Buyer: Capital One (COF)

Target: ING Direct

Date: 6/16/11

Price tag: $9B

Costs

Buyer: BMO Financial Group (BMO)

Target: Marshall & Ilsley

Date: Dec. 17, 2010

Price tag: $5.8 billion

Buyer: PNC (PNC)

Target: RBC Bank USA

Date: 6/19/11

Price tag: $3.5B

PNC Chief Executive James Rohr said the integration of the deal, completed in March, was "

Buyer: Hancock Holding (HBHC)

Target: Whitney Holding

Date: 12/21/10

Price tag: $1.8B

Hancock has agreed to pay nearly $7 million to

Buyer: Mitsubishi UFJ Financial Group

Target: Pacific Capital (PCBC)

Date: 3/9/12

Price tag: $1.5B

Pacific Capital and its majority owner, Texas financier Gerald Ford,

Buyer: First Niagara (FNFG)

Target: NewAlliance

Date: 8/18/10

Price tag: $1.5B

The NewAlliance deal gave First Niagara, led by John Koelmel, the No. 6 in deposit share in Connecticut. It planned to

Buyer: Comerica (CMA)

Target: Sterling Bancshares

Date: 1/16/11

Price tag: $1B

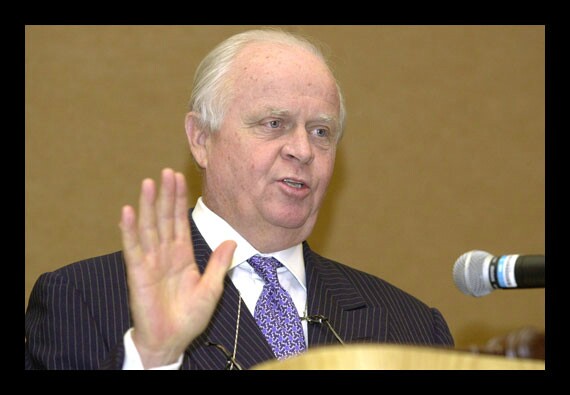

Comerica CEO Ralph Babb

Buyer: Prosperity (PB)

Target: American State

Date: 1/12/12

Price tag: $529M

Prosperity's offer was seen as relatively safe because

Buyer: Hilltop Holdings (HTH)

Target: PlainsCapital

Date: 5/08/12

Price: $527M

Hilltop, led by investor Gerald Ford,

Buyer: People's United Financial (PBCT)

Target: Danvers Bancorp

Date: 1/20/11

Price tag: $489M

People's United, led by Jack Barnes, has