Here we go again

Durbin impact

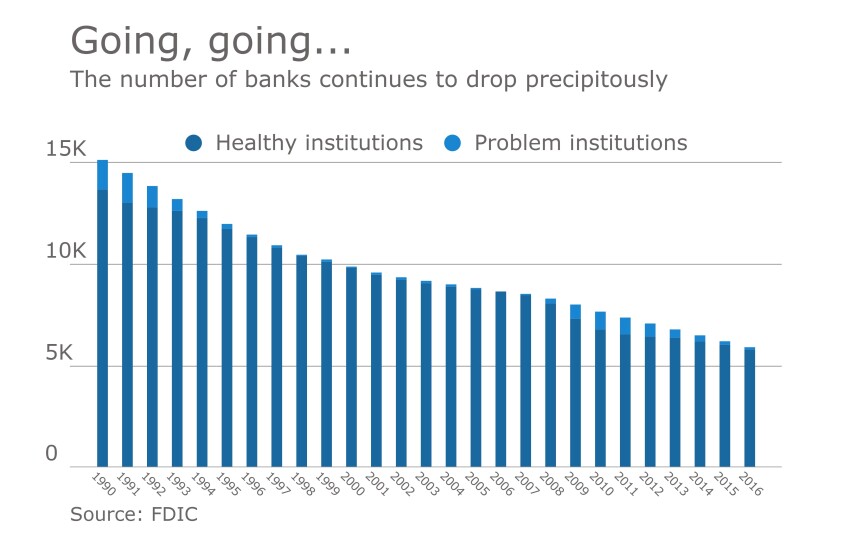

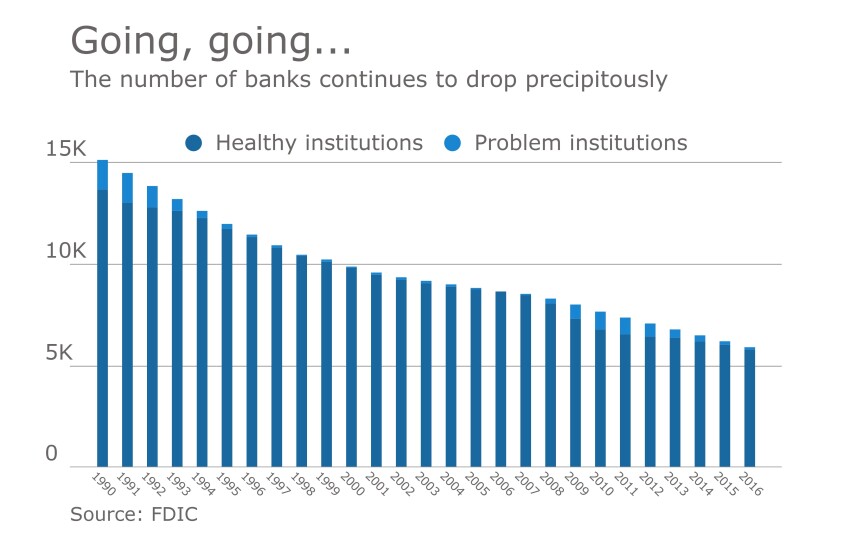

The number of banks

Interest rate hikes

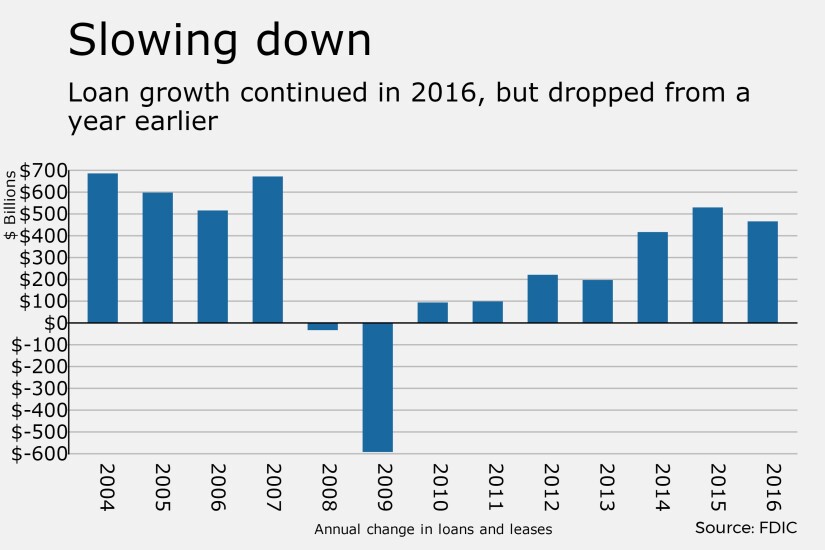

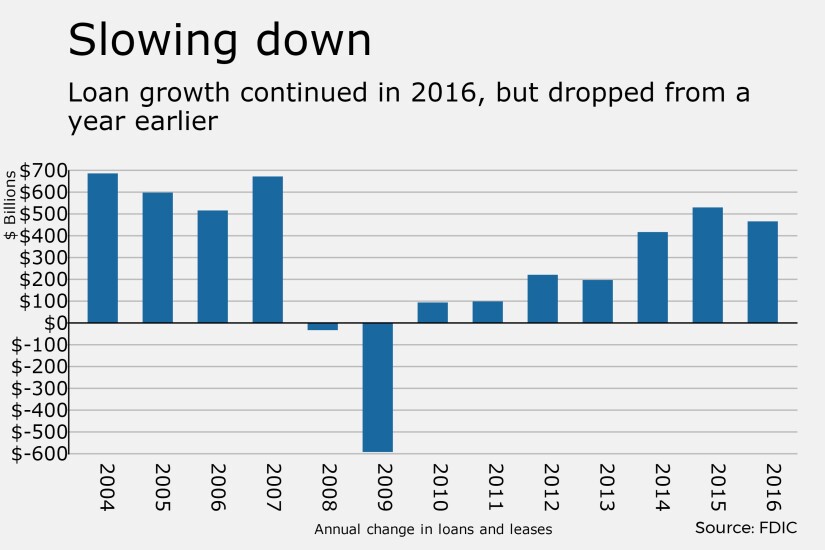

Loan growth

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

At a hearing Tuesday, executives at the Swiss banking giant faced tough questions from both Republicans and Democrats. The lawmakers are unhappy with the bank's recent decision to withhold certain documents from a lawyer who's overseeing research regarding Nazi accounts.

Prosecutors claim the Forbes 30 Under 30 honoree maintained two sets of books to hide Kalder's actual revenue of just $60,000.

The buy now, pay later lender is carving out a lane for itself with exclusive deals with Intuit's Quickbooks Payments and Expedia's websites. It also will be the default BNPL provider for Bolt's one-click checkout.

Banking trade associations told the Office of the Comptroller of the Currency that regulators should reform rules around third-party risk, saying concentration and limited choice of core service providers places an undue burden on banks.