Digital banking's global strides

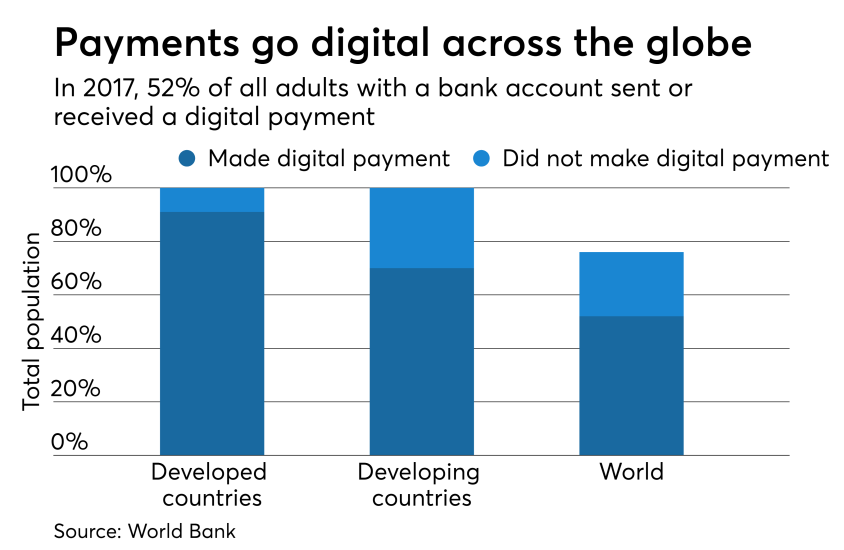

Two global studies — a study of 150,000 consumers polled by Gallup for the World Bank for its Global Findex Database, and a survey of 5,200 consumers by the tech giant Oracle — found complementary trends in the use and adoption of digital banking.

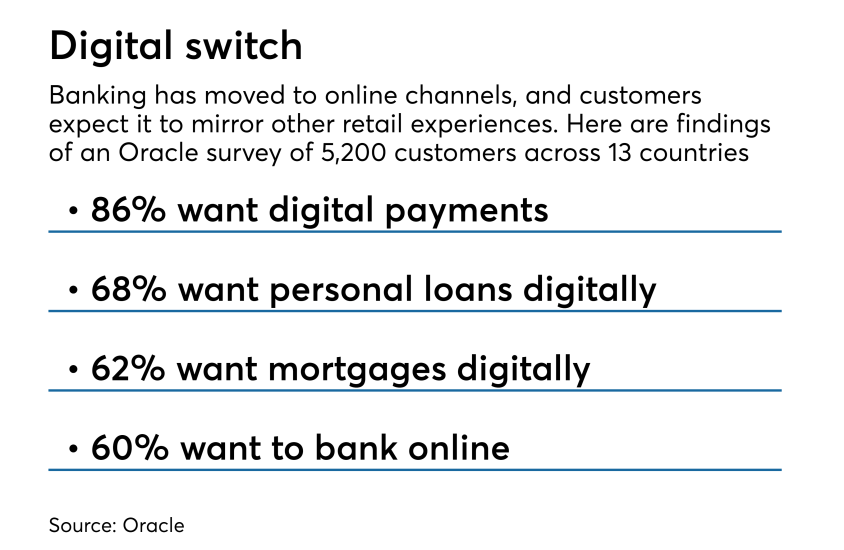

Whether by necessity or choice, customers want more digital options for accessing banking, both reports determined. For example, 60% of customers globally want to open a bank account online, according to Oracle's survey.

Many are already there: Sixty-seven percent of customers globally are on digital banking platforms now, according to Oracle; the World Bank reports that 515 million customers worldwide opened a banking account through a mobile money provider in the last three years.

While traditional firms still enjoy an incumbent trust advantage over competitors, the Oracle survey noted banks lag when consumers weigh alternatives: Customer experience, the survey said, is becoming a factor in determining which banking option customers will settle on.

The increased popularity of digital banking has opened customers up to alternative providers, too, Oracle reported, with over 30% of respondents stating they would consider giving banking fintechs a try.

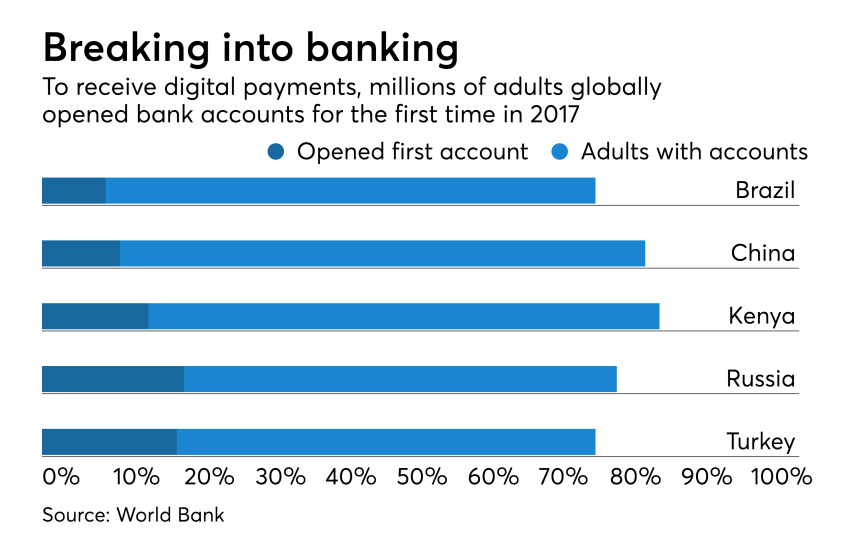

Overall, the increased use of digital banking is resulting in more access globally, the World Bank study noted, with 140 million unbanked individuals opening their first-ever account to receive digital payments in 2017.

Customers everywhere want to log in

Passport for digital platforms

For payments, borders keep falling

Digital gateway to banking

Banking at home

A red flag for PFM

Room for tech contenders

Trust advantage: Banks