-

The House Financial Services Committee is expected to question two of the bank's former board members, raising public scrutiny to a new level for bank directors.

March 8 -

The bank said it was Sloan's decision to retire, but a new report from House Democrats reveals that Fed and OCC officials made moves behind the scenes in 2018 and 2019 to pressure the bank's board to remove him.

March 5 -

The bank's announcement comes a week before CEO Charlie Scharf and two board members will testify on Capitol Hill.

March 4 -

Under CEO Charlie Scharf, the bank that has historically viewed itself as more Main Street than Wall Street is becoming deeply embedded in the nation’s financial capital and its hard-charging culture.

February 26 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

Mike Weinbach will lead consumer lending as part of a reorganization that will change the responsibilities of three longtime bank executives.

February 11 -

Michael Cleary will report to Scott Powell, who had been his boss at Santander Bank.

February 6 -

The Charlie Scharf era began with the company's lowest quarterly net income in more than nine years. Culprits included falling revenue, rising salaries and yet more financial fallout from the bank's sales scandal.

January 14 -

Wells Fargo & Co. may have a new leader, but the work of reinvigorating the firm after years of troubles is far from over.

January 14 -

Estimates for 2020 are for a combined profit drop of $10 billion as global interest rates remain stubbornly low and geopolitical tensions stay high.

January 10 -

Intense scrutiny from poker-faced CEO Charlie Scharf is prompting executives at the bank to ponder their units’ strategies — as well as what’s in store for their own careers.

December 27 -

House Financial Services Committee Chairwoman Maxine Waters said oversight of the bank will be a focus for the panel next year.

December 19 -

Charles Peck, the head of public finance, is temporarily joining the leadership of the public affairs team.

December 18 -

Muneera Carr, who will become the San Francisco bank's controller on Jan. 6, is the newest addition to a team being assembled by CEO Charlie Scharf.

December 13 -

CEO Charlie Scharf said in a letter to Congress that a review is underway to determine how many customers were affected by confusion over monthly fees and that the bank will begin issuing refunds next year.

December 5 -

Scott Powell, who resolved numerous regulatory problems as the head of the Spanish bank's U.S. operations, will face similar challenges at scandal-plagued Wells. As the bank's chief operating officer, Powell will report to CEO Charlie Scharf, a former colleague at JPMorgan Chase.

December 2 -

Avid Modjtabai, who runs Wells Fargo's payments and technology innovation unit, is leaving the firm as new Chief Executive Officer Charlie Scharf continues to shake up top management.

November 21 -

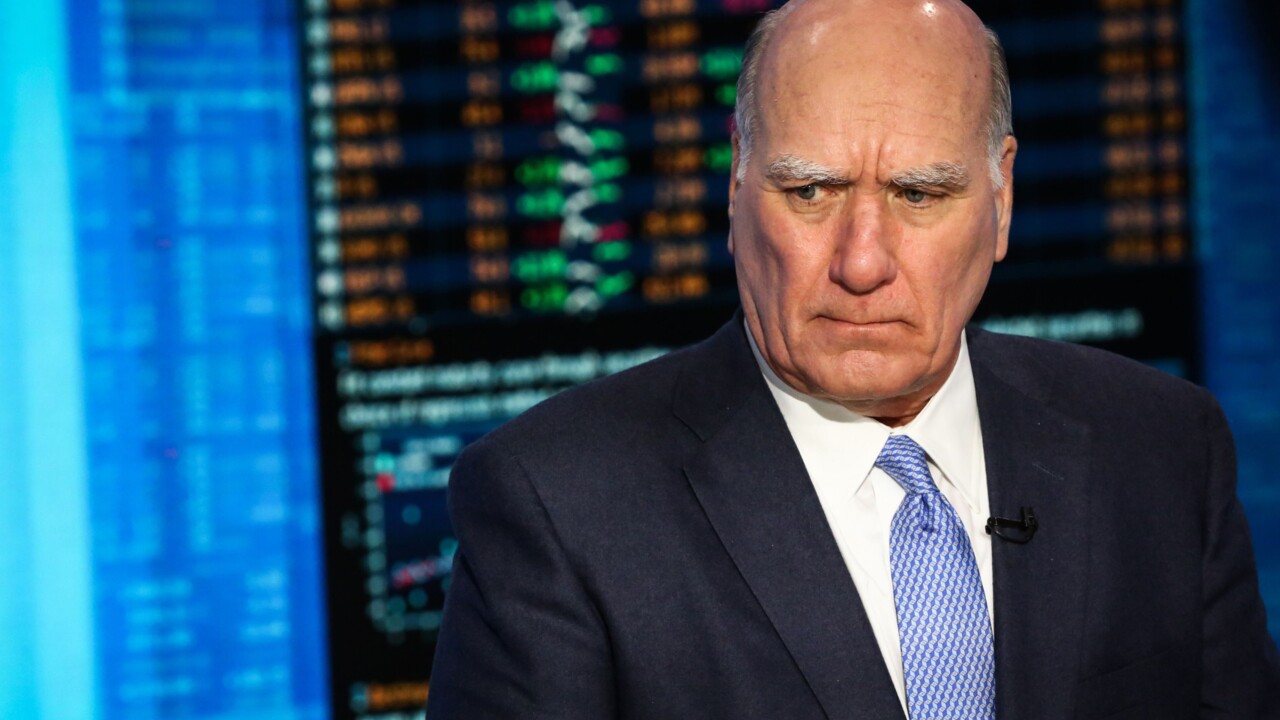

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

The new CEO is the first outsider to head the scandal-ridden bank in decades; Facebook CEO faces the House Financial Services Committee on Wednesday to discuss Libra.

October 22 -

Perhaps the biggest test that Charles Scharf will face when he starts next week will be how to control expenses while still trying to make the necessary investments in risk management to satisfy regulators.

October 15