-

The Massachusetts senator and presidential candidate sent a letter to CEOs of five of the largest U.S. banks asking about their response to the outbreak.

February 28 -

How New York became Wells Fargo's new center of power; banks walk fine line in preparing for a coronavirus outbreak in U.S.; bankers on Bernie's electoral chances and whether a Sanders presidency would pose a threat; and more from this week's most-read stories.

February 28 -

The release of Richard Cordray's retrospective of his tenure will come one day before the Supreme Court hears a pivotal case about the leadership structure of the agency.

February 27 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to contribute $502.2 million to two funds that help preserve and build affordable housing.

February 27 -

CFPB Director Kathy Kraninger promised to complete the rule mandated by Dodd-Frank one day after a California court set a process for doing so.

February 27 -

Comptroller of the Currency Joseph Otting suggested the central bank was adopting a “partisan” stance against his plan to overhaul the Community Reinvestment Act.

February 27 -

While the Democratic debates have had little discussion about financial policy, the remaining presidential contenders have taken noteworthy positions on regulatory relief, antitrust rules and bankruptcy reform, among other issues. Here’s a rundown.

February 26 -

Under CEO Charlie Scharf, the bank that has historically viewed itself as more Main Street than Wall Street is becoming deeply embedded in the nation’s financial capital and its hard-charging culture.

February 26 -

Rep. Blaine Luetkemeyer, R-Mo., said Congress has "got to be pushing back" against the Current Expected Credit Losses standard, while Rep. Steve Stivers, R-Ohio, indicated that not all Republicans view the cannabis banking issue the same way.

February 26 -

At a credit union conference, Rep. Blaine Luetkemeyer, R-Mo., said Congress has "got to be pushing back" against the Current Expected Credit Losses standard, while Rep. Steve Stivers, R-Ohio, indicated that not all Republicans view the cannabis banking issue the same way.

February 26 -

JPMorgan would consider buying other businesses; collectors would be allowed to pursue debt past the statute of limitations, if they warn borrowers.

February 26 -

The regulator completed a thorough process, which included ensuring investors would treat borrowers well, before settling on a buyer.

February 25 -

Deputy Director Brian Johnson spent more than two years serving under two separate CFPB directors. He will become a partner at Alston & Bird LLP next month.

February 25 -

The agency's director said both steps will come as part of an ongoing review of agency rules and show her "commitment under the law to be effective and evidence based” in providing clarity to stakeholders.

February 25 -

Jennifer Piepszak, JPMorgan's chief financial officer, said the largest U.S. bank planned to borrow funds through the Federal Reserve's emergency lending facility in an exercise designed to break the stigma attached to that program.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

The Credit Union National Association is submitting a FOIA request to get more information about the National Credit Union Administration's recent portfolio sale, but further action could be necessary if those answers aren't satisfactory.

February 24 -

The agency plans to conduct a review of how it regulates the 11 Federal Home Loan banks amid concerns that some companies are inappropriately seeking a back door into the Home Loan Bank System.

February 24 -

The deal, which could be announced Monday, would push the TurboTax maker into consumer finance; the bank would follow U.S. rival Goldman Sachs into the British market.

February 24 -

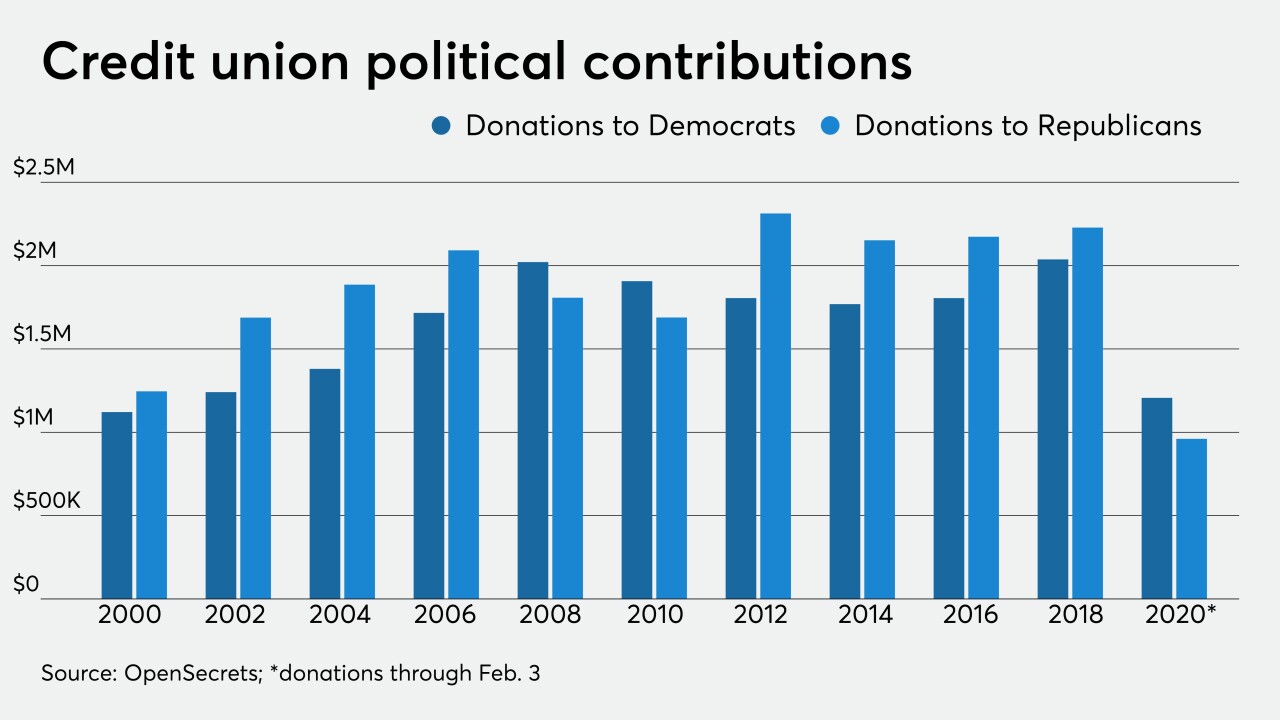

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24