gift card dollar volume will rise 37%, to $243 billion, by 2020 from $178 billion this year, the research group predicts. This broad definition of the category takes in gift cards in physical and virtual form, employee incentives and retail loyalty program rewards, in a format redeemable at a specific store or for cash with a network-branded cash value gift card.

One driving factor for gift cards is the rise of mobile and online commerce, where merchants—most notably Amazon—offer consumers the option to buy gift cards and pay online from a gift card account balance. Amazon and other large retailers are poised to accelerate this trend by offering incentives for gift card reloads, and pulling funds first from any available gift card before tapping other funding sources, according to Kevin Morrison, a senior analyst at Aite who authored the firm’s latest prepaid card study.