(Image: Fotolia)

On Jamie Dimon's future at JPMorgan Chase (JPM) following reports that the bank will pay $13 billion to settle federal charges:

Related Article:

(Image: Thinkstock)

On Citigroup's (NYSE: C) third-quarter results:

Related Article:

(Image: Bloomberg News)

On why the earnings reports of banks showing strong loan growth last quarter should be viewed skeptically:

Related Article:

(Image: Bloomberg News)

On what weak industrywide revenue growth in the third quarter means for banks:

Related Article:

(Image: Thinkstock)

On how the health of buyers has become an important factor in M&A negotiations:

Related Article:

On the need for community bankers to aggressively seek out new business:

Related Article:

(Image: Thinkstock)

On the hope that bank regulators will follow recent conciliatory talk with regulatory relief:

Related Article:

(Image: Bloomberg News)

On the Consumer Financial Protection Bureau's priorities:

Related Article:

(Image: Thinkstock)

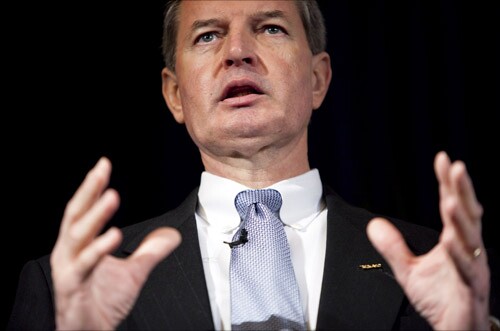

CFPB Director Richard Cordray on why bankers need to be will be ready to comply with the agency's qualified-mortgage rule when it takes effect in January:

Related Article:

(Image: Bloomberg News)

On why the CFPB is pushing for stricter rules covering student-loan servicers:

Related Article:

On why Independence Bancshares in Greenville, S.C., has invested heavily in technology:

Related Article: