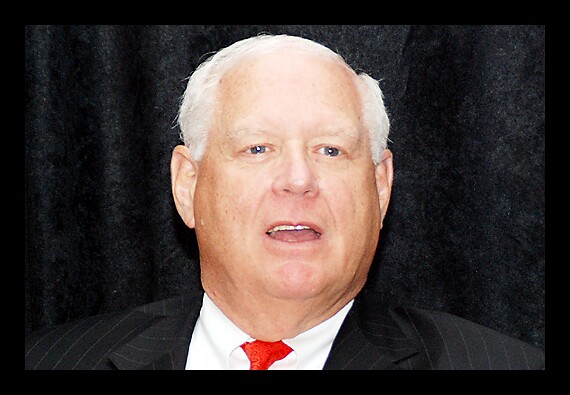

Rusty Cloutier, president/CEO, MidSouth Bancorp in Lafayette, La.

John Corbett, president/CEO, CenterState Bank of Florida in Winter Haven.

Gerald Lipkin, chairman/president/CEO, Valley National Bancorp in Wayne, N.J.

William Moss, president/CEO, Community Partners Bancorp in Middletown, N.J.

Rich Dailey, president/CEO, Apollo Bank in Miami

Frank Sorrentino, chairman/CEO, North Jersey Community Bank in Englewood Cliffs, N.J.