-

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

Credit unions could have an answer about when a new credit loss standard will take effect, while the National Credit Union Administration will hold its monthly board meeting this week.

July 15 -

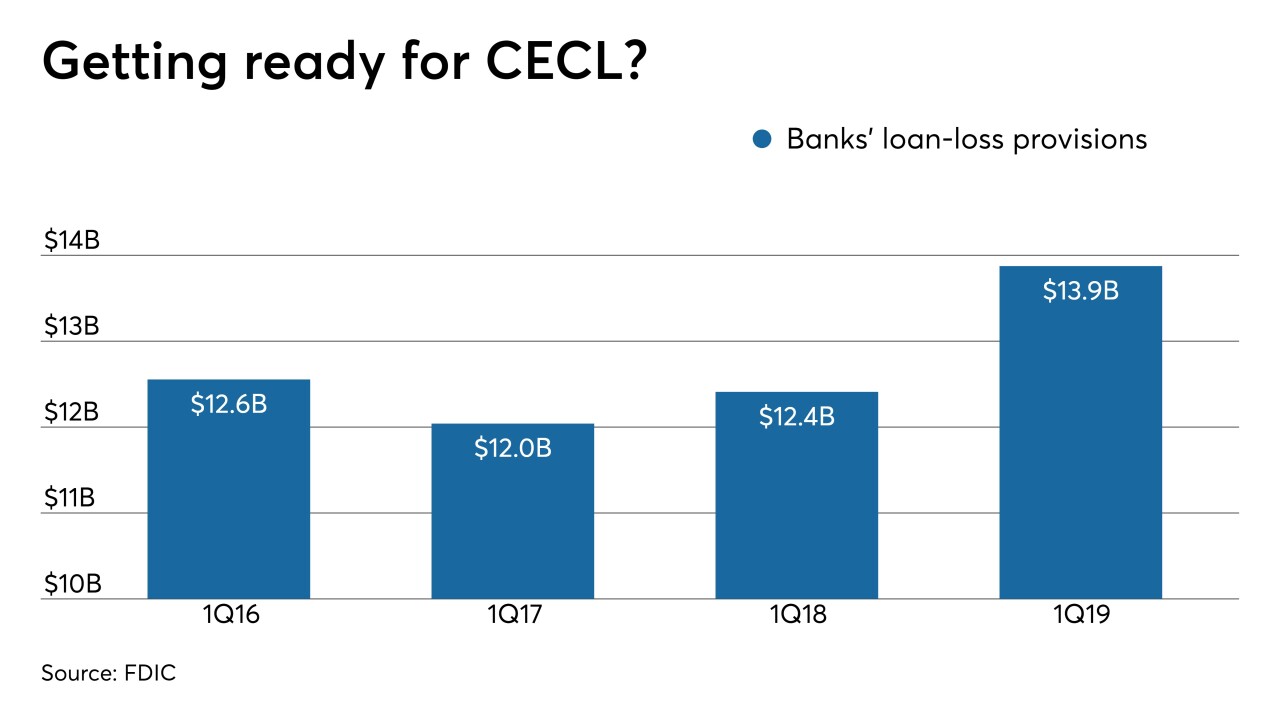

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

July 11 -

Questioning whether core-banking technology is nearing a 'big shake-up'; Capital One keeps closing branches, even as rivals open them; FASB chair defends CECL, saying 'the benefits justify the cost'; and more from this week's most-read stories.

July 5 -

Readers react to Congress vetting Facebook's Libra, heavily debate whether to delay CECL, opine on attempts to roll back overdraft laws and more.

July 4 -

With some adjustments, the loan-loss accounting standard can be more secure and workable for banks.

July 2 Prescient Models LLC

Prescient Models LLC -

As many as 20% of institutions haven't started planning for the new standard, according to one study. Many say CUs must start now in order to be ready, even if the rule is postponed.

July 1 -

Russ Golden, the chairman of the Financial Accounting Standards Board, says implementation of its credit loss rule should go forward, but will issue new supporting documents.

June 30 -

From regulatory reform to natural disasters and more, here's a look at Credit Union Journal's special report on what to expect for the second half of the year.

June 28 -

Banks clear both rounds of stress tests (though two of them needed a do-over); BNY Mellon goes all-in on digital; bank industry struggles to stop slide in latest reputation survey; and more from this week's most-read stories.

June 28 -

The new accounting standard for loan losses combined with an expected rule change around incentive-based compensation could hit bank chiefs in the wallet, according to a new report.

June 28 -

The accounting rules group is weighing whether to consolidate and push back deadlines for smaller firms to comply with credit-loss accounting change in light of concerns they will not be ready.

June 27 -

Executives and directors from across the industry discussed their concerns for the industry and priorities for the next year during this year's NAFCU and CUNA annual conferences.

June 21 -

Readers weigh in on big tech companies walking away from OCC's fintech charter, House committee wanting Facebook to halt Libra, calls to stop Congress from delaying CECL, and more.

June 20 -

Lawmakers recently introduced legislation to delay implementation of a new accounting standard for current expected loan losses. But policymakers should seek to preserve the accounting body’s independence.

June 18

-

The bipartisan House effort to delay the Current Expected Credit Loss standard comes less than a month after Republican senators introduced a similar bill.

June 11 -

Jury's out on whether BB&T-SunTrust will serve the community or Wall Street; 'we were willing to shock historical norms,' says Otting on OCC's makeover; is it too late for Congress to stop CECL?; and more from this week's most-read stories.

May 24 -

Readers weigh in on the role of the Financial Accounting Standards Board, consider personnel changes at the Consumer Financial Protection Bureau, debate the viability of public banks and more.

May 23 -

The effort to delay CECL comes a week after a House panel mounted a bipartisan attack on the new FASB standard.

May 22