-

A Federal Reserve proposal that would require banks to give merchants more choices in routing certain debit transactions could be a prelude to a more consequential change: a lower cap on interchange fees for banks with more than $10 billion of assets.

May 12 -

While a merchant may choose to run a program incorrectly, it is our responsibility as professionals to fully understand what the rules are and communicate the impact if they are not followed, says Clearent's Phil Ricci.

April 28 Clearant

Clearant -

The U.S. debit networks have always been strong supporters of open standards created through open, consensus building, says the Secure Remote Payment Council's Paul Tomasofsky.

December 17 Secure Remote Payment Council

Secure Remote Payment Council -

The Federal Reserve is facing pressure to allow retailers to route PIN-less debit-card purchases over their choice of networks. It’s a new stage in an old battle, fueled by the shift toward online shopping during the pandemic.

November 19 -

More lending regulation and interchange restrictions are on tap, says Intrepid Ventures' Eric Grover.

November 19

-

Regulators were receptive to Republican lawmakers' calls to ease burdens on banks that cross new asset thresholds as a result of their participation in the Paycheck Protection Program.

November 10 -

Several community banks are warning Congress that their participation in the Paycheck Protection Program could cause them to cross a threshold that may lead to, among other things, supervision by the CFPB and a cap on interchange fees.

September 3 -

H&R Block intends to break off the relationship since the parties have been unable to restructure compensation to reflect new interchange fee caps at Axos.

May 14 -

Stay-at-home orders and business shutdowns have led to a sharp decline in consumer use of credit and debit cards.

May 4 -

There is no doubt that many restaurants and merchants are struggling right now. But it makes no sense to hurt consumers and financial institutions by expanding failed policies like the Durbin Amendment, argues Jeff Tassey, chairman of the board for the Electronic Payments Coalition.

April 13 Electronic Payments Coalition

Electronic Payments Coalition -

The San Diego bank is struggling to renegotiate a partnership with the tax preparation firm to address caps on interchange fees.

March 3 -

The specific impetus for the Federal Trade Commission's inquiry into Visa and Mastercard's debit transaction routing processes is not entirely clear, but it likely stems from the effect that advanced payments technology has had on Durbin amendment compliance.

January 15 -

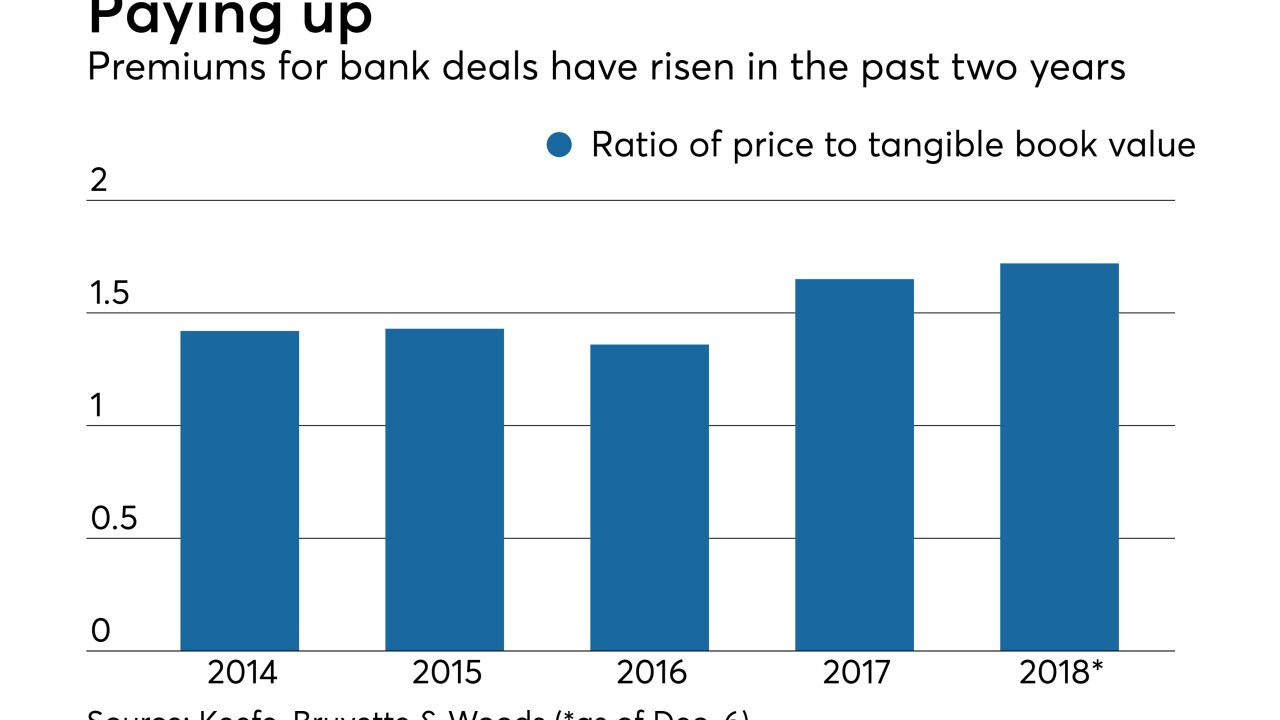

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

BankMobile will remain part of Customers for at least two years after regulatory snags derailed a plan to transfer the unit to a Florida bank.

October 16 -

Customers Bancorp said Flagship Community Bank has temporarily withdrawn its application with the FDIC to acquire the digital bank.

August 10 -

Renasant is requiring Brand Group to sell $55 million in classified loans before closing the deal, while attaching an incentive for the seller to get as much as possible for those sales.

March 29 -

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

Limited organic growth opportunities and rising premiums for bigger deals are fueling more sales of banks with $1 billion to $10 billion in assets.

March 9 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

Walmart is the first major merchant to add Fiserv’s Accel signature debit service following the debit network’s recent expansion of routing options, in a move to cut costs for card acceptance.

February 5