-

Readers react to Capital One's massive data breach and The Bancorp's expansion in CRE securitizations, defend fintechs offering retirement plans and more.

August 1 -

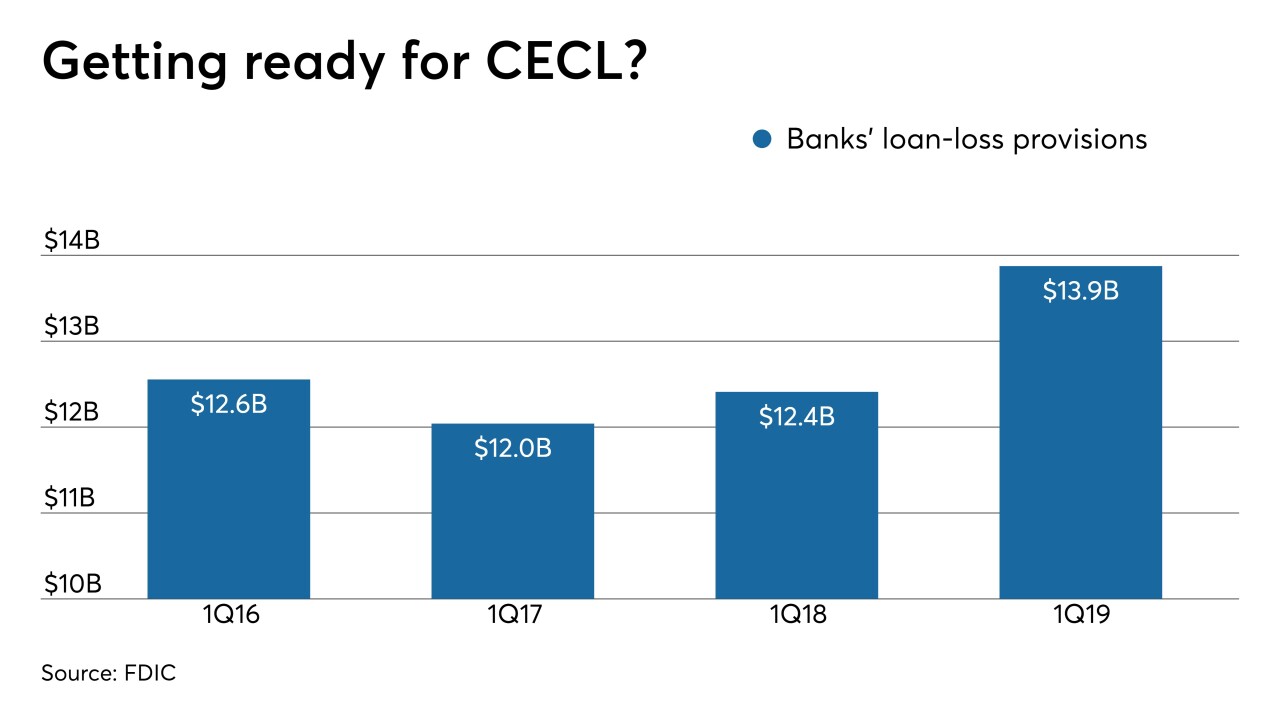

Among other things, the letter asked the regulators to ease requirements for a new community bank leverage ratio and analyze the impact of the pending CECL accounting change.

July 30 -

The new accounting standard meant for publicly traded firms creates greater headaches for privately held community banks.

July 29 Bank of St. Elizabeth

Bank of St. Elizabeth -

Regulators should proceed with removing one of the margin requirements for trading swaps.

July 26

-

FASB may have voted to delay its controversial new credit loss standard, but credit unions who use that delay as an excuse to further procrastinate are setting themselves up for failure.

July 23 Experian

Experian -

A court ruling deals a blow to efforts by HUD to restrict nonprofit housing funds from operating on a national scale; most banks get another year to implement CECL; PNC chief William Demchak plans to enter more markets and more from this week’s most-read stories.

July 19 -

Readers react to House lawmakers attempting to overhaul the credit bureaus, express sarcasm to the Senate Banking Committee eyeing cannabis banking, criticize Sen. Elizabeth Warren's plans to overhaul Wall Street and more.

July 18 -

The company will work on Libra, but won’t issue digital currency without proper authority; the bank’s profit dropped 8% on reduced revenue.

July 18 -

After FASB's decision to give most credit unions and banks extra time to prepare, lobbying groups are pushing for more.

July 18 -

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17