-

As upstart companies mature, they face pressure to develop deeper relationships with their customers. That is leading some to offer to a wider range of products, including deposit accounts.

April 12 -

Orchard Platform Markets, a provider of lending data and services backed by the former heads of Citigroup and Morgan Stanley, is set to be acquired by the small-business lending platform Kabbage, said people familiar with the deal.

April 12 -

Investors are growing worried about lackluster loan growth this year at community banks.

April 12 -

A plan to bring in banks was created right after last summer’s hurricane devastation, but the magnitude of those storms, government dawdling on the issue and lenders’ reluctance to participate are key reasons zero loans have been made under the program.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

Following its acquisition last November of Capital Bank in North Carolina, First Horizon will fund mortgage and small-business lending in low-income areas of the Southeast and expand its vendor relationships with minority-owned firms.

April 10 -

The heads of Mastercard and Santander outlined the concrete steps their firms are taking to bring unbanked consumers into the financial system.

April 6 -

Struggling to find quality loans in the grueling Philadelphia market, Beneficial Bank is looking to accelerate growth by building a nationwide leasing firm from the ground up.

April 6 -

Millennium Bank in Tennessee has quickened approval times on loan applications by using software that frees lenders from repetitive, manual tasks. The result: Loan balances have increased by more than 50% in less than two years.

April 5 -

The bank on Monday launched a loyalty and rewards program aimed at small businesses.

March 26 -

On Dec. 31, 2017. Dollars in thousands, except for average loan amount.

March 26 -

Only North Dakota has its own state-owned bank, but policymakers in other states say more public banks are necessary to fully meet society's needs. Among those who proponents say would benefit the most: small-business owners and legal marijuana suppliers and distributors.

March 25 -

The e-commerce giant is muscling its way into a number of businesses that banks have long dominated.

March 18 -

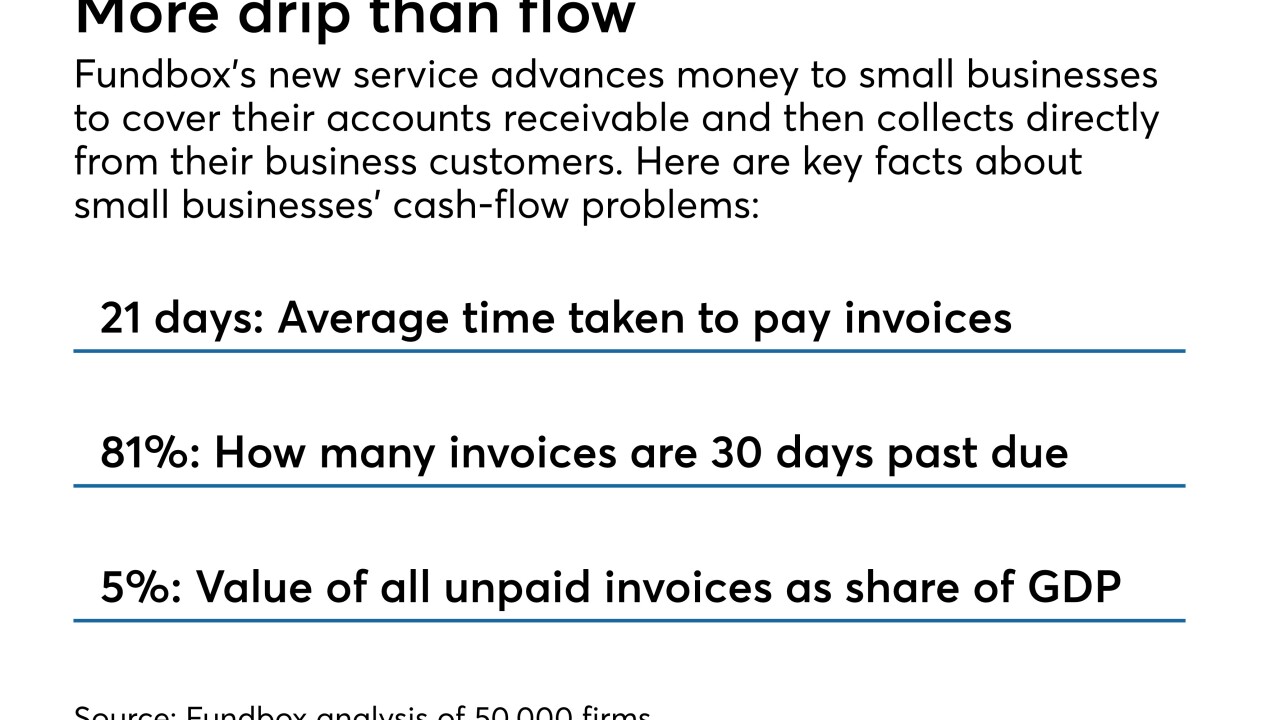

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

Amazon.com is planning to offer a credit card to U.S. small-business customers, furthering its push to supply companies with everything from reams of paper to factory parts, according to people with knowledge of the matter.

March 12 -

Franklin Synergy and MidFirst both plan to deploy the online lending platform, which according to its creator can render loan decisions in just under three minutes.

March 12 -

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

The Charlotte, N.C., company will open 500 new branches and hire 5,400 employees as it continues to expand in midsize cities across the country.

February 26 -

On Sep. 30, 2017. Dollars in thousands.

February 26