In response to an op-ed championing chip cards, regardless of whether they are used with signatures or PIN codes:

Related Article:

A reaction to a new CFPB report that still found significant problems in the credit card market:

Related Article:

A response to TD Bank coming under fire from a New York City official for doing business with gun manufacturers:

Related Article:

Questioning an op-ed highlighting the reasons why consumers feel burdened by overdraft charges:

Related Article:

In defense of overdraft restrictions:

Related Article:

On a move by Green Dot, which had previously stated its firm belief against raising fees, to reverse course and charge a higher fee:

Related Article:

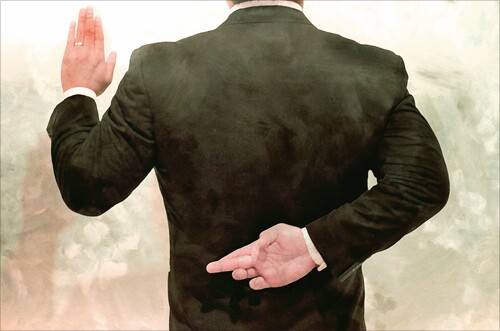

On the idea of using social media data to underwrite consumers:

Related Article:

In response to an argument on the need to overhaul the ways banks serve affluent customers:

Related Article: