-

Diebold Nixdorfs shiny new corporate moniker is already threatened by a possible deep investigation by U.K. authorities into the companys possible anti-competitive violations.

August 22 -

The New York State Department of Financial Services has fined Mega International Commercial Bank in Taiwan $180 million in connection with allegations that it violated New Yorks anti-money-laundering laws.

August 22 -

The Federal Deposit Insurance Corp. is receiving a rising number of new inquiries from organizations seeking to obtain a bank charter, the agency said in a report Monday.

August 22 -

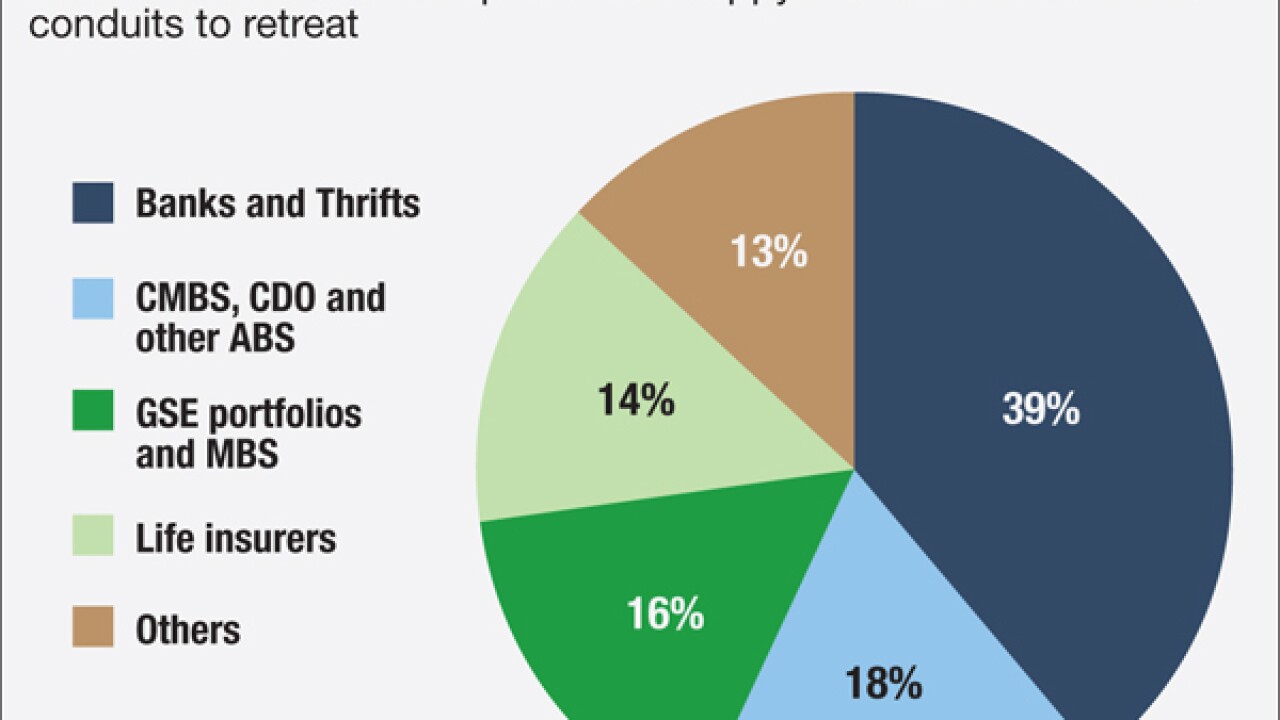

Despite headwinds working against the mortgage insurance industry, this business could be the catalyst for bringing private capital back to the mortgage market.

August 22

-

The Georgia Department of Banking and Finance closed the $21.4 million-asset Woodbury Banking Company on Friday, marking this year's fourth bank failure.

August 19 -

With the Office of the Comptroller of the Currency evaluating the possibility of a nationwide charter for certain fintech firms, state regulators are voicing concerns that a charter could cut into their authority.

August 19 -

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

August 19 -

The Consumer Financial Protection Bureau on Thursday urged student loan servicers to provide more help to consumers who apply for income-driven repayment plans.

August 18 -

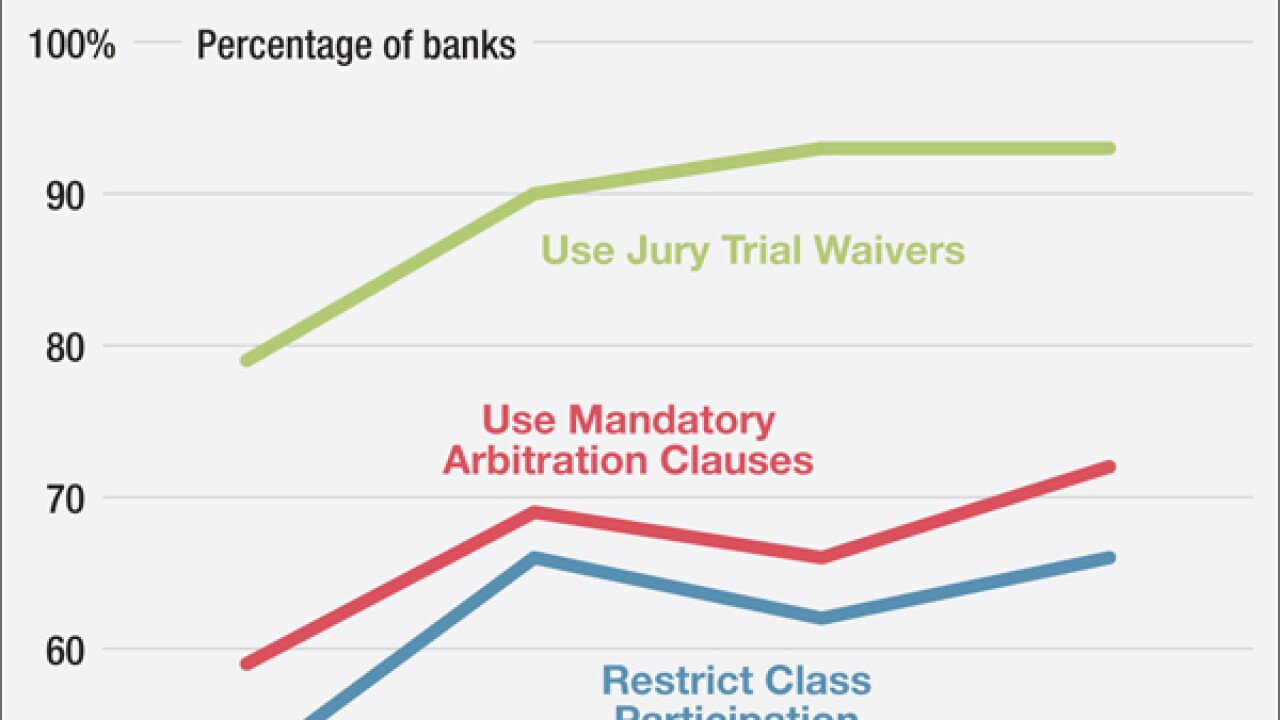

Industry representatives pushed back against a report that continues to paint a negative picture of arbitration clauses just as the Consumer Financial Protection Bureau plans to restrict such agreements.

August 18