Aging affects everyone

But even millennials’ lives are affected by the needs of aging baby boomers: Twenty-five percent of millennials and 50% of Generation X members are caregivers for older family members, according to Brad Kotansky, founder and CEO of Onist Technologies.

“When you think about technology for the older market, it's fair not to just think about the older person, you have to think about the network around them — their children, the professionals they work with,” Kotansky said. “Seventy-five percent of that group is in their 30s, 40 and 50s, and that generation is tech forward.”

Kotansky is one of a handful of fintech entrepreneurs who have developed financial technology geared toward multigenerational families, where children are helping parents, and vice versa, with their finances.

“As an industry, we need to move beyond creating tech solutions for 18-35 year olds, to focus on solutions to meet the needs of all as we age,” said Theodora Lau, founder of Unconventional Ventures and until recently director of market innovation at AARP. Lau has been influential in getting startup founders to focus on the over-50 demographic and organized a panel on the topic at the Digital Banking conference this month.

“Central to that strategy is assisting the ecosystem that supports older adults, including their caregivers,” she said. “Only then will we be able to not only take care of the needs of the older, existing clients, but also provide solutions to address the real needs and challenges that the families face.”

Onist Technologies

“It should have been a walk in the park for me, given my experience on Wall Street,” said Kotansky, who previously worked at SAC Capital and TD Securities.

But that turned out not to be the case.

“It took me three years to put the pieces of the puzzle together,” Kotansky said. “Not because there was tremendous wealth accumulated, there was just tremendous stuff accumulated over 80 years. Step one for me was to speak to my mother, who was an intelligent, capable woman who was completely in the dark about finances. She knew where her bank accounts and credit cards were, but that was where it ended. It turns out that she's not alone: Forty million spouses in the U.S. are in the dark about finances.”

That's true not just for baby boomers, but the millennial generation as well.

Kotansky formed Onist, a household financial management app that helps connect family members and stakeholders in family financial data.

Using Onist, adult children can create accounts for parents or for their own children. They can link all financial accounts — banks, credit cards, investment accounts, mortgage — to that account and upload important documents like wills, powers of attorney, DNRs and operating agreements.

“You can add all relevant people to the household so it's a private network — family members, professionals you work with, trusted advisers — then you can start to share that information. You can share everything with your spouse at a granular level.”

Onist launched a year ago, originally as a business-to-consumer solution. It now offers its software to banks, too.

Pefin

“She realized there are probably a lot of very smart people in this world like her father who don't understand how any of this stuff works and probably don't have the money to go to a private banker or financial adviser who would ask for thousands of dollars for a financial plan and require a high level of assets under management,” said Catherine Flax, Pefin's CEO.

Pefin provides financial planning, advice and investment, similar to a human adviser but through automated channels.

“Ultimately, though money is the vehicle, this is about people achieving what matters most to them in life, then ongoing coaching and advice,” Flax said. “When an incremental dollar comes in, should I be saving it, should I be paying down debt, should I be optimizing my 401(k)? We will tell people they shouldn't be in the markets, if that's the case.”

Pefin's artificial intelligence software creates a new model for each new client that captures between two and five million data points. As the user uses the platform, it increasingly understands whether they are net savers or net spenders, and that helps the neural network to be more predictive.

Like Onist, Pefin launched a direct-to-consumer platform last year; it now has 4,500 users. The company also has a version for businesses that’s being used so far by a pension fund in the Netherlands with 4.5 million pensioners.

EverSafe

That might sound innocent enough, except his mother did not have a car or a driver's license. And she was legally blind.

She then got placed on a list and other people sold her inappropriate products. She took money out of her annuity early, paying penalties, to pay for them. She stopped paying for long-term care insurance.

“My mother was an accountant, it wasn't that she wasn't financial astute,” said Tischler, co-founder and CEO of EverSafe. “She brought somebody in to pay her bills who wrote herself a check every week. At the end of the day, she lost her entire life savings. Until I noticed she was having trouble with her memory, I had no idea she was being exploited. Hence EverSafe was born.”

(Tischler’s partner and cofounder is Liz Loewy, who was previously chief of the Elder Abuse Unit in the Manhattan District Attorney's Office, where she was a prosecutor on the Brooke Astor case, in which Astor’s son stole $60 million from her.)

EverSafe monitors clients’ credit card and banking transactions for signs of exploitation or bad habits. It warns customers and family members through its app, emails or text messages.

“We see things like people buying from QVC or the Home Shopping Network every day and hoarding what they buy,” he said.

It also watches driving habits.

“Often people are taken advantage of by stranger who gets in to their life and starts driving their car,” Tischler said.

EverSafe uses machine learning to understand the customer’s financial profile, then identify any behavior that differs considerably from past activity.

“When we identify erratic activity, we send out alerts to trusted advocates,” Tischler said. “They could be family, advisers, a lawyer, an accountant.”

EverSafe recommends having more than one trusted advocate.

“Over half of the exploitation comes from family and people they know,” he said.

Tech savvy

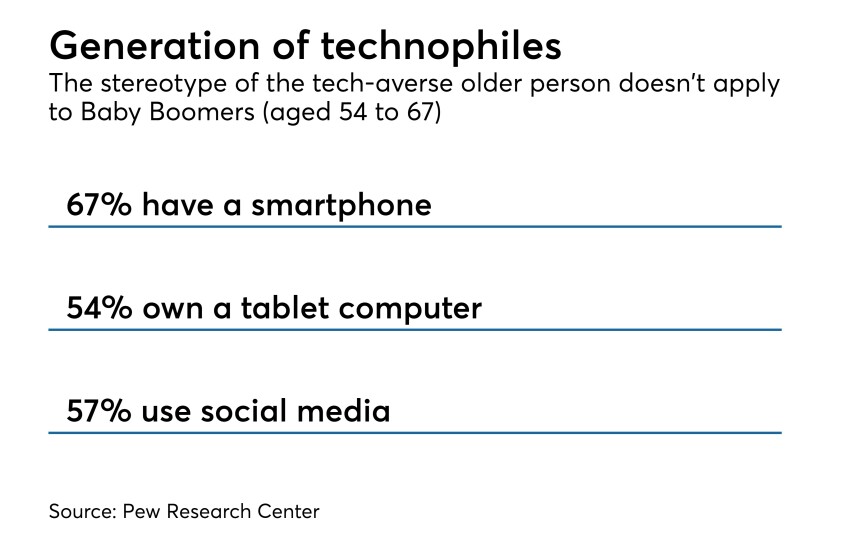

One thing in their favor: Each successive generation is more tech-forward than the last.

"My father is 84, and he doesn't have a smartphone or email address; he couldn't do a Google search if you paid him," Kotansky said. "But my wife's father is 71 and a whiz on anything tech. As we move forward, the question of whether older people want to use technology will become less relevant."