-

Caitlin Long, member of the Wyoming Blockchain Task Force, explains why the state has enacted 13 blockchain laws and what they mean for fintechs and banks.

November 4 -

Melissa Koide, co-founder and CEO of FinRegLab, analyzed loan data from six lenders that use cash-flow data in their underwriting. She shares what she found.

September 17 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

Readers react to regulators revamping the Volcker Rule and the U.S. Postal Service getting into banking, criticize HUD's plan to make it harder for consumers to allege discrimination and more.

August 22 -

Banks should work to shield some customers who may otherwise be flagged or blocked by AI-powered safeguards, and consider using alternative data to expand services to the underbanked.

October 17 -

Regtech — the intersection of regulatory compliance and financial innovation — is still taking shape in the U.S with some pushing for "tech sprints" to speed the development of new tools, while some see new threats and opportunities looming in the space. Following is a look at hot-button topics at American Banker's RegTech summit.

October 17 -

Banks need dedicated teams to shore up digital compliance efforts, officials at SourceMedia’s RegTech 2018 conference said.

October 16 -

The regtech firm Arachnys, which recently raised $10 million from QED Investors and others, draws from a collection of 23,000 data sources to help banks protect themselves from money launderers and other criminals.

October 15 -

Executives at Wells Fargo, BBVA Compass, ATB and Banco Popular share some of the pain points they've encountered as they've implemented artificial intelligence, and how they overcame them.

October 2 -

The subprime auto lender Prestige Financial Services used machine learning to make more effective lending decisions than its former model.

September 27 -

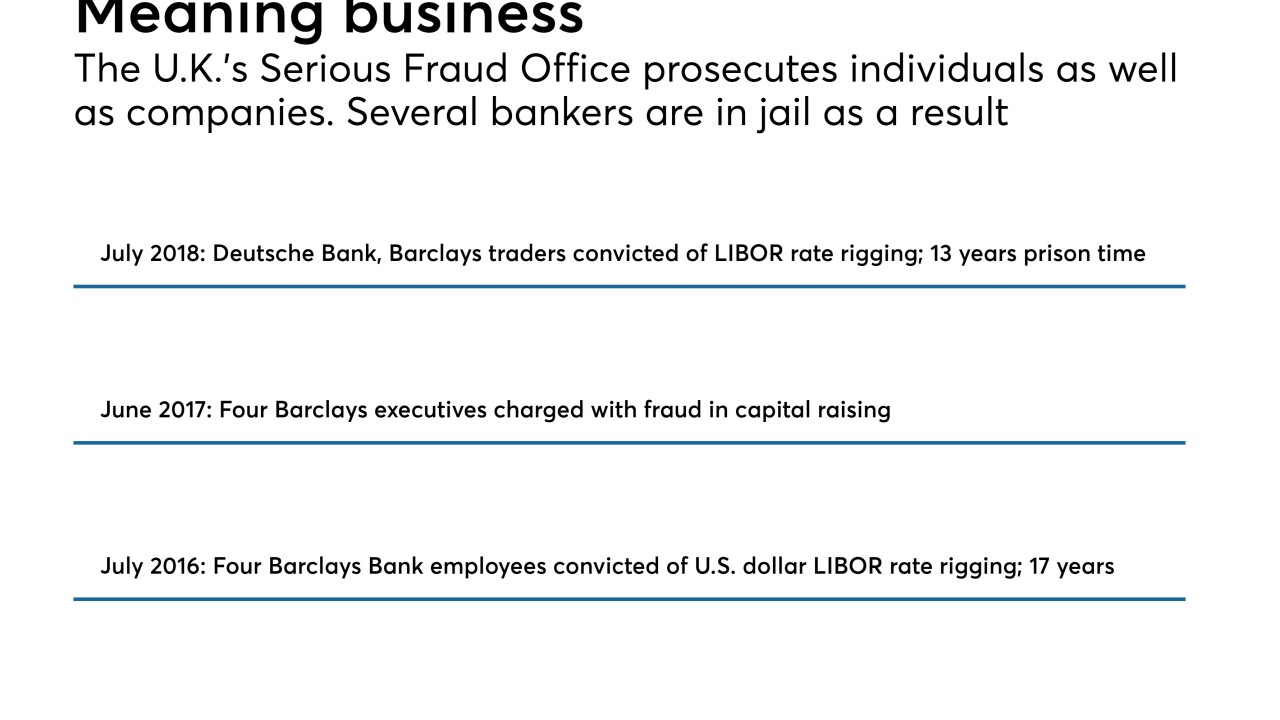

The U.K.'s Serious Fraud Office employs software that can read discovery documents about 2,000 times faster than human lawyers and can find previously unknown patterns between people, enabling quicker investigations and penalties.

September 17 -

State regulators said Wednesday they will refile a lawsuit against the OCC, attempting to block the agency's new federal bank charter for fintechs.

September 12 -

At a glance, New York regulator's first license to cryptocurrencies appears to be a good sign for other digital currencies. But there's a catch.

September 11 -

A family-owned community bank in Oklahoma is testing a Spotify-like service by fintech Meed that allows customers to pay $9.95 a month to obtain digital banking services.

September 10 -

Concentration risk, threats to data privacy and the potential for discrimination are among the unintended consequences of letting fintechs and tech giants dabble in financial services without bank-like regulation, an expert says.

September 6 -

It is critical that banks blend data science and their industry knowledge to better identify and mitigate compliance risk, says a director at Promontory Financial Group.

September 5 -

Many financial institutions are unaware that they're banking marijuana-related businesses, pot bankers and regtech experts say.

August 24 -

IBM claims that by monitoring customer behavior first and foremost, banks can make suspicious activity reporting far more accurate.

August 16 -

Bci Miami is one of the first banks in the U.S. to publicly acknowledge using AI this way, when many still consider the technology to be new, risky and unsanctioned by regulators.

August 9 -

A week after the Treasury Department laid out a plan for federal fintech regulation, it is already unclear which agency is leading the charge.

August 9