-

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

Alongside identity-document scanning and other ID verification, the two companies are offering real-time checks of lists of suspicious persons. The goal: keep money launderers out of the banking system.

March 22 -

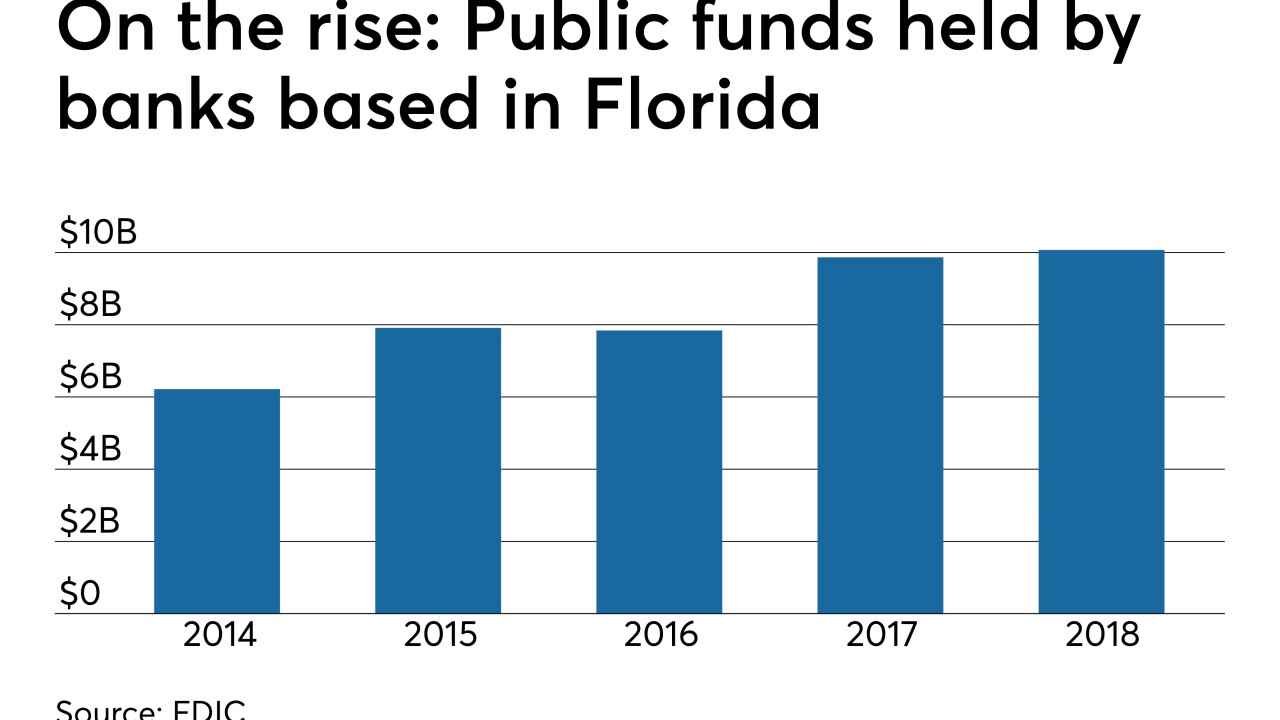

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

The head of the agency said she wants FDIC staff to be proactive with banks that show visible problems, but not “focus more on seeking out dirt than on whether the home is clean.”

March 22 -

Financial startups are becoming important partners for community banks and credit unions, despite lobbying efforts to limit their growth.

March 22 Upstart

Upstart -

Readers debate the odds of legislative reform to Fannie Mae and Freddie Mac, consider the growing problem of "friendly fraud," weigh ways to avoid reputation problems and more.

March 21 -

The bill by Sens. Kevin Cramer, R-N.D., and John Kennedy, R-La., would block banks and credit unions with over $10 billion of assets from refusing service to "customers that may not share the same political values."

March 21 -

The changes will expand the role of the Consumer Advisory Board and other panels, but stopped short of reversing the downsizing ordered last year by former acting Director Mick Mulvaney.

March 21 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

The role of the central bank has changed over the decades, but presidential pressure on the Fed has been a constant.

March 21