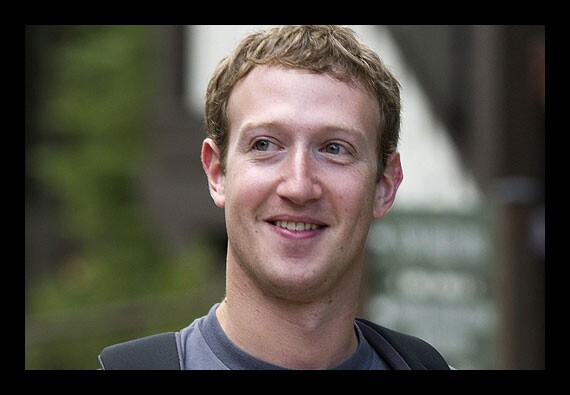

On Facebook CEO Mark Zuckerberg's 1% mortgage:

Related Article:

(Image: Bloomberg News)

On Facebook CEO Mark Zuckerberg's 1% mortgage:

Related Article:

(Image: Bloomberg News)

On whether merchants will pass reduced interchange on to the consumer:

Related Article:

(Image: Thinkstock)

On the credit card interchange settlement:

Related Article:

(Image:

On merchants' dissatisfaction with the credit card settlement:

Related Article:

(Image: Thinkstock)

On the CFPB's stifling regulations:

Related Article:

On claims that CFPB regulations are stifling financial services:

Related Article:

(Image: Thinkstock)

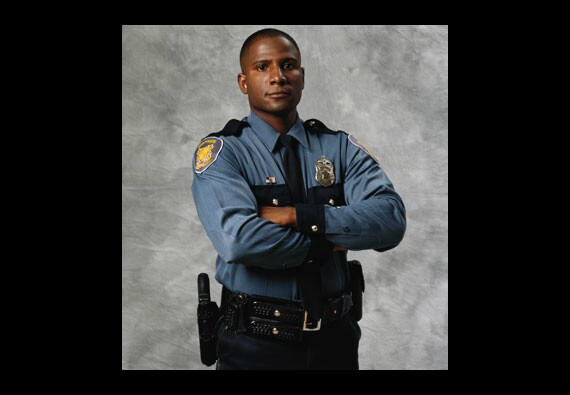

On the CFPB's staff:

Related Article:

(Image:

On HSBC's anti-money laundering blunders:

Related Article:

On Fed chair Ben Bernanke's claim that it's unclear whether U.S. banks manipulated Libor:

Related Article:

On regulators' learning of possible Libor rigging in 2008:

Related Article:

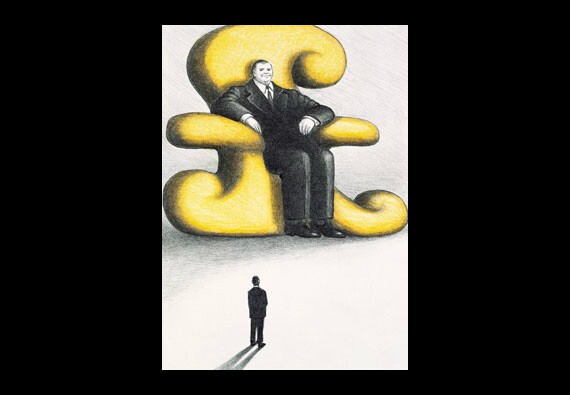

On the view that the Libor scandal undermines the argument that banks are over-regulated:

Related Article:

(Image: Thinkstock)

On the view that the Libor scandal undermines the argument that banks are over-regulated:

Related Article:

(Image: Thinkstock)

On a Texas community banker's lawsuit against the CFPB:

Related Article:

(Image: Thinkstock)

On the Consumer Financial Protection Bureau's first enforcement action:

Related Article:

(Image: Thinkstock)