-

The National Credit Union Administration and the Small Business Administration have established a program to boost SBA lending by credit unions, which was very light last year. It is sure to irk bankers, who have raised competitive concerns.

May 3 -

The online small-business lender said it tightened its underwriting standards during the first quarter as credit quality worsened.

May 2 -

The good times continue to roll for two New York City marshals whose work collecting debts for predatory lenders is making them millionaires.

April 30 -

Chantel Chase knows the value of efficiency, and her many ventures at Zions Bancorp. have depended on it.

April 29 -

Readers respond to the debates over economic inequality and CEO pay disparities, weigh in on FDIC board membership, consider LendingClub exiting small-business lending and more.

April 25 -

Instead the online lender will refer commercial prospects to two partner companies as it seeks to focus on its core personal lending business.

April 23 -

The findings of a new survey suggest that banks risk becoming irrelevant unless they match the speedier processes that are a key selling point for online lenders.

April 16 -

The New Jersey company agreed to buy BoeFly, which connects franchisors, small businesses, lenders and loan brokers.

April 12 -

The chairwoman of the House Small Business Committee promised to block action on the agency's budget unless it can justify its fee-hike request.

April 11 -

Gail Jansen, who oversees member business lending at Kinecta Federal Credit Union, warned that increasing fees for Small Business Administration loans would hurt borrowers.

April 11 -

The bipartisan bill, praised by credit union trade groups, is the top 2019 legislative priority for the Defense Credit Union Council.

April 11 -

The online lender's recent completion of a $700 million securitization provided Jonathan Ebinger at BlueRun Ventures an opportunity to reflect on what he has learned about the power of alternative data.

April 10 -

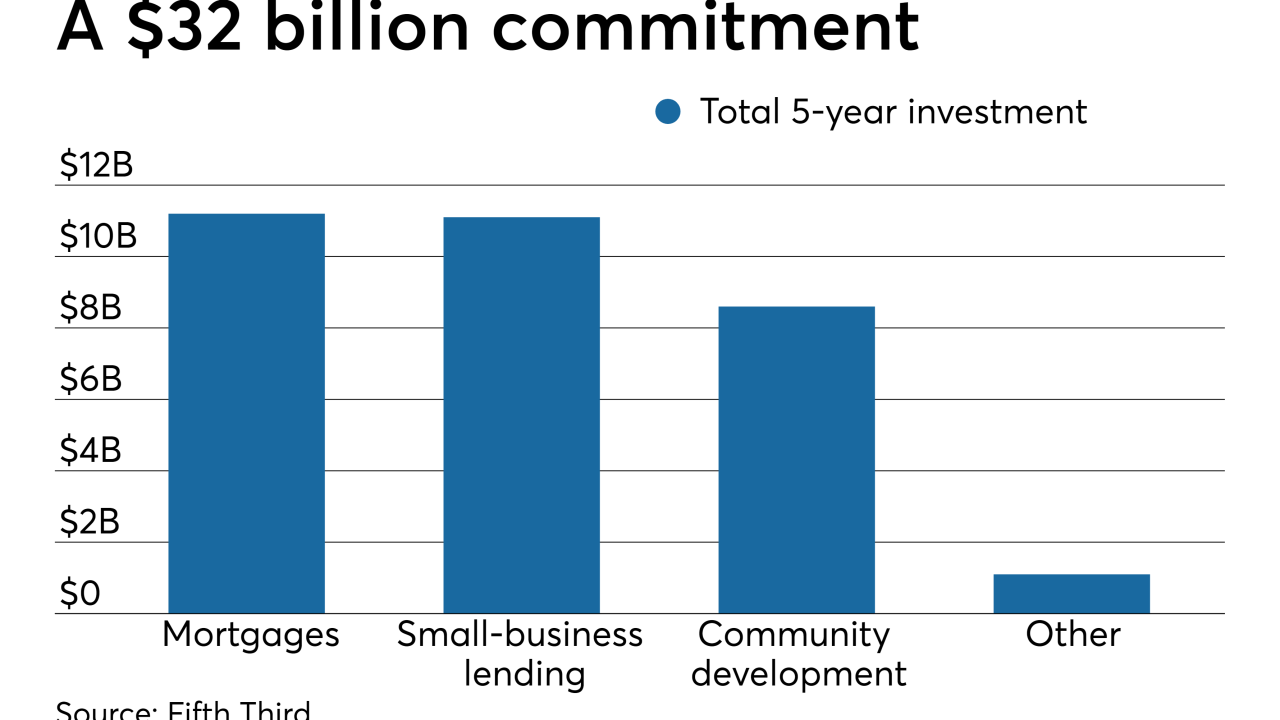

The bank is pledging to lend another $2 billion in a market where it has invested $3.6 billion in various community development initiatives since 2016. Most of the new funds will be used to make loans to small businesses that operate in low- and moderate-income neighborhoods.

April 5 -

On Dec. 31, 2018. Dollars in thousands, except for average loan amount.

April 1 -

StreetShares will add to its line of financing products with a credit card specifically for small-business owners with a military background.

March 28 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

AI-driven customer insights, mortgages and small-business loans are among the features in the app, which the bank is rolling out Friday.

March 24 -

The Connecticut bank, which has been unable to complete a pending deal for an SBA platform, has managed to build the business anyway.

March 13 -

The Nusenda Credit Union Foundation, which is being honored with a Wegner Award, works with its partners to find creative solutions to unmet needs, including its mircolending program, Co-op Capital.

March 11 -

The bank will fund community development financial institutions that lend to women-owned businesses backed by the fashion designer's foundation.

March 7