-

In addition to merger work and a data center consolidation, Guild’s combined team has been busy with several major tech initiatives this year.

October 6 -

Executives from banks, credit unions, card issuers and investment firms at American Banker's Card Forum discussed ways the public's embrace of digital transactions and credit alternatives like buy now/pay later is shaping everything from products to business strategies.

October 5 -

Housing will still be a priority of the Consumer Financial Protection Bureau, but newly confirmed Director Rohit Chopra is also expected to investigate discrimination in the Paycheck Protection Program and bias in AI-powered lending algorithms.

October 4 -

Online lenders are a fast-growing sector of the financial system that hardly existed when the Consumer Financial Protection Bureau was created. The bureau should hold fintech lenders to the same standards as banks to eliminate a blind spot in supervision.

October 4

-

The U.K. challenger bank rescinded its application to become a U.S. bank after pandemic-driven losses.

October 4 -

The tech company has abandoned plans to offer checking accounts in partnership with banks and will instead focus on being a technology provider for them. Citigroup says it will press ahead with aspects of the digital banking project on its own.

October 1 -

Bank of America’s online-banking platform went down for several hours Friday, leaving thousands of customers locked out of their accounts before service was restored.

October 1 -

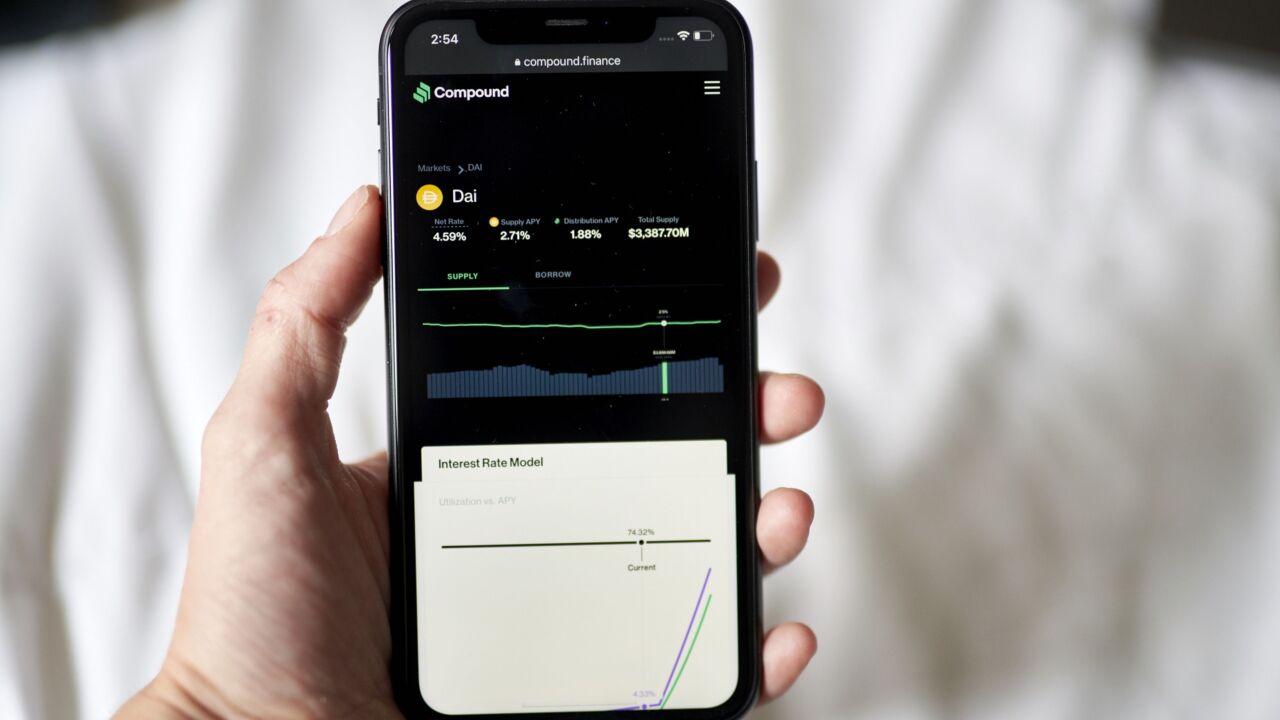

A bug in a recent update of the decentralized finance platform Compound sent users nearly $90 million worth of cryptocurrency in error, leaving its creator’s CEO begging users to voluntarily send it back.

October 1 -

Neobanks and Fintechs have raised the bar in terms of client experience and expectations, forcing incumbents to break free and innovate. Now they are coming after the next generation, launching next-gen youth-focused offerings. Europe is leading this charge with nearly half of the startups based in the region. With the increased popularity and competition how are these neobanks finding different ways to market and monetize? In this session hear from Taylor Burton, co-founder of Till Financial on why there is a race to capture the next generation and how Fintechs like Till Financial is turning is a popular trend into a profitable business.

-

Rather than targeting the masses, the founders of these neobanks are narrowing their focus to serve people who may benefit from specialized products and services. The latest example: Nerve, a banking app for musicians.

September 29