-

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

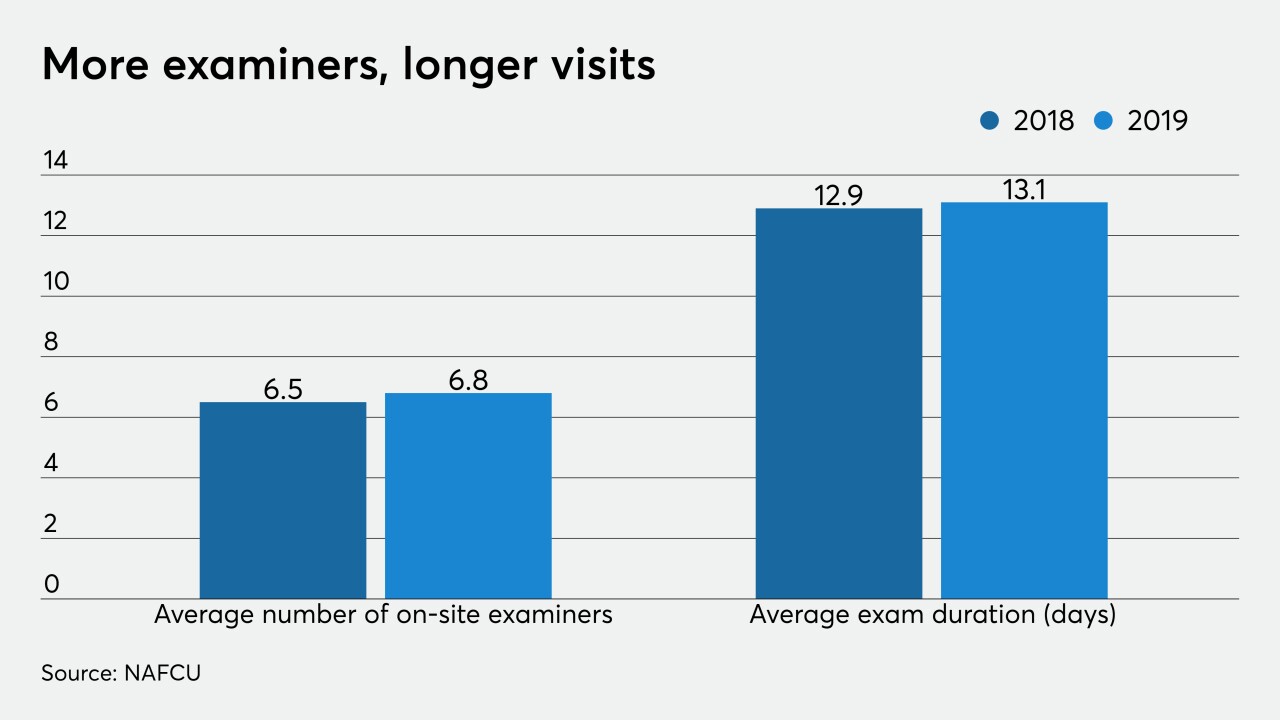

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

Last week, Indian regulators ordered an antitrust probe of Walmart and Amazon while Jeff Bezos and other Amazon execs traveled to New Delhi to tout a $1 billion investment to digitize local businesses. The message is U.S. investment is welcome, as long as U.S.-driven data mining is kept at bay.

January 20 -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

The central bank’s top regulatory official laid out a comprehensive set of proposals to update how the agency supervises banks — particularly large institutions — with an eye toward improving transparency.

January 17 -

The agency issued a fair housing proposal last month that would perpetuate segregation and make it harder to detect discrimination.

January 17 George Washington University

George Washington University -

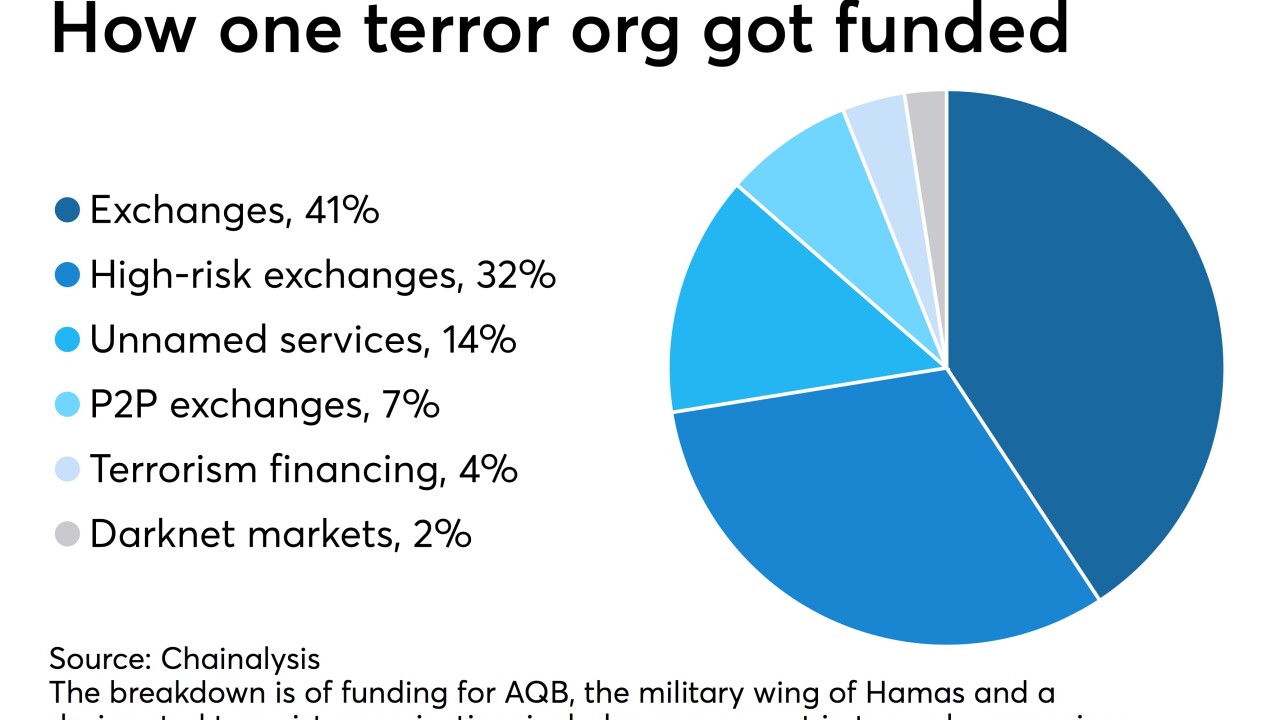

Terrorism financing schemes using cryptocurrencies are growing in sophistication, according to researcher Chainalysis, which helps law enforcement track digital-coin transactions.

January 17 -

The president tapped the pair in July for the two remaining vacancies, but the formal announcement of his intention to nominate them didn’t come until this week.

January 17 -

The central bank is aiming to finish a rule creating a streamlined capital buffer ahead of the upcoming round of stress testing, but industry experts say that timeline may be too ambitious.

January 16 -

The two agencies cited geopolitical tensions in issuing the warning and best practices tips, though they stopped short of referring directly to the recent U.S. clashes with Iran.

January 16