(Image: Fotolia)

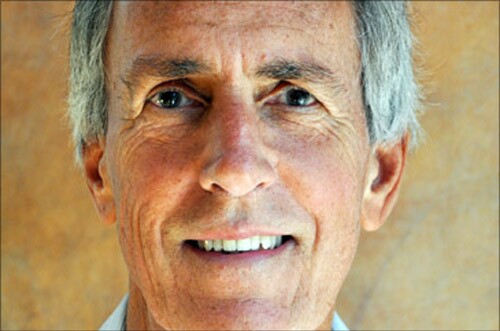

On who's to blame for Fannie Mae's troubles:

Related Article:

On why punishing senior execs at badly behaving banks would encourage reform:

Related Article:

(Image: Thinkstock)

On the need for more ways to refinance student loans:

Related Article:

(Image: Thinkstock)

On the state of the M&A market:

Related Article:

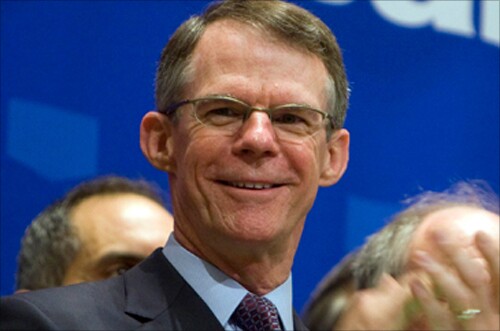

(Image: Bloomberg News)

On how Bank of America's (BAC) purchase of Countrywide has taught him to be cautious in making deals:

Related Article:

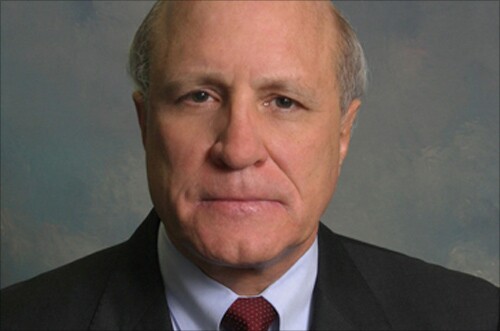

(Image: Bloomberg News)

On why banks have started to become numb to the growing regulatory burden:

Related Article:

(Image: Thinkstock)

On how bank foreclose procedures have changed:

Related Article:

(Image: Thinkstock)

On why bankers deserve better reputations:

Related Article:

On working to resolve a Federal Deposit Insurance Corp. enforcement action early in his career:

Related Article:

On having had his phone number posted on the internet:

Related Article:

On whether banks can restore their reputations after the financial crisis:

Related Article:

(Image: Bloomberg News)

On concerns that a crackdown on payday loans could force lenders to cancel profitable products:

Related Article:

On whether regulators will be able to finalize the Volcker rule by the White House's unofficial year-end deadline:

Related Article:

(Image: Bloomberg News)

On the appropriate penalty for first-time violators of the Volcker Rule:

Related Article:

(Image: Bloomberg News)