-

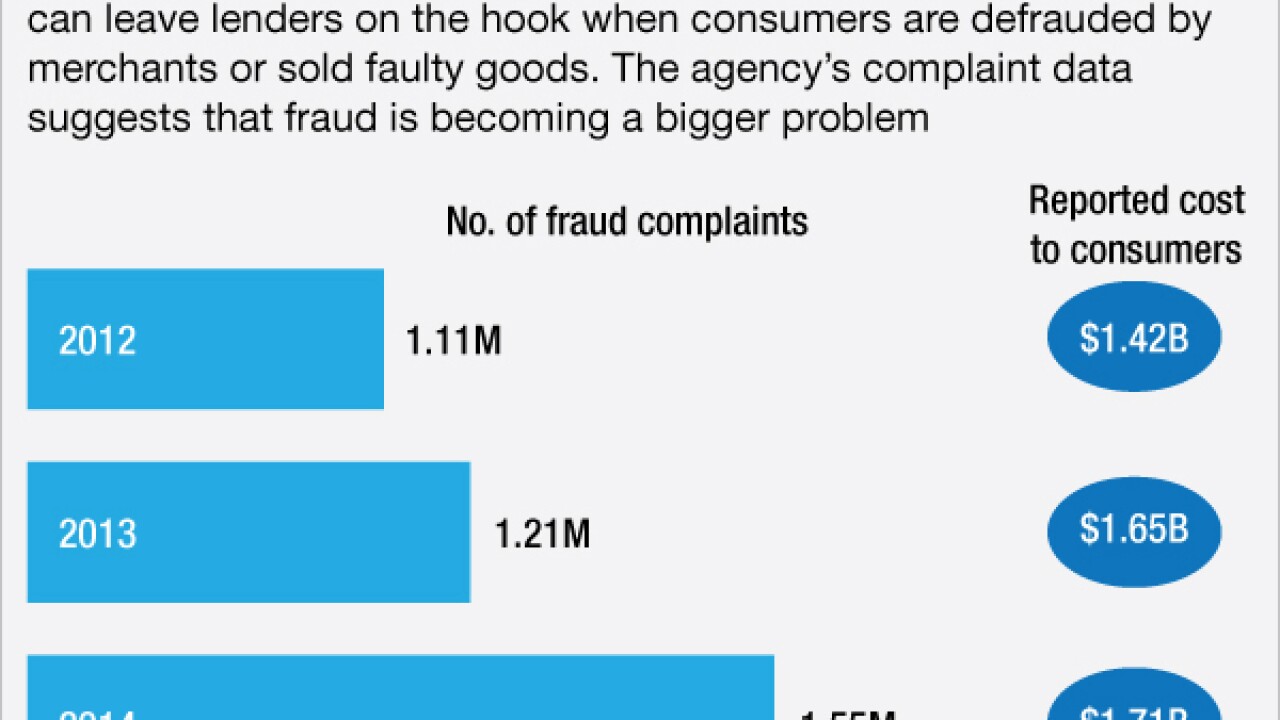

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

The Consumer Financial Protection Bureau acknowledges that gearing up for the Truth in Lending Act/Real Estate Settlement Procedures Act integrated disclosures has been tough, and it promises to consider that fact in exams.

February 19 -

Inefficient, paper-bound processes, oligopolies that can charge high prices, the Rube Goldberg structure of correspondent banking, and excessive regulation all make it expensive for migrants to send money home. Technology is a big part of the answer.

February 19 -

Key differences in the CFPB's agreements with Toyota and Honda are making it harder for the CFPB to make systemwide changes to the auto lending market. Here's why.

February 19 -

Not only does evidence point to small banks escaping interchange restrictions as Congress intended but there are also signs smaller institutions are gaining retail market share because of the exemption.

February 19 National Association of Convenience Stores

National Association of Convenience Stores -

WASHINGTON Federal bank regulators unveiled an interim final rule Friday allowing highly rated community banks to qualify for a less-stringent 18-month examination cycle.

February 19 -

Fannie Mae's net income fell 23% to $11 billion in 2015 from a year earlier despite benefiting from higher purchases of single-family and multifamily loans, the government-sponsored enterprise said Friday.

February 19 -

Survey results of voter attitudes from competitive swing districts indicate that the 2010 financial law is ripe for reform.

February 19 American Action Forum

American Action Forum -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 19 -

The decision in Yvanova v. New Century Mortgage Corp. has the potential to radically increase the number of lawsuits brought by borrowers, particularly on loans that were pooled into securitized trusts.

February 18